-

Congress publicly excoriated the supervisors and CEOs of last year's trifecta of megabank failures. But, what about the directors who were supposedly overseeing those CEOs? The entire chain of bank oversight needs to be rethought from congressional hearing rooms to banking board rooms.

August 12 K.H. Thomas Associates

K.H. Thomas Associates -

Democrats Ritchie Torres and Gregory Meeks called on the New York Home Loan bank to follow the lead of its peers and use alternative credit scoring models for collateral to improve consumers' access to homeownership.

August 9 -

The Federal Housing Finance Agency wants to update the dual mission of the Federal Home Loan Banks. Members of the private bank cooperative say their regulator has no authority to redefine the mission.

August 8 -

As the 2024 election season once again puts the Federal Reserve's independence under a microscope, some observers see a weakness in one of the landmark policy arrangements that undergird the financial system as we know it.

August 8 -

Gary Quinzel, vice president of portfolio consulting at Wealth Enhancement Group, gives his views about monetary policy and offers his opinion on the FOMC statement and Fed Chair Jerome Powell's press conference.

-

Governor Tim Walz, whom Vice President Kamala Harris selected as her running mate Tuesday, has a slight but progressive record on financial policy, suggesting a potential leftward shift in banking policy in a prospective Harris administration.

August 6 -

President Joe Biden's administration and Senate Democrats are ramping up pressure on the Federal Home Loan Bank system to pump more money into solving the nation's housing crisis.

August 6 -

High borrowing costs led to fewer mortgage originations in the second quarter, according to the Federal Reserve Bank of New York's Quarterly Report on Household Debt and Credit released Tuesday.

August 6 -

A bill from Sens. Richard Blumenthal, D-Conn., and Elizabeth Warren, D-Mass., and companion House legislation from Rep. Maxine Waters, D-Calif., would change the Electronic Fund Transfer Act to guard consumers against losing money in authorized transfers that involve scams

August 2 -

Graham Steele, formerly the assistant secretary for financial institutions at the Treasury Department, laid out a detailed bank regulatory reform agenda for future progressive policymakers to consider that includes rolling bank Trump administration-era tailoring rules and accounting for the increased digitization of the banking system.

August 1 -

The Federal Reserve chair said Fed researchers continue to explore central bank digital currencies to stay current on international payments developments, but emphatically denied that the central bank is considering creating one of its own.

July 31 -

Capital One's proposed deal to acquire Discover is being viewed by progressives as a test of how skeptical the administration really is about big bank mergers, while Republican lawmakers mostly support the deal.

July 30 -

Sen. Cynthia Lummis announced a forthcoming bill that would require the government to hold 5% of the global bitcoin supply. Presidential candidates Donald Trump and Robert F. Kennedy Jr. have also called for strategic holdings of the cryptocurrency.

July 29 -

Despite being a top concern for a wide swath of voters, housing affordability has largely been absent from presidential politics.

July 26 -

The siren song of greater regulatory uniformity will lead the industry to disaster, as the kind of innovation that benefits consumers is stifled.

July 25

-

Vice President Kamala Harris has kept a low profile in banking policy, and there is a reasonable expectation that her administration would pick up where Biden left off. But if she wanted to, Harris could reset Democrats' financial policy agenda.

July 23 American Banker

American Banker -

America must never cease to be the global leader in innovation and entrepreneurship. However, when it comes to bank-fintech relationships, politics and misguided regulatory forces threaten the very foundation of that innovative spirit and limit consumer choice.

July 23

-

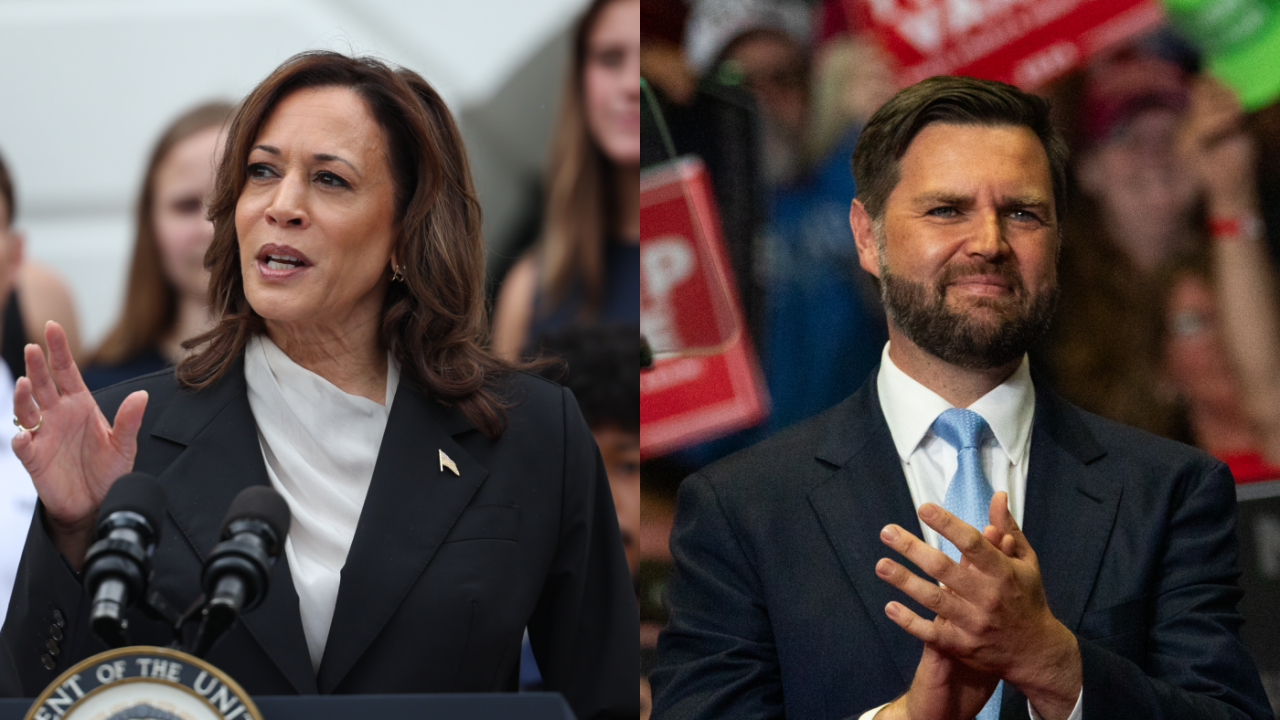

Vice President Harris' surprise elevation to the top of the Democratic ticket and the ascent of Ohio Sen. J.D. Vance to be the Republican vice presidential pick brings renewed vigor to each party's economic vision.

July 22 -

Vice President Kamala Harris, the most likely choice to replace President Joe Biden on top of the Democratic presidential ticket in November, has a long and complicated history with the banking industry.

July 21 -

Investors are set to start the week scrambling to decide if President Joe Biden's decision to end his reelection campaign and endorse Vice President Kamala Harris increases or decreases Donald Trump's chances of regaining power.

July 21