-

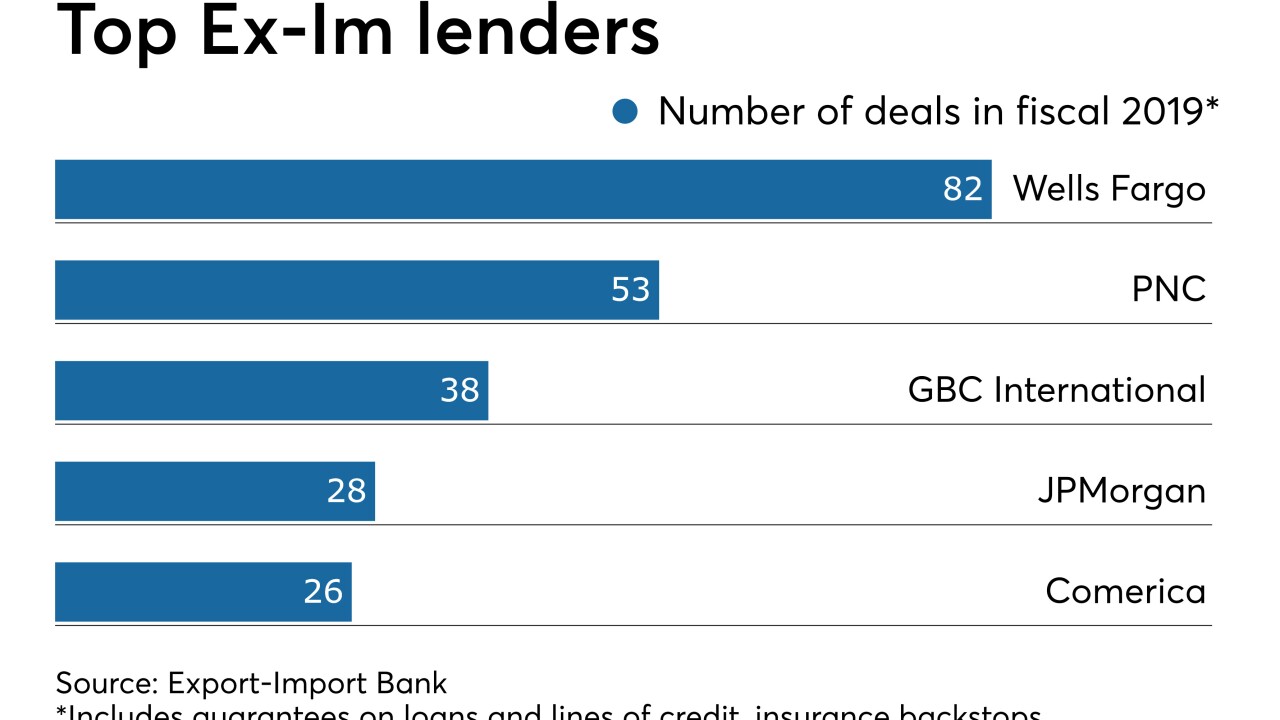

Lenders that depend on the Export-Import Bank to back loans to exporters are already seeing business borrowing pick up after Congress reauthorized the agency in December.

January 30 -

The U.S. arm of Toronto-Dominion Bank said Matt Boss will oversee credit cards, residential loans and deposit products, among other areas.

January 27 -

As more consumers order in using such services as Uber Eats and Grubhub, restaurants are selling fewer desserts, drinks and other high-margin items, said CEO Rajinder Singh.

January 24 -

While most banks are shrinking their branch networks, the Cincinnati bank is approaching the day where its branch expansion in the Southeast will more than offset closings in its legacy markets, its CEO says.

January 22 -

The Dallas bank’s troubled energy loans reached a nearly two-year high as crude prices plummeted.

January 21 -

While the New York bank has a handle on deposit pricing, Joseph DePaolo said a new accounting standard will play tricks with how it addresses credit quality.

January 21 -

Total loans at Regions Financial fell slightly last year, but executives say a shift in consumer lending priorities and more aggressive C&I lending will start to pay off this year.

January 17 -

Citizens Financial Group’s fourth-quarter results highlight the challenges regionals face in generating top-line growth.

January 17 -

The Southeast banks expect to complete their merger by midyear, hit their savings targets and still be able to invest in growth, according to Bryan Jordan.

January 17 -

A tough fourth quarter seemed to foreshadow challenges in the year ahead for the nation’s fifth-largest bank.

January 15 -

CEO William Demchak said the bank has witnessed "a lot of mischief" among customers who open checking accounts to collect bonuses and then never use the accounts again.

January 15 -

Stateside banks are starting to play catch-up to banks worldwide that are incorporating environmental, social and governance factors into their underwriting. Pressure from big shareholders is a driving force.

January 13 -

The regional bank, formed from the merger of BB&T and SunTrust, will begin marketing its new brand in conjunction with next month's Super Bowl.

January 13 -

Clients will have an active role in testing new products and services at the regional giant formed by the merger of BB&T and SunTrust, says Chairman and CEO Kelly King.

January 7 -

Though there were several high-profile mergers of equals among bigger banks, deal activity rose only slightly, and the vast majority of transactions involved the smallest of institutions. Here's an overview of those trends and others that stood out in bank dealmaking last year.

January 5 -

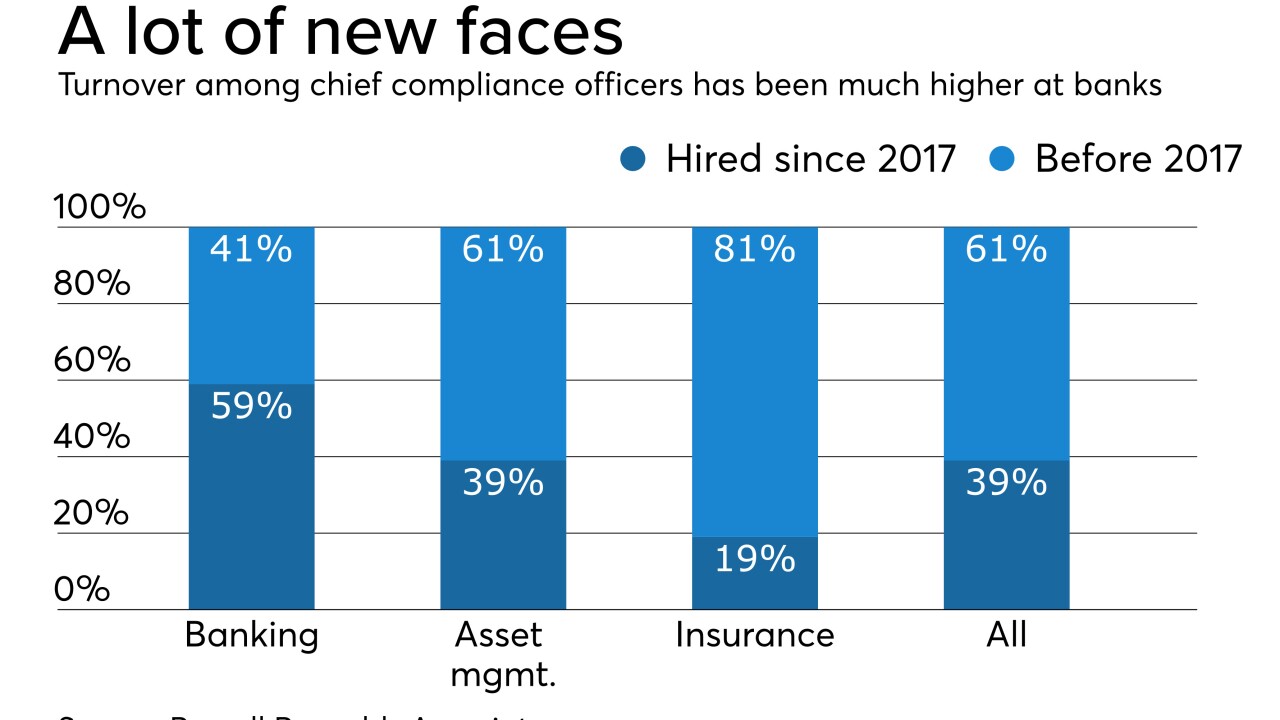

Banks had the highest turnover of chief compliance officers among the 100 largest financial services firms in the world, according to a recent study. Recruiters say that’s a function of changing job demands, high pressure and poaching by fintechs — plus old-fashioned demographics.

January 3 -

While his focus is on organic growth in Texas and California, Curt Farmer says he would consider a deal in those states if the right one comes along.

January 2 -

Political uncertainty, sector-specific concerns as well as interest rate and labor trends may continue to depress commercial and industrial lending in the coming months.

December 31 -

With adjustments to the post-crisis regulatory framework now complete, the Federal Reserve may begin the decade year with a focus on supervisory and examination processes.

December 25 -

The fresh optimism is starting to outweigh some of the worries hanging over the sector heading into the new year.

December 19