-

The window for moving financial services regulatory relief through Congress is rapidly closing, but there appears to be little hope that the partisan tensions that have stalled the process will ease in time.

September 16 -

Federal Deposit Insurance Corp. Vice Chairman Thomas Hoenig said favorable leverage-ratio treatment for certain derivatives would undermine postcrisis capital reforms.

September 16 -

Criminal charges don't scare big banks anymore. Perhaps the Justice Department's fresh commitment to threatening top executives with prosecution will keep them in line.

September 15

-

The North Carolina-based BB&T is far larger than any other bank regulated by the FDIC. It should be under the supervision of an agency with more experience overseeing large banks.

September 14

-

Gregory Baer, the head of regulatory policy for JPMorgan Chase, will be the next president of The Clearing House Association, the group announced Friday.

September 11 -

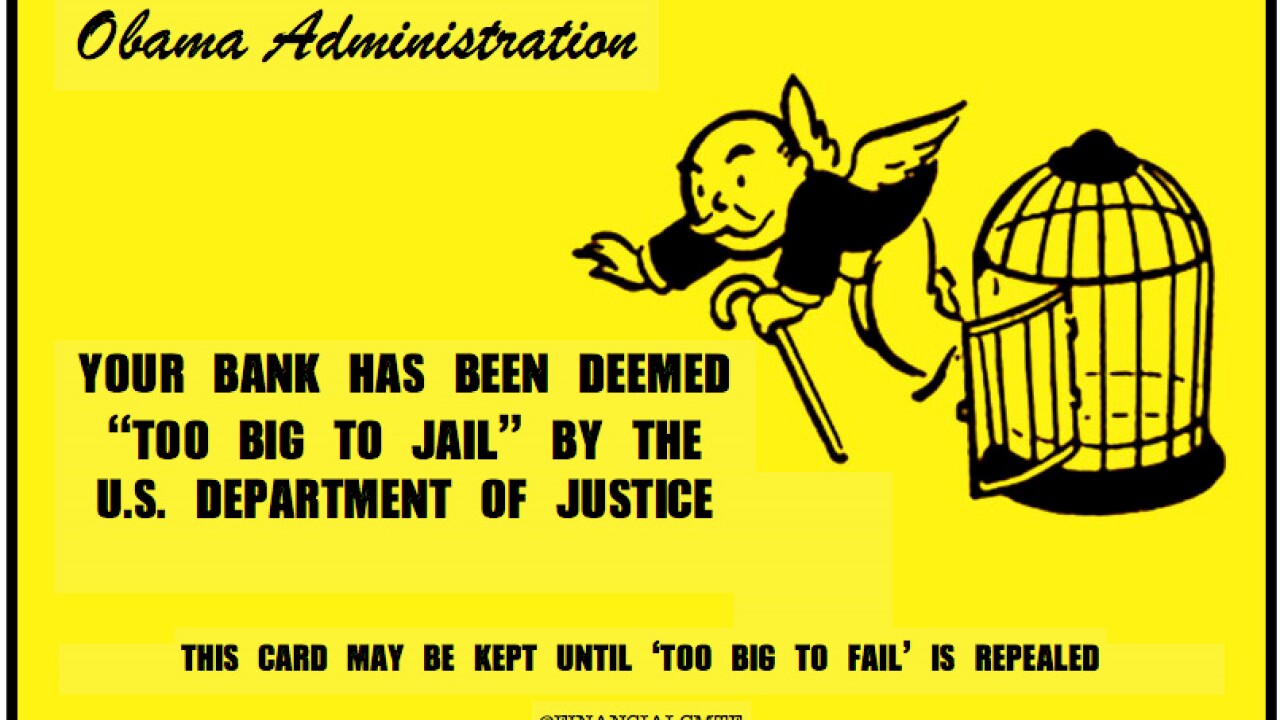

The Justice Department's announcement that it would target individual executives at banks and other companies that are being investigated for wrongdoing has sparked a debate about whether the move is actually substantive or instead just designed to boost the agency's public image.

September 10 -

With summer recess ending, banking agencies are about to embark on a busy policymaking schedule leading up to the end of the year.

September 8 -

The world's biggest banks may gain greater flexibility in meeting new crisis rules as the Financial Stability Board adjusts its total loss-absorbing capacity proposal to eliminate bias against decentralized lenders and opportunities for regulatory arbitrage.

September 8 -

IMGCAP(1)]

August 28 -

Nearly seven years after the financial crisis, the uncomfortable truth for the banking industry is that populist anger remains alive and well.

August 27 -

The lack of liquidity in the bond markets has drawn significant attention from policymakers, but agreeing on what is causing it, and whether new regulations required by Dodd-Frank are to blame, may be impossible.

August 24 -

Some large U.S. banks are likely to be impacted by recent volatility in emerging markets like Brazil and China. But their opaque risk metrics make it difficult for investors to judge banks' level of exposure.

August 24

-

The failure to prosecute bankers as a result of the financial crisis has sparked an ongoing debate about whether enforcement officials lacked the will to move forward with any cases or didn't have enough proof that any crimes had been committed.

August 21 -

For those who lament the U.S. government's failure to put individuals on trial for their role in the 2008 mortgage crisis, Iceland's prosecution of bankers represents a platonic ideal of financial supervision. But the comparison between the Icelandic and U.S. cases is not as simple as it may appear.

August 20 -

As the 2008 financial crisis fades into memory, it has become increasingly unlikely that any bankers or traders involved will see jail time. But while no individuals were ever charged with a crime, the feeling that the financial industry got away scot-free will affect the 2016 presidential race and beyond.

August 19 -

The Financial Stability Oversight Council has a mandate to designate nonbank financial companies as systemically important based on criteria established by Congress. Its designation decisions should not be predetermined by the actions of global regulators.

August 19

-

A look at how Dodd-Frank has affected the banking industry, and what other forces are at play.

August 18 -

Regulators need to be able to impose tough requirements on foreign banks with U.S. units in order to safeguard the domestic financial system from turbulence abroad. Sen. Richard Shelby's proposal to raise the asset threshold for systemically important banks would put that ability in jeopardy.

August 11

-

JPMorgan Chase is the bank most integral to the stability of the global financial system, followed by HSBC and Citigroup, according to a U.S. study.

August 4 -

While the Federal Deposit Insurance Corp. has not deviated from a 2013 paper outlining a method for unwinding a giant firm, the agency has appeared to fine-tune its approach in significant ways.

July 31