-

The revisions would emphasize activities-based regulation over labeling individual firms as systemically risky.

March 6 -

The central bank is limiting the use of its qualitative objection in this year’s stress tests, the agency announced Wednesday.

March 6 -

The interagency panel formed to head off approaching systemic risks must figure out its next move after having undone designations of nonbank firms.

March 5 -

Assets increased 6% in 2018 to nearly $52 billion as loan originations surged and the company redeployed $2 billion of cash into higher-yielding securities.

January 30 -

Sen. Elizabeth Warren questioned the five largest U.S. retail banks in a letter on what they are doing to reduce the impact of the government shutdown on customers.

January 16 -

A no-deal Brexit could throw the international swaps market into disarray in a way that could be difficult to predict, and could have dire consequences for U.S. banks and the world economy.

January 15 American Banker

American Banker -

The Dodd-Frank Act gave the central bank authority to set capital requirements for insurance companies that own a federally insured bank, as well as those determined to be systemically important.

January 9 -

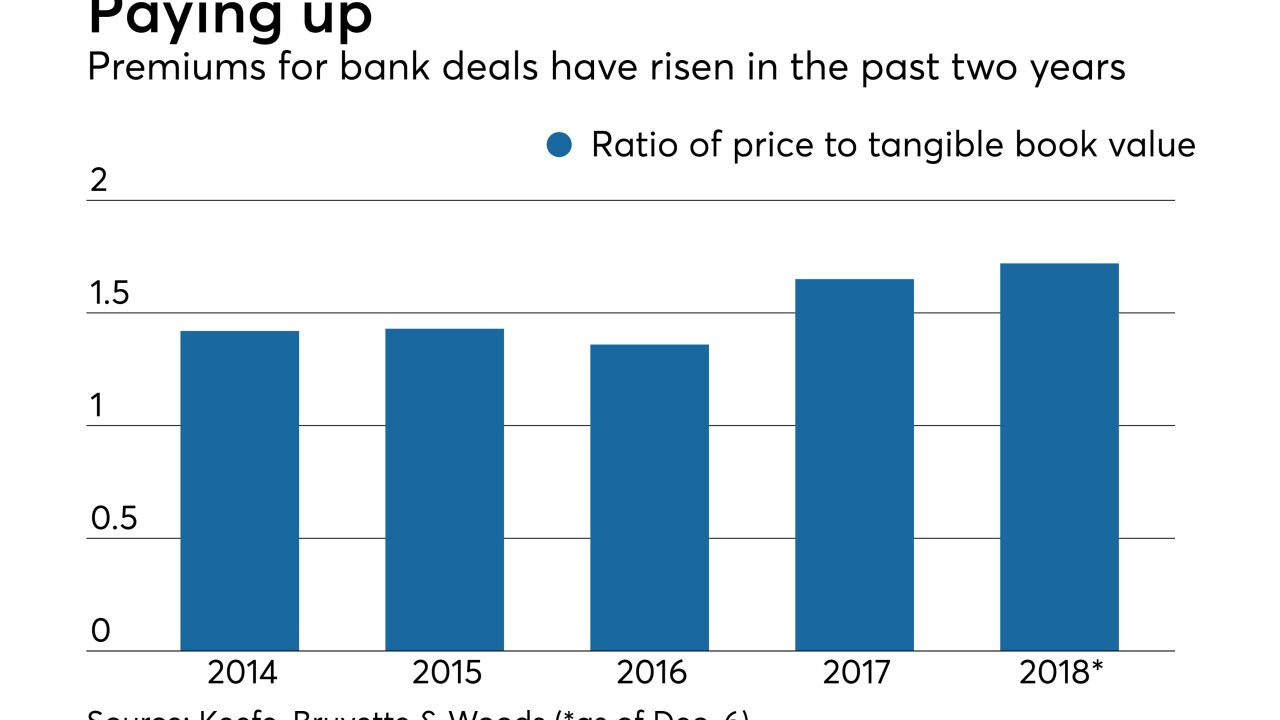

A big splash by Fifth Third, a bid by WSFS to reinvent itself and some bold long-distance expansions highlighted a year where deal activity held steady but premiums rose.

December 23 -

Sen.-elect Kyrsten Sinema, D-Ariz., and Sen. Tina Smith, D-Minn., will join the panel as their caucus loses two other committee members who suffered election defeats.

December 13 -

Just as a recent law softened Dodd-Frank resolution plan requirements, the head of the Federal Deposit Insurance Corp. announced an effort to ease such rules for depository institutions.

November 28 -

His knack for public policy, dedication to technological improvements once considered the province of big banks, and willingness to tear up a business model that he and his father built make him our top Best in Banking honoree.

November 25 -

Rep. Kyrsten Sinema, D-Ariz., crafted a moderate message and will head to the Senate after having backed legislation providing banks with regulatory relief.

November 12 -

The central bank's top regulator said public comments about the new tool, used to gauge capital strength during stress tests, will likely result in changes before it is adopted.

November 9 -

The final rule aligns ratings with a supervisory program the Fed established in 2012 to emphasize capital, liquidity, and governance and controls.

November 2 -

Regional banks were the ultimate winners in the Federal Reserve’s proposal to tailor supervision, but rules for the biggest banks remained largely unchanged.

October 31 -

In a highly anticipated proposal, the central bank outlined a new approach for its post-crisis supervisory program that divides banks into different tiers based on size.

October 31 -

The Federal Reserve Board’s meeting to discuss supervisory standards for midsize institutions will be closely watched by regulatory relief advocates and those who want the Fed to maintain its firm hand.

October 29 -

The central bank will hold an open meeting Oct. 31 to discuss changes to the enhanced supervisory regime as required by the regulatory relief bill passed in May.

October 24 -

Banks technically relieved of the “systemically important” label in last spring’s legislative package are lobbying regulators hard over concerns that they could still face tough standards.

October 21 -

Banks ask Congress for help with a rule that forces them to estimate loan losses; The network will allow banks to "exchange and verify trade information."

October 18