-

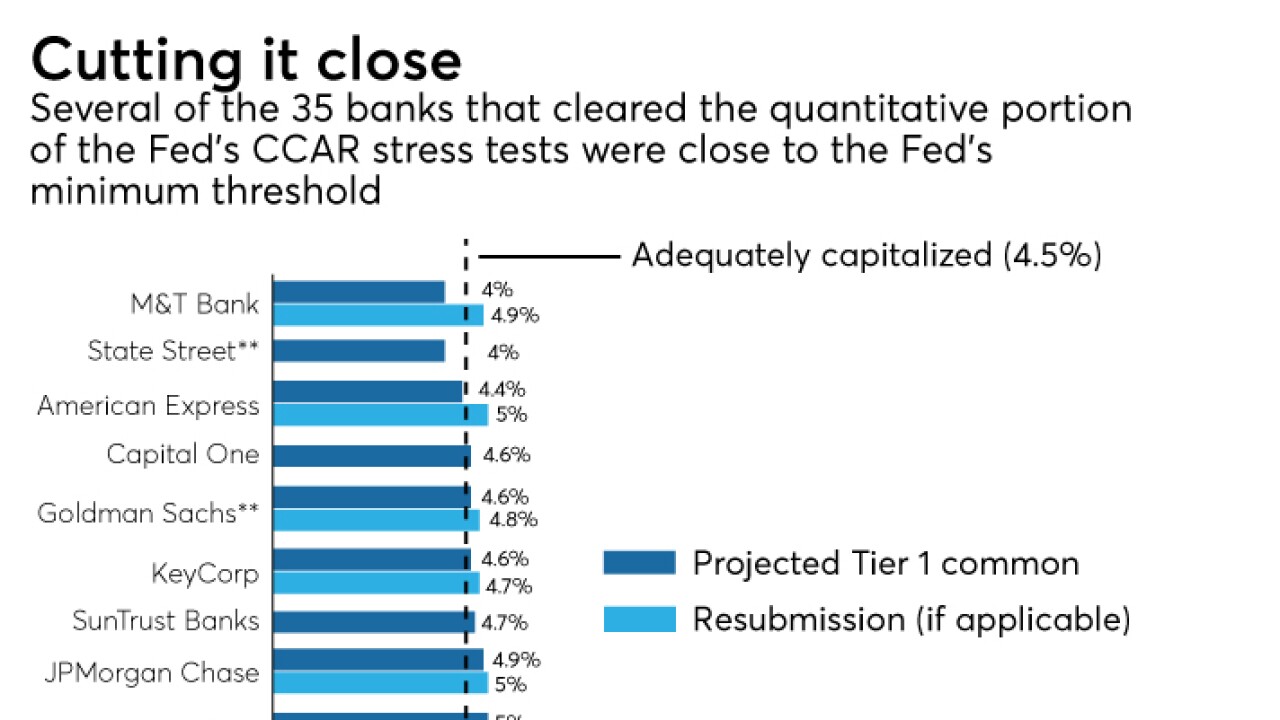

The central bank has encountered criticism for allowing three banks to direct funds to dividends and buybacks even though their capital levels fell below required minimums.

July 17 -

The chairman of the Federal Reserve is testifying before Congress this week, where he will likely face tough questions about the agency’s decision to let two banks slide on their exams late last month.

July 16 American Banker

American Banker -

The industry is slated for another busy week, with more bank results on the horizon, plus a nomination hearing for Trump’s pick to head the CFPB.

July 13 American Banker

American Banker -

The Senate Banking Committee's top Democrat singled out Morgan Stanley and Goldman Sachs, which he said "got passing grades" despite being unable to maintain minimum required capital levels.

July 10 -

Almost 10 years after the financial crisis, Wall Street was starting to wonder aloud: Might Goldman Sachs or Morgan Stanley make a big acquisition? Much of that speculation got a reality check on June 28 when both firms scraped through the Federal Reserve's annual stress tests.

July 9 -

The Fed, the FDIC and the OCC said Friday that they have begun implementing changes for regional banks under the new regulatory relief law passed in May.

July 6 -

A judge rules the accounting firm should have detected the fraud that brought down Colonial Bank; Fed deal with Goldman and Morgan Stanley shows softer side.

July 3 -

The bank can pay out 40% more than it is expected to earn; the German bank’s stock slide may lead to its removal from a major European bank index.

July 2 -

Deutsche Bank failed and Goldman Sachs and Morgan Stanley restrained; antitrust lawsuit brought by retailers may be near a resolution.

June 29 -

The president’s signature tax reform law muddled this year’s stress test results, causing several banks to incur greater-than-expected losses and spurring the Federal Reserve to constrain capital distributions at a handful of banks.

June 28