-

A judge rules the accounting firm should have detected the fraud that brought down Colonial Bank; Fed deal with Goldman and Morgan Stanley shows softer side.

July 3 -

The bank can pay out 40% more than it is expected to earn; the German bank’s stock slide may lead to its removal from a major European bank index.

July 2 -

Deutsche Bank failed and Goldman Sachs and Morgan Stanley restrained; antitrust lawsuit brought by retailers may be near a resolution.

June 29 -

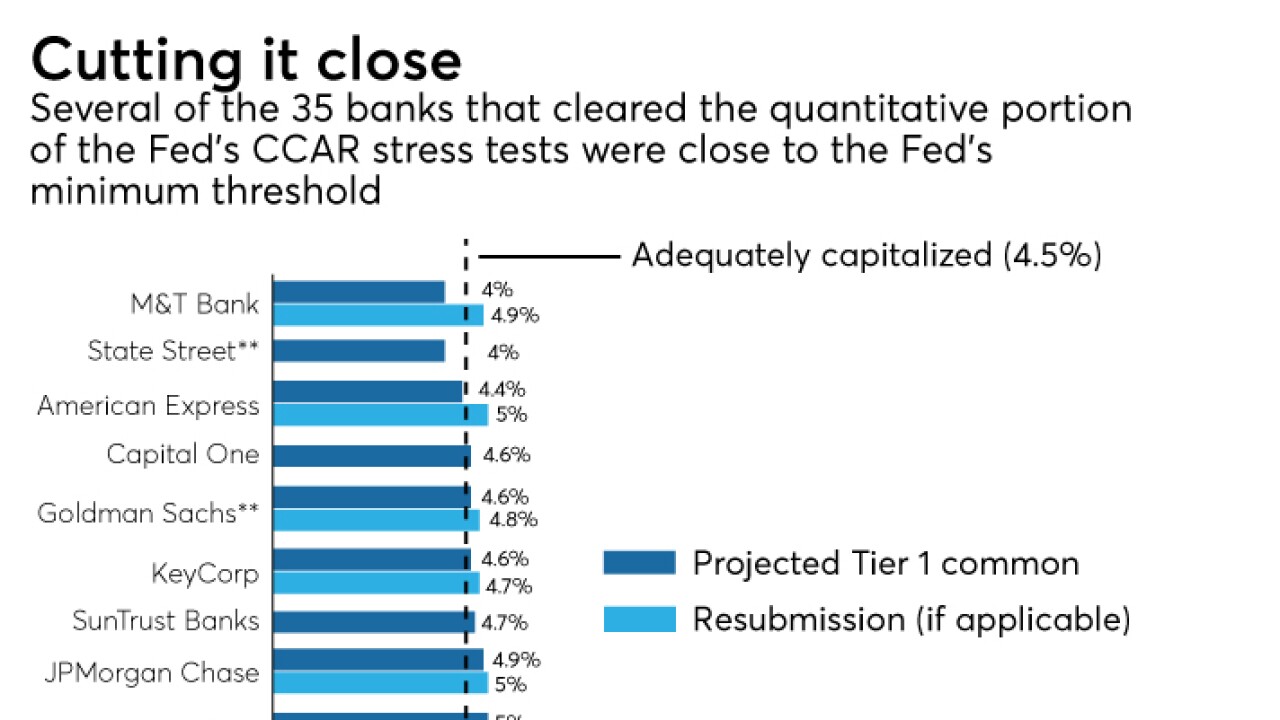

The president’s signature tax reform law muddled this year’s stress test results, causing several banks to incur greater-than-expected losses and spurring the Federal Reserve to constrain capital distributions at a handful of banks.

June 28 -

Eight states want the credit bureau to show what it’s doing to improve data security; Goldman, Morgan Stanley and Wells Fargo will be the focus of this set.

June 28 -

The recent string of positive news for the banking industry, from lower corporate taxes to less regulation, is starting to feel like a distant memory.

June 27 -

The S&P 500 Financials Index fell for the 12th straight day Tuesday amid concerns that the flattening yield curve will suppress banks' second-quarter profits.

June 26 -

Pass/fail may be replaced by public capital ratio; high court allows company to prevent merchants from favoring other cards.

June 26 -

The two Wall Street firms anxiously await the second round of stress test results; Commerzbank is working on using technology to generate basic research notes.

June 25 -

How the big banks fared in the Fed's latest round of stress testing; what's on new FDIC chair Jelena McWilliams' plate; why banks' biggest risk factor may be employees who don't speak up; and more from this week's most-read stories.

June 22 -

Judge says agency should not exist; the Fed says the largest banks are “strongly capitalized” and could withstand a severe crisis.

June 22 -

All 35 banks passed the Federal Reserve's first round of tests, but their results were not as stellar as last year's.

June 21 -

Jelena McWilliams said the agency will ask banks what's working and what's not; the acquisition of Hyperwallet Systems lets PayPal offer more services.

June 20 -

Among the six biggest U.S. banks, Bank of America might deliver one of the steepest jumps in payouts. Wells Fargo is the wild card.

June 19 -

Federal Reserve Chairman Jerome Powell said the agency has its hand full between proposals on liquidity and capital requirements and additional mandates made by the recently enacted regulatory relief law.

June 13 -

The agency will release the results of the Dodd-Frank Act Stress Test on June 21 and the Comprehensive Capital Analysis and Review on June 28.

June 7 -

The regulatory relief legislation rolls back several stress test requirements for regional and midsize banks, putting more onus on financial institutions and their regulators to ensure banks are managing their risk appropriately.

June 6 Moody's Analytics

Moody's Analytics -

As the Fed continues to hone post-crisis tools, its chairman said central banks cannot take their independence for granted.

May 25 -

The Federal Reserve’s top regulator says proposed capital changes make system safer while overall capital levels are unchanged.

May 4 -

Overseas firms have been subject to nonpublic versions of the Federal Reserve reviews, but observers say some foreign banks may be tripped up by the public version.

May 1