-

Regional and community banks are working to finance the economic development districts created by the new law. But they have lots of questions about how the program works — and thoughts on how to improve it.

March 26 -

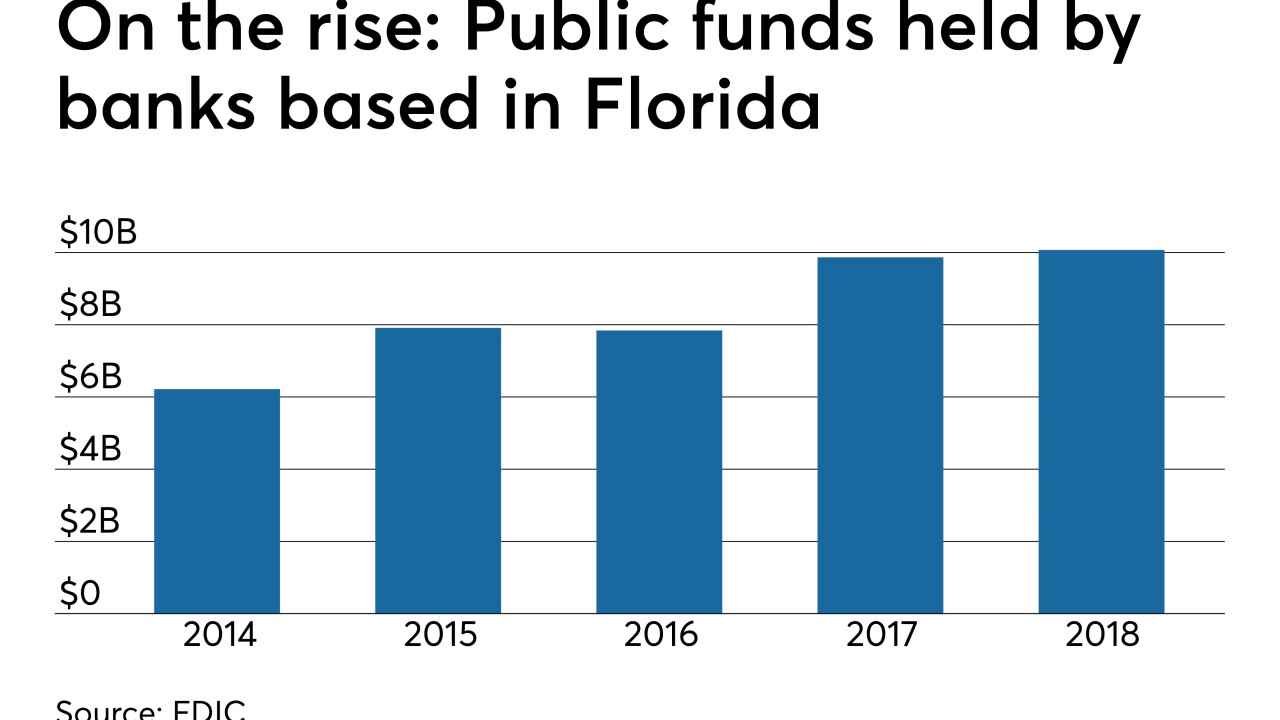

State law bars credit unions from accepting deposits from cities, counties and other government entities. Florida banks say it should stay that way unless tax advantages for credit unions are removed, but credit unions counter that banks are trying to stifle competition.

March 22 -

Several banks could lose money over tax credits tied to DC Solar, a California firm wrestling with a fraud claim.

March 8 -

At least five banks have warned about the potential loss of tax benefits if it is proven that DC Solar operated an investor scheme.

March 1 -

Victor Karpiak stepped down as CEO of First Financial in 2013 after years of wrangling with a prominent activist investor.

February 28 -

Banks earned $59.1 billion in the fourth quarter, a 133% year-over-year increase, due to a one-time charge in the year-earlier quarter and a lower effective tax rate throughout 2018.

February 21 -

Congressional investigations are often rushed affairs that fail to dig beneath the surface. But the hiring of a veteran investigator who has tangled with Deutsche in the past suggests that this politically charged inquiry is likely to be thorough.

February 20 American Banker

American Banker -

The National Credit Union Administration has become too soft on the industry it is supposed to regulate. A hearing on two board nominees is a chance for Congress to change this.

February 13 Iowa Bankers Association

Iowa Bankers Association -

Readers respond to the Consumer Financial Protection Bureau's overhaul of its payday loans rule, debate reforms to Fannie Mae and Freddie Mac, consider regulatory exemptions for regional banks and more.

February 7 -

Major U.S. banks shaved about $21 billion from their tax bills last year — almost double the IRS’s annual budget — as the industry benefited more than many others from the Republican tax overhaul.

February 6