-

Federal "Opportunity Zones" that reduce exposure on capital gains could draw rich investors — and commercial lenders along with them — into economic development projects in thousands of troubled communities around the country.

October 29 -

Earnings were bolstered by lower taxes and higher asset-servicing fees, but revenue was flat and analysts raised concerns about a shrinking deposit base.

October 18 -

Amid a push to re-examine the tax status for large credit unions, let's look at the reality of the benefits they provide to CUs a fraction of their size.

September 21 Freedom Credit Union

Freedom Credit Union -

Unlike previous spots produced by the group that just backed candidates, the latest ones reflect a somewhat different approach.

September 19 -

Policymakers are right to re-examine the industry’s exemption and the unfair competitive advantage it provides.

September 14

-

The payments technology that powers international trade is crucially important because it helps streamline the processes and trim the costs of conducting business overseas, according to Darren Hutchinson, head of commercial in the Americas for WorldFirst.

September 13 WorldFirst

WorldFirst -

Rising tariffs are rapidly increasing the cost of building materials, putting banks at risk.

September 10 Contract Simply

Contract Simply -

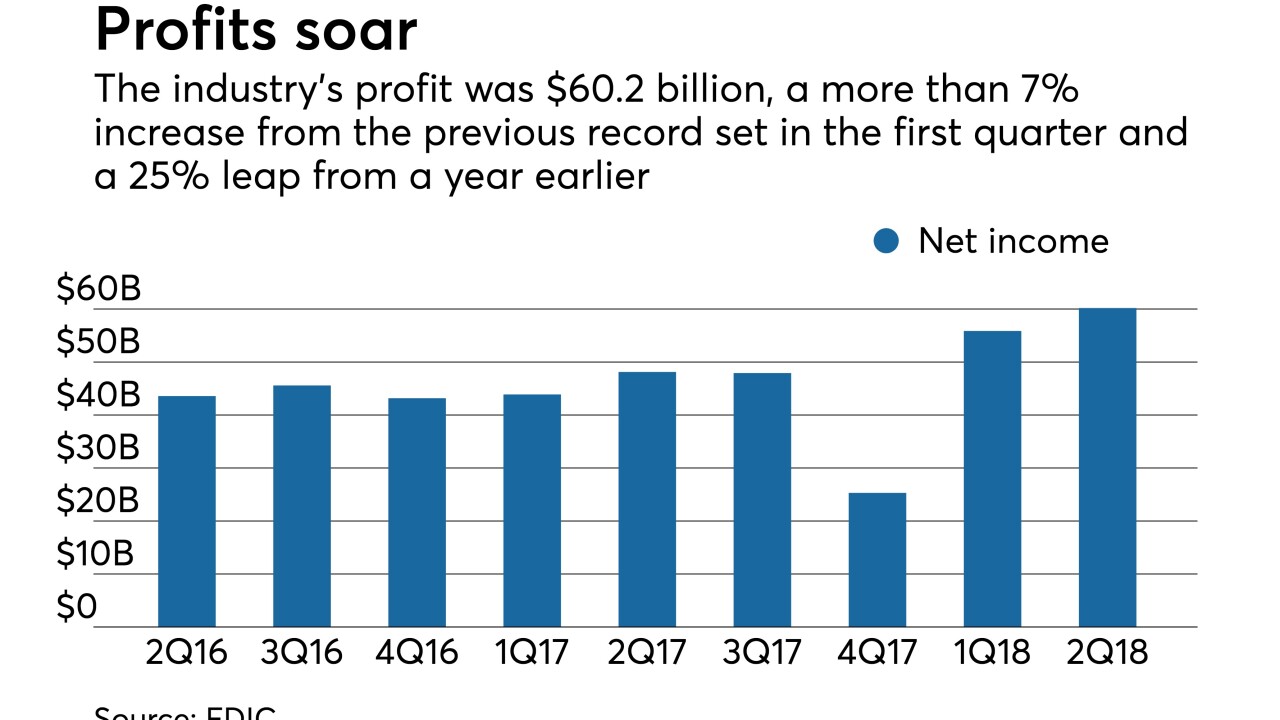

A huge chunk of the profit increase in the second quarter was due to a lower tax rate, but rising net interest margins and loan growth signal that institutions continue to derive revenue from their loan book.

August 23 -

The industry’s profit was $60.2 billion, a more than 7% increase from the previous record set in the first quarter and a 25% leap from a year earlier, the agency said in its quarterly report on the industry's health.

August 23 -

What are community banks doing with savings from the corporate tax cut? Several CEOs share how they've put that money to use.

August 23 -

The Treasury Department and the Internal Revenue Service issued a proposal that would allow pass-through businesses like Subchapter S banks to deduct 20% of their business income as part of the new tax law President Trump signed last year.

August 9 -

Multiple agencies are looking into its purchase of certain credits tied to low-income housing developments, the bank said in a securities filing Friday.

August 3 -

Depending on the asset class, about 11%-18% of earnings per share came from tax savings. The looming question is how do they top themselves in 2019 when tax rates don’t change like they did this year.

July 31 -

The recent decision involved sales taxes, but Wells Fargo recorded a net expense of $481 million under the assumption that it will also lead to higher state income taxes. Other banks may have to follow suit.

July 18 -

From medical expenses to home improvements, here's a look at some of the most frequently cited reasons homeowners are borrowing against their home equity.

June 26 -

Bankers would be better off cleaning their own houses and focusing on deregulation efforts, instead of going after credit unions, suggests NAFCU's Carrie Hunt.

June 20

-

After making the switch from banks to CUs four years ago, the CFO of American First Credit Union loves the movement – but he has some thoughts on how it can improve.

May 24 -

A coalition of free-market-oriented groups is calling on Senate Finance Committee Chairman Orrin Hatch to rethink his push for a new tax on credit unions.

May 23 -

Banks were helped by better loan spreads thanks to higher net interest margins, but the recently enacted tax cut helped boost profits by 27% from a year earlier.

May 22 -

Credit unions nationwide celebrated a recent victory for the CU tax status in Iowa, but bigger battles in more states could be just over the horizon.

May 14 Callahan & Associates

Callahan & Associates