-

The trial of Stefan Buck was an unusual courtroom showdown in the decade-old fight by the U.S. against tax evasion aided by financial institutions in Switzerland.

November 21 -

Beyond overall tax cuts, there's also potential benefits for investors in fintech and payments innovation, writes Rick Lazio, former Republican Representative from New York and current senior vice president at alliantgroup.

November 21 alliantgroup

alliantgroup -

The House-passed tax bill would eliminate the New Markets Tax Credit while the Senate bill would not reauthorize it when it expires in two years. Bankers and other proponents say that if it is discontinued many economic development projects in rural and low-income communities won’t be funded.

November 17 -

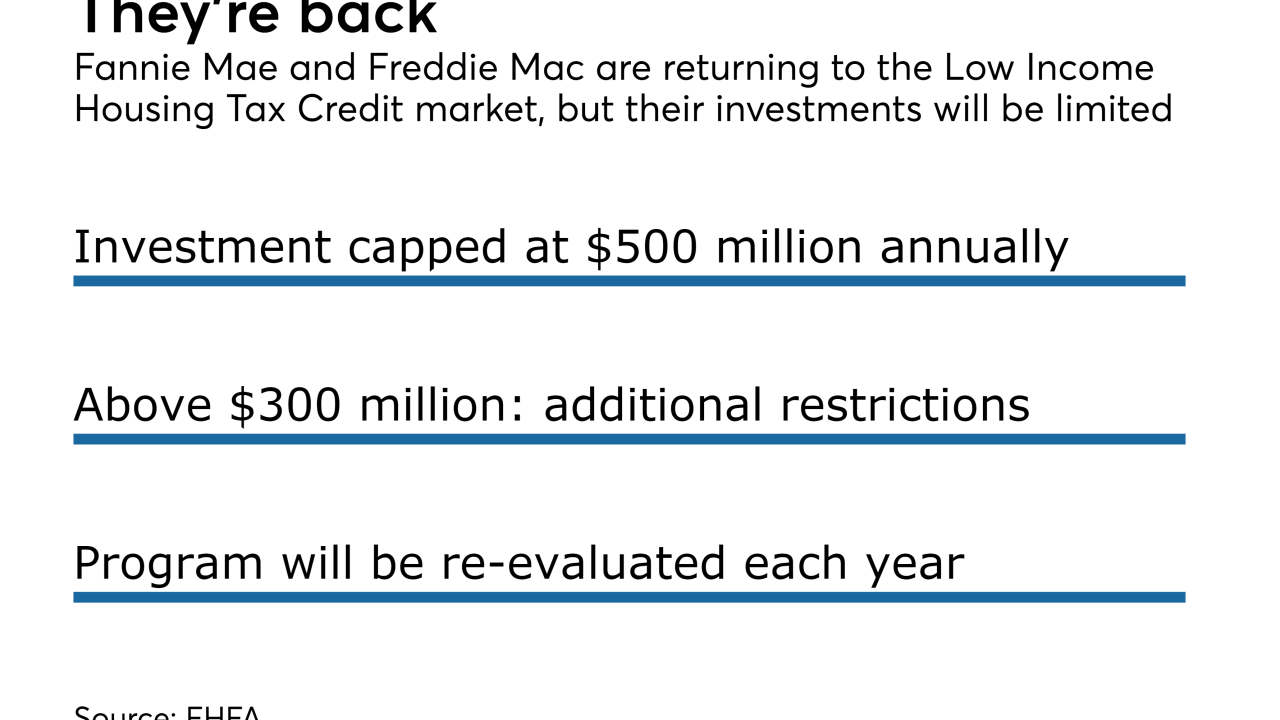

The FHFA is allowing Fannie Mae and Freddie Mac to invest in the credits for the first time since they entered conservatorship. Its purpose is to promote affordable housing in underserved markets.

November 16 -

Banks would be big winners if Congress slashes corporate tax rates and they will have no shortage of options for deploying all that extra cash.

November 15 -

Housing advocates are pressing Senate Republicans to expand the low-income housing tax credit program while pushing back against a House GOP plan that would eliminate financing for half of all affordable housing units.

November 14 -

While the Bank of America chief says he is encouraged by progress on tax reform, he cautioned that it remains politically and fiscally tough to accomplish, and that the wrong moves on immigration could offset some of the gains from tax cuts.

November 13 -

After so many political surprises in the last year, could a CU tax-status shake-up be next?

November 13 Credit Union Journal

Credit Union Journal -

The industry was understandably pleased to see its tax exemption isn't on the chopping block, but this contest has only just begun.

November 10 -

Company’s first earnings report since the data breach also discloses lots of suits and investigations; Senate bill also calls for one-year delay in corporate tax rate cut to 20%.

November 10