-

Paula Comings, the head of currency sales for U.S. Bancorp, said American importers are hearing from their foreign counterparties that they no longer want to be paid in U.S. currency.

June 16 -

The president said Treasury Secretary Scott Bessent and Commerce Secretary Howard Lutnick "will be sending letters out essentially telling people" what "they'll be paying to do business in the United States."

May 16 -

The London-headquartered bank is extending its TradePay platform to directly cover the cost of tariff payments, allowing importers to effectively borrow to meet the increased expenses involved in shipping products into the U.S.

May 7 -

The tariff regime unveiled last week by President Donald Trump has injected a significant dose of uncertainty into the banking industry and unleashed the specter of an economic slowdown.

April 9 -

The president exempted Mexican and Canadian goods covered by the North American trade agreement from his 25% tariffs, offering reprieves to America's two largest trading partners.

March 6 -

Commerce Secretary Howard Lutnick said the president is likely to defer his 25% tariffs on Canada and Mexico for all goods and services covered by the North American trade agreement.

March 6 -

President Donald Trump's 25% tariffs on Canada and Mexico are on track to go into place on Tuesday and he plans to impose an additional 10% tax on Chinese imports, moves that would deepen his fight with the nation's largest trading partners.

February 27 -

The COVID-19 pandemic revealed the fragility of complex global supply chains. Bankers say they are hearing from more U.S. clients who want to change that by moving manufacturing and supplier operations closer to home.

August 17 -

The timing couldn’t be worse for ag and energy lenders as well as global banks, which were all counting on the Chinese market to help bolster commercial lending and fee income.

February 4 -

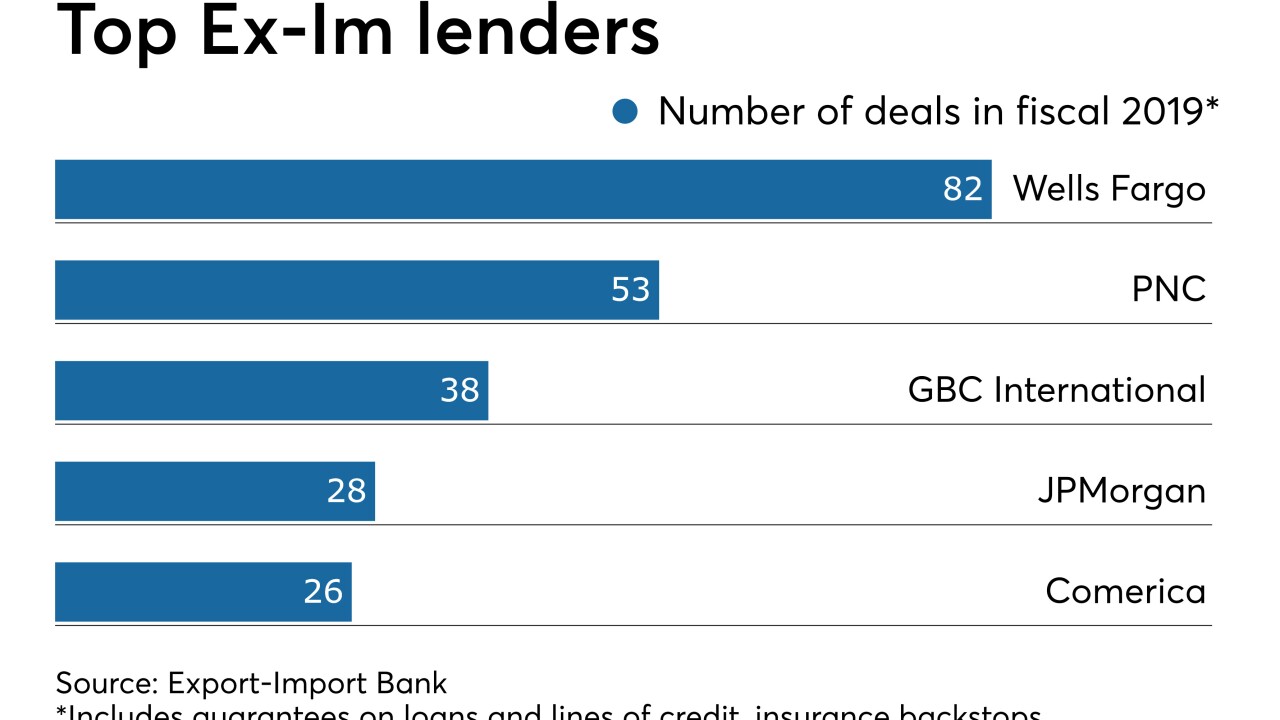

Lenders that depend on the Export-Import Bank to back loans to exporters are already seeing business borrowing pick up after Congress reauthorized the agency in December.

January 30 -

A smiling President Donald Trump thanked some of the biggest U.S. companies for about 10 minutes on Wednesday at the White House, where he was celebrating his trade deal with China. When it came to JPMorgan Chase, he asked for reciprocation.

January 15 -

The country's biggest bank is leaning more on fee income to offset rate pressures, expanding in selected U.S. cities and laying the groundwork for operations in China that CEO Jamie Dimon hopes will endure “for 100 years.”

January 14 -

But some industry watchers are tempering expectations, saying that the language is too vague to know for sure if China is serious about introducing more foreign competition.

December 16 -

Though details of a potential pact with China aren't clear, bankers are hoping it could convince leery customers to finally go through with delayed investments.

December 13 -

Many business customers are putting off expansion because they can’t find enough workers to fill available jobs.

December 11 -

The percentage of farm lenders losing money hit a six-year high in the third quarter, according to the FDIC.

December 5 -

So far farm loans are holding up well, but bankers gathered at an industry conference this week said they are growing increasingly concerned that credit quality will weaken if the U.S. and China don’t reach a deal soon.

November 12 -

Sen. Thom Tillis of North Carolina called for the panel to hold a hearing on what he termed the danger that the Federal Reserve will meddle in the 2020 presidential election.

August 28 -

Competition for deposits is tight, the outlook for loan demand is uncertain, and regulatory relief is slow-moving. Yet community bankers are feeling better about the economy than they have in two years, a Promontory Interfinancial Network survey found.

August 19 -

China's decision to stop buying U.S. soybeans and let its currency depreciate raised the prospect of further interest rate cuts. That hurt banks slightly more than the rest of the market on what was a bad day for all equities.

August 5