Top Billing

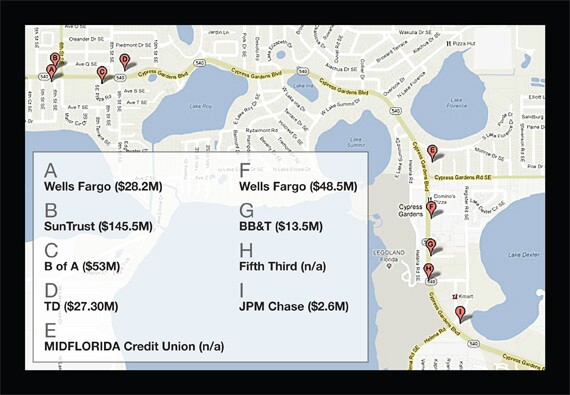

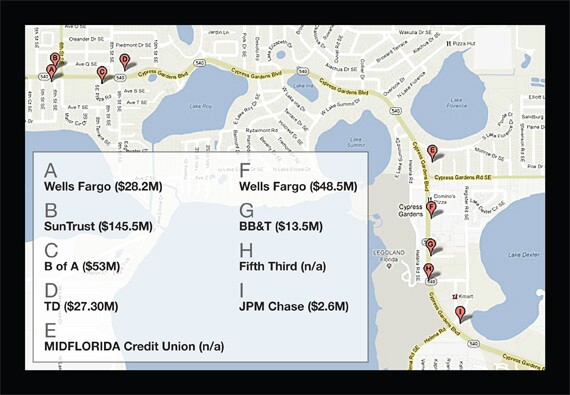

Bank Boulevard

Ready to Roll

Creatures Big and Small

Branding ... Brilliant!

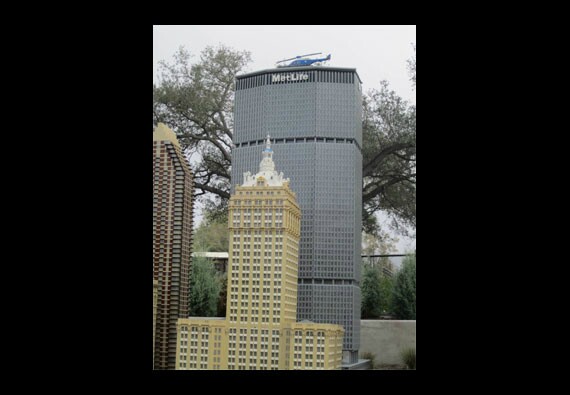

National Banking

D.C. Double Take

Landscaping 101

Exit Plan

Real Money

As federal watchdogs step back from regulating "Buy Now, Pay Later" loans, state authorities are stepping in. This week, the attorneys general from California and several other blue states joined the fight.

In a relatively mild oversight hearing in the House Financial Services Committee Tuesday morning, regulatory heads at the Federal Reserve, Office of the Comptroller of the Currency, National Credit Union Administration and Federal Deposit Insurance Corp. outlined plans for reduced capital requirements and debanking enforcement.

South Plains Financial agreed to pay $105.1 million in stock to acquire a seven-year-old Houston community bank in its first M&A foray since 2019.

Democratic lawmakers, led by Senate Banking Committee ranking member Elizabeth Warren, D-Mass., press 21 institutions for fee data after a federal agency halted disclosure requirements.

The CEO spoke with American Banker about the company's plans for AI, blockchain, taking its digital wallet global and making PayPal and Venmo work together for the first time.

Financial institutions see an opportunity to nab scale after years of tepid dealmaking, but investors are pushing back against such efforts out of concerns about shareholder value.