(Image: Thinkstock)

Swiping in at Capital One

Bank of the West's Pre-Login Balance Check

Four-Digit PIN at Frost Bank

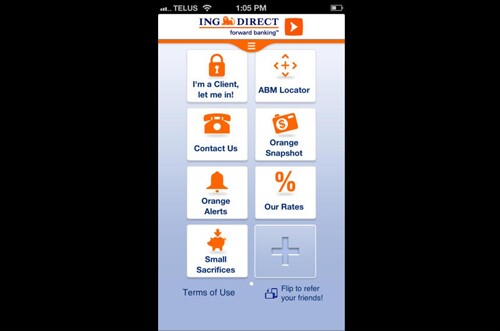

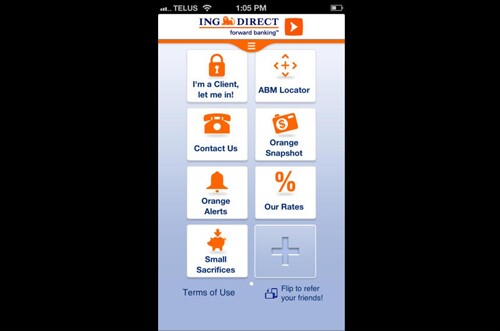

Face, Voice Recognition at ING Direct Canada

(Image: Thinkstock)

Jack Dorsey's payments company also laid off employees early in 2025 and 2024 following a self-imposed employee cap of 12,000 in November 2023.

To address a budget deficit, the state of Washington has begun taxing credit unions that buy banks. Critics say there's just one problem: The tax will deter any such acquisitions from happening.

Kohler Credit Union, Think Bank and Communication Federal Credit Union gave their onboarding and direct deposit tech an upgrade through fintech partnerships.

Some distressed companies that tapped the Federal Reserve's Main Street Lending Program say they've been crushed by the agency's hard-line stance on modifications.

Threat group ShinyHunters claimed responsibility for the attack, which reportedly targeted third-party platforms rather than Betterment's own systems.

Artificial intelligence developments are stoking investor fears about software companies. Banks' limited exposure to the sector and general stability is proving attractive to investors.