-

Rep. Darrell Issa, the chairman of the House Oversight Committee, is calling Elizabeth Warren back to the Hill for a second hearing following a dispute with a subcommittee chairman last week.

June 1 - WIB PH

Analysts said personally attacking the de facto head of the Consumer Financial Protection Bureau is a smart political strategy for the GOP — but also, strangely, helps the Democrats.

May 27 -

Senate Republicans are urging the House to use a procedural maneuver to block President Obama's recess appointment powers for the remainder of his term.

May 26 - WIB PH

The atmosphere at a House hearing reflected how polarizing a figure Elizabeth Warren has become, being portrayed either as a symbol of overreaching government or a defender of the consumer.

May 24 -

While Sen. Shelby has every right to seek changes to laws that aren't working, he should give Dodd-Frank and the Consumer Financial Protection Bureau a chance before he tries to crush them.

May 9 -

Republicans are strongly considering using a rare procedural move to prevent President Obama from making a recess appointment to install a director of the Consumer Financial Protection Bureau.

May 6

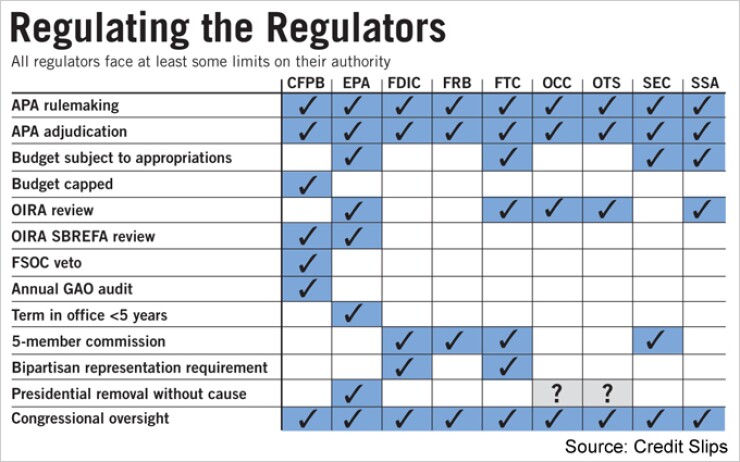

WASHINGTON — Depending on which political party you talk to, the Consumer Financial Protection Bureau is either the most powerful federal agency ever created, or the most constrained.

While the truth lies somewhere in between, one thing is clear: Most of the claims made about the CFPB just aren't true. Republican assertions that the agency enjoys an unlimited budget and is exempt from congressional oversight, for example, are demonstrably false. But Democrats' contention that the CFPB is a severely restricted agency is also misleading.

"Like a lot of these things, it's a little of both," said Karen Shaw Petrou, a managing partner with Federal Financial Analytics. "There's no question that other banking agencies are powerful, and the two I would cite immediately that are independent — i.e., not subject to the president and exempt from the appropriations process and somewhat limited accountability

ash; are the Fed and the FDIC."

But, she said, the statute gave the CFPB a "terrific amount of authority, and far better protection from political interference or judgment … than is often the case for most regulators."

With that in mind, we offer a guide designed to separate fact from fiction concerning the CFPB.

Myth No. 1: The CFPB is the most powerful agency to ever exist.

In an interview with CNBC in March, Tom Donahue, the chief executive of the U.S. Chamber of Commerce, called the CFPB "the most powerful regulatory agency that's ever been put together." House Financial Services Committee Chairman Spencer Bachus and other top panel Republicans have all echoed similar claims.

So what are these new, sweeping powers the CFPB has? Well, for starters, most of the agency's authority is not new at all, but transferred from other federal agencies. That includes enforcement of dozens of different consumer financial rules, such as the Home Ownership and Equity Protection Act and Home Mortgage Disclosure Act.

Like other agencies, it has the power to hold hearings and subpoena witnesses and documents. It can also issue cease-and-desist orders and penalize individuals upward of $1 million for each day they are in violation of a consumer law. It is the only bank regulator that can take a bank directly to court on any fair-lending matter, rather than having to go through the Justice Department.

One "new" power is a twist on an existing one bank regulators previously had. Before Dodd-Frank, the Federal Reserve Board could ban "unfair or deceptive" practices, a power the agency used only sparingly. But the CFPB has the power to define "unfair, deceptive or abusive" practices in connection with consumer products. Unlike the Fed, the new agency is expected to be much more proactive in pursuing practices it deems are inappropriate. By adding "abusive," the CFPB also may have additional leeway that other agencies did not.

Another provision of Dodd-Frank allows the CFPB to consider whether a bank has taken advantage of the consumer's reasonable reliance on the provider to watch out for the consumer's best interest. Some observers see that as significant new authority. "There is so much power in that statement … it's almost a carte blanche," said Jo Ann Barefoot, the co-director of Treliant Risk Advisors. "I definitely think that there's more power and latitude in the CFPB than most of the comparable agencies."

But the primary difference is the agency's focus. Instead of having other concerns, like safety and soundness, that might take priority over consumer issues, the CFPB is just worried about one thing: borrower protection. The real fear is not that the agency is much more powerful, but that unlike the bank regulators, it may use its authority.

Still, the bureau doesn't exactly have a blank check to do what it wants. Dodd-Frank includes some unique requirements that other banking regulators do not face, including that it must consider the potential costs and benefits of any new rule to both consumers and providers, and must consider the impact of proposed rules on community banks and smaller credit unions, and on consumers in rural areas. It's worth noting that it must, like other federal agencies, comply with the Administrative Procedures Act, which requires regulators to allow the public to comment on any rule before it is finalized.

"In terms of the powers themselves, I don't think that there is a huge advantage that they hold," said Donald Lamson, a former bank regulator who was detailed to the Treasury Department in 2009 to help draft the administration's regulatory reform proposal. "Instead, they've got a focus that previously no regulator had. Some people would say that that's an advantage, that in the past banking agencies have not used their authority, so it's appropriate to use it now. Now where is the right balancing point? Time will tell."

Myth No. 2: CFPB has virtually unchecked authority.

Rep. Patrick McHenry, R-N.C., claimed last month that the CFPB will possess virtually unchecked discretion. Although observers said Republicans have legitimate concerns about the effectiveness of checks and balances for the CFPB, it's simply untrue to say that they don't exist.

Under Dodd-Frank, the Financial Stability Oversight Council can overturn the CFPB's rules by a two-thirds vote. Democrats, correctly, point out that no other regulator is subject to such an override, implying it is a significant check on the agency's authority.

But it's an open question whether the FSOC would ever really use such power. It requires a two-third vote by the council — with one of the 10 votes held by the director of the CFPB. While not an impossibly high bar — after all, the Senate meets the threshold on a regular basis — it is designed to make it hard to override the CFPB.

"I think there will be a very strong tilting of the balance in favor of the agency being able to do what it wants," Barefoot said.

Critics have also pointed to the bureau's structure — headed by a single director — as evidence of its unchecked authority.

Many other regulators, including the Federal Deposit Insurance Corp., Fed Board, Securities and Exchange Commission, Federal Trade Commission and Consumer Product Safety Commission, are run by a commission or board, whose members are made up of Democrats and Republicans.

But Petrou questioned what that means in practice. "Theoretically, it limits an agency from an oligarch, but that's not really been the case," she said. "If you look at the FDIC, it is really run by Sheila Bair. I'm trying to remember the last time the FDIC board rejected not just her, but any chairman."

The two notable exceptions to the board structure, the Office of the Comptroller of the Currency and the Office of Thrift Supervision, are technically bureaus of the Treasury, a fact that Republicans like to note when Democrats raise the point that the OCC has unchecked powers.

But in real terms, the OCC is hardly controlled by the Treasury. Other than limiting the comptroller's testimony before Congress, former OCC officials agree the Treasury seldom attempts to oversee the OCC, and certainly never attempted to overturn regulations.

"They could comment on it and they could complain about it, but they couldn't really change it," said Bob Clarke, a former comptroller.

Clarke said the real oversight of the OCC comes from Congress.

"You can't just go off as the head of an agency and do anything you want to do," he said. "Somebody is going to call you on the carpet if you're doing something that is just off the charts."

Myth No. 3: CFPB is not subject to congressional oversight.

Among the disparate claims about the CFPB is that the agency somehow does not have to answer to Congress.

While Republicans may be frustrated with what they see as misleading or evasive testimony from Elizabeth Warren, the bureau's de facto head, the fact that they can call her up to the Hill for a hearing — twice in a single month — is evidence of their oversight authority.

Under Dodd-Frank, the bureau is also required to submit annual financial reports to Congress, and report twice a year to justify its budget. The director must testify twice each year about the bureau's activities, and must submit financial operating plans and forecasts and quarterly financial reports to the Office of Management and Budget.

Unlike any other banking regulator, the CFPB will be subject to an audit by the Government Accountability Office, which will present its findings to Congress. Congress also has the power to overturn regulations through the Congressional Review Act.

Myth No. 4: CFPB has unparalleled budget authority.

At the heart of Republican arguments is that the CFPB is not on the appropriations process, unlike many other federal agencies, including the SEC, Consumer Product Safety Commission and FTC.

But as a banking regulator, the CFPB is hardly alone in being free of the congressional purse strings. Every other bank regulator — including the FDIC, OCC, Fed and Federal Housing Finance Agency — is funded by exam fees or other activities such as deposit insurance assessments. "The whole reason behind that was to try to make bank regulators independent," Clarke said. "Not that they're not accountable to anybody, but just that they're independent of the political process."

Unlike other bank regulators, however, the CFPB is not funded by exam fees but by a fellow regulator. Under Dodd-Frank, it can pull as much as 10% from the Fed's budget. While a large sum, it's important to note that it isn't, as some critics would claim, unlimited. For this year, the CFPB has a budget of $142.8 million, and has requested $329 million for fiscal 2012.

While Republicans have supported independent funding for certain agencies they do not feel the same way about the CFPB.

"If I wanted to see an activist CFPB, I would want the agency to be insulated from political whims, from appropriators that might want to slow down the mission," Lamson said. "If I were concerned that the bureau is going off in a direction that I disagreed with, I might want to see greater accountability through the appropriations process, where after all, the appropriators are elected."