-

The five largest mortgage servicers are suddenly eager to provide relief to distressed homeowners, but after years refusing to modify loans or reduce principal, they are concerned that borrowers will ignore their solicitations.

August 22 -

Joseph Smith, who is responsible for monitoring the 49-state mortgage servicing settlement, plans to spread the work among multiple consulting firms.

June 5 -

Joseph Smith, who is responsible for monitoring compliance with the $25 billion multi-state mortgage settlement talks potential fines, consumer complaints about servicers and how he plans to move forward on hiring help for the massive undertaking.

April 9

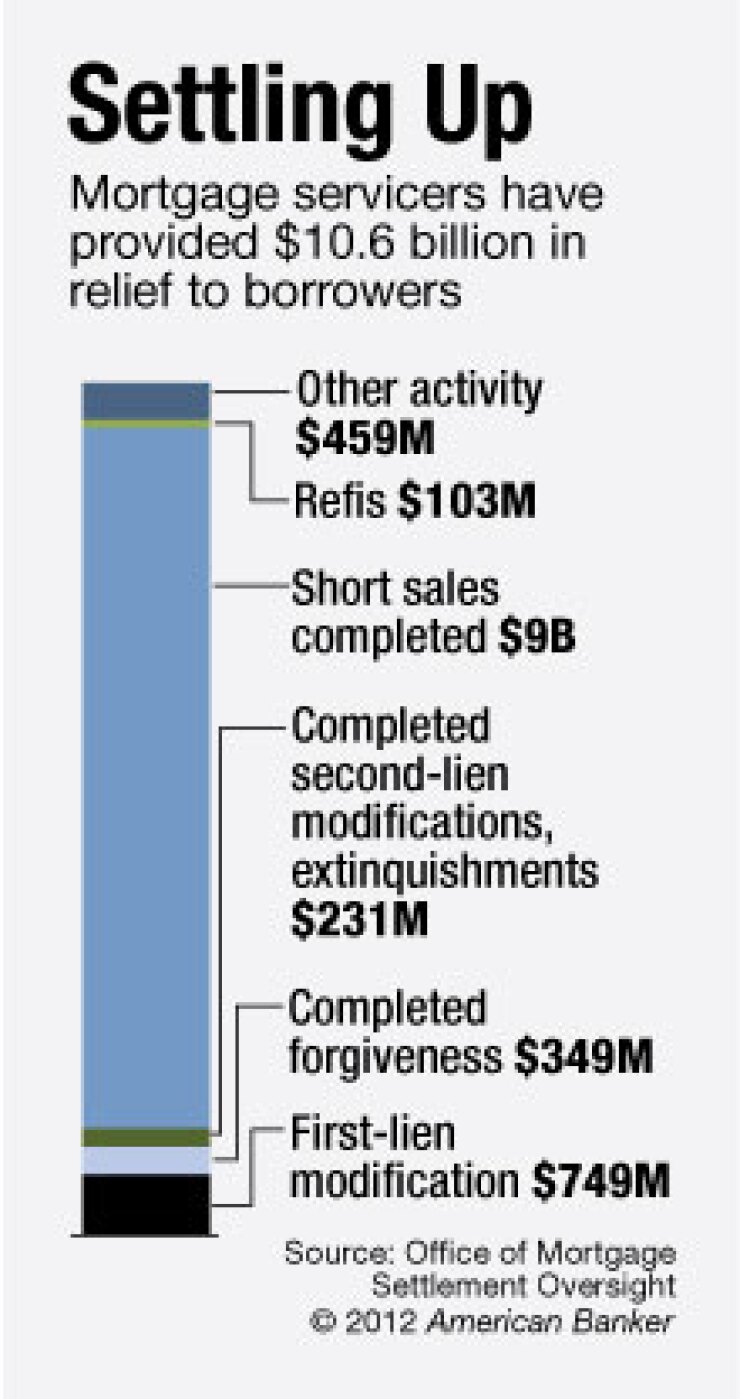

The top five mortgage servicers offered $10.6 billion in consumer relief as part of the $25 billion national mortgage settlement, with the vast majority of aid coming in the form of short sales, the independent monitor said in a preliminary report Wednesday.

Bank of America (BAC) stood out because it failed to complete any loan modifications or refinancings from in the first four months after the settlement took effect March 1. But the Charlotte, N.C., bank completed $4.8 billion in short sales to nearly 40,000 borrowers — the bulk of all relief — and is on track toward approving nearly $3 billion in principal reductions to borrowers, B of A and the independent monitor said. B of A trailed in modifications because servicers do not get credit toward principal reductions until the borrowers have completed a 90-day trial period.

Joseph A. Smith, the former North Carolina banking commissioner who is now monitoring the settlement agreement, cautioned that because the information contained in his first report was given voluntarily by the servicers, the total cannot be used to evaluate the progress they have made in fulfilling their obligations as laid out in the national settlement. The bulk of the relief will ultimately come in the form of first- and second-lien principal forgiveness and refinancings, though the banks get partial credit for short sales.

"It's a snapshot and a baseline from which to judge what happens next," Smith said in an interview Wednesday. "There is a significant amount of work in progress so let's wait and see."

The top five mortgage servicers — B of A, Citigroup (NYSE: C), JPMorgan Chase (JPM), Wells Fargo (WFC) and Ally Financial — have two years to meet 75% of their goals that give them credits toward the settlement.

Roughly 138,000 homeowners received relief in the four-month ramp-up period that ended June 30, though the vast majority came in the form of debt forgiveness for short sales, in which the bank takes a loss when a home sells for less than the amount of the mortgage.

Short sales have been the easiest to execute because they did not require the development of new technology. Going forward, the servicers will face even more rigorous testing on 29 different metrics related to the settlement agreement.

"We will be watching like hawks to make sure they fulfill the requirements under the settlement," Shaun Donovan, the Department of Housing and Urban Development Secretary said Wednesday on a conference call with reporters. "This is very much a ramp-up period. I am cautiously optimistic and encouraged by what's in the report."

There is some concern that homeowners who receive principal write-downs on their mortgages will have to pay taxes on the aid they receive. Donovan said he is working on getting an extension to legislation that expires at year-end that would exempt distressed homeowners from having to pay taxes on principal reductions.

The banks have until Oct. 5 to comply with more than 300 servicing standards that are expected to put an end to lost paperwork and improper legal filings of foreclosure that have plagued the industry.

All of the servicers claim to have met 56 separate servicing standards that have been incorporated into their practices after massive failures led to the robo-signing scandal that prompted the settlement and a two-year review of foreclosure practices by regulators.

The first official report on servicers' progress is expected to be released in November. Smith can impose fines and penalties if the banks fail to comply with any of the terms of the settlement, including taking the banks back into court.

Under the settlement, servicers are supposed to provide $17 billion in debt forgiveness, forbearance plans and short sales, and roughly $3 billion in refis.

In the four-month period that ended in June, JPMorgan Chase offered $367 million in first-lien modifications and $2.4 billion in short sales while Wells Fargo completed $217 million in loan modifications and $733 million in short sales. Ally Financial provided $111 million in first-lien loan mods and $350.8 million short sales and Citi completed $54 million in mods and $423 million in short sales.

In that same timeframe, the servicers extinguished $231.4 million in second liens for more than 4,200 borrowers. More than 22,000 refinanced their loans, reducing their average interest rate by 2.1 percentage points.