-

U.S. Bancorp in Minneapolis lowered its loan-growth expectations for the fourth quarter to reflect borrower uncertainty about the election, the fiscal cliff and the overall economic environment, CEO Richard Davis says.

October 17 -

Banks are growing increasingly worried that the failure to stem impending tax hikes and steep budget cuts could reduce lending demand, savage profits and cripple M&A activity.

September 27 -

Uncertainty surrounding the economy, the election and other concerns are keeping some potential borrowers "on the sideline," Beth Mooney, the chairman and chief executive at KeyCorp (KEY) said Monday.

September 10

The potential of falling off the fiscal cliff is making bankers more cautious about their exposure to government contractors.

Community banks in particular are re-evaluating every client that provides government services because of concerns about

"Every bank and every client should be playing the 'what if' scenario" of major spending cuts, says Mark Moore, the chief lending officer at John Marshall Bank in Reston, Va. "We have to prepare for the worst and hope for best."

Fiscal gridlock would be bad for all banks, but it would be especially taxing on community banks that have managed to make loans to government contractors even as overall loan demand has waned. It would also pressure contractors should banks cut back in government lending.

Lending had "been tight for several years but it has gotten better," says Wes Teague, the chief operating officer of Z Systems, which provides logistics services to the public and private sectors. Legislative bickering will "stall some of that improvement," says Teague, who began working with a community bank in August.

"If work is cut across the board, it will reduce the backlog and pipelines and it will reduce a bank's appetite, if you will, for lending," Teague says.

If legislators fail to reach a compromise this year, an automatic $1.2 trillion in deficit reduction moves will kick in on Jan. 2, harming businesses that provide services to the federal government. At best, those borrowers could

Some banks are hosting seminars and meeting with contractors to vet business plans. John Marshall Bank is sitting down with every client that provides government services. The $485 million-asset bank reviews financial statements and business prospects while discussing each client's hiring philosophies, cost structures and bid proposals.

"When things come up for bid, they might have to lower their pricing" expectations, regardless of the budget situation, Moore says. "This is all basic stuff, but this is where it really matters the most right now."

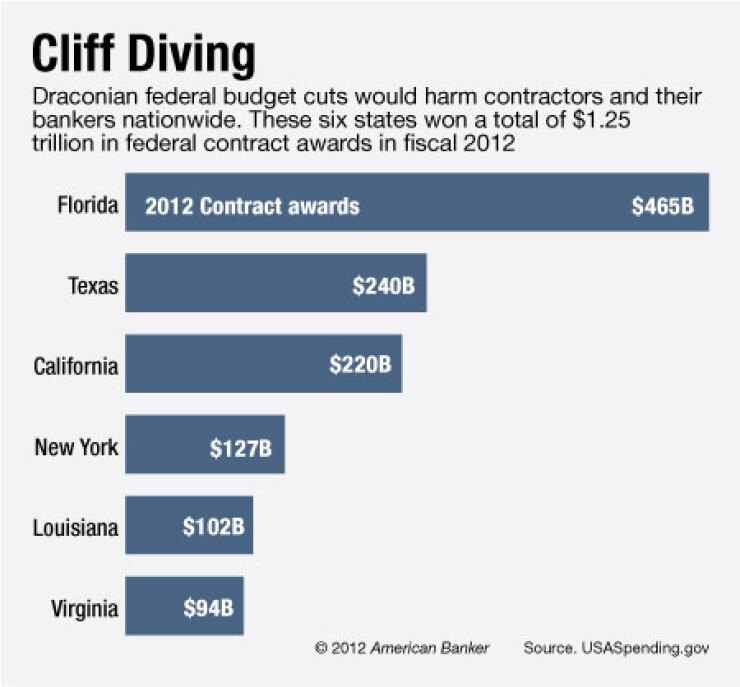

Most banks in the Washington area have ties to government contractors, but the cutbacks would have repercussions far beyond the nation's capital. Florida, California and Texas received the most federal contract assistance during the past fiscal year, with a total of $925 billion, according to USASpending.gov.

"The trickle-down effect will completely undermine business confidence," says Michael Clarke, the president and chief executive of Access National in Reston. "Banks in other areas around the country are just now starting to heal. To be hit with this kind of setback will really push them back a few years in terms of strengthening their balance sheets."

Bankers typically like to lend to government contractors, and John Marshall Bank and Access National have no plans to leave the business. Contractors tend to be low-risk credits because they have the backing of the federal government.

That dynamic could change if projects are cut or scaled back.

Problems will surface "if a customer gets cut off and contract funding gets withdrawn," Clarke says. "Then the customer and the bank are faced with a situation of whether to take the risk of advancing credit."

Access National added $1.2 million to its loan-loss allowance during the first half of this year, compared with just $221,000 a year earlier, in part to prepare for challenges with contractors. About a quarter of the $840 million-asset company's clients have ties to government services.

Access National has hosted seminars covering ways to reduce exposure to potential cutbacks. The company has also pulled back on longer-term loans, or those that span three to five years and are based on cash flow and profit.

"In an uncertain environment like this, we're less willing to make those types of loans," Clarke says. "They have a higher degree of risk to the bank and are in greater jeopardy of being put in default if there is a government shutdown."

Contractors are also making adjustments, which will put more pressure on banks that are struggling to post loan growth. "We're being very fiscally responsible" with expansion, including hiring and equipment purchases, Teague says.

Companies are reluctant to tap more than half of their existing credit lines. Businesses that would otherwise use up to 70% of their lines at Access National are showing a preference to stay below 30%, Clarke says.

Z Systems is not looking for additional loans. The contractor has enough credit to meet existing needs, Teague says.

"I think some companies have a lot of" credit lines … and potential budget cuts have to be "a much more serious concern for them," he says.