-

A three-year legal odyssey raises questions about whether banks are pursuing meager revenues at the risk of serious errors, damage to reputations.

March 29 -

How a whistleblower's allegations about mishandled credit card debt and shoddy recordkeeping at JPMorgan Chase snowballed into the shutdown of a multi-billion dollar credit card litigation operation and an OCC review.

March 15 -

Robo-signed affidavits and sloppy legal work led the bank to halt court claims. The errors cast doubt on billions of dollars in judgments.

March 12 -

Banks, collections agencies face a rising tide of challenges that echo the mortgage market's documentation scandal.

January 30 -

JPMorgan Chase & Co. has quietly ceased filing lawsuits to collect consumer debts around the nation, dismissing in-house attorneys and virtually shutting down a collections machine that as recently as nine months ago was racking up hundreds of millions of dollars in monthly judgments.

January 10

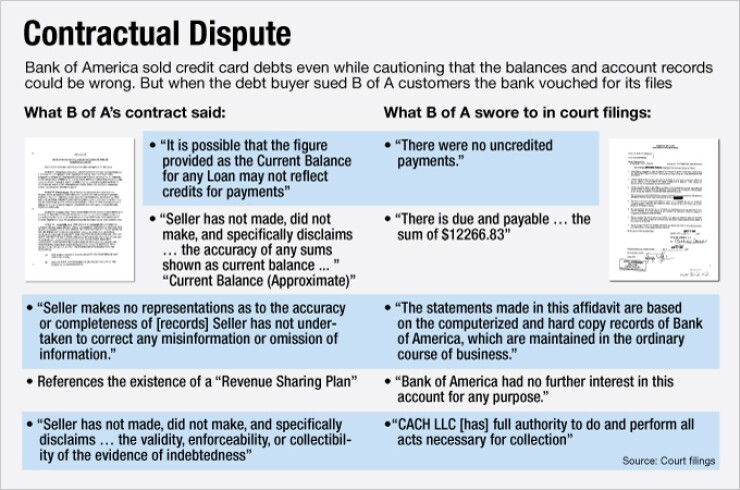

Bank of America has sold collections agencies rights to sue over credit card debts that it has privately noted were potentially inaccurate or already repaid.

In a series of 2009 and 2010 transactions, Bank of America sold credit card receivables to an outfit called CACH LLC, based in Denver. Co.

The pricing reflected the accounts' questionable quality, but what is notable is that the bank could get anything at all for them. B of A was not making "any representations, warranties, promises, covenants, agreements, or guaranties of any kind or character whatsoever" about the accuracy or completeness of the debts' records, according to a 2010 credit card sales agreement submitted to a California state court in a civil suit involving debt that B of A had sold to CACH.

In the "as is" documents Bank of America has drawn up for such sales, it warned that it would initially provide no records to support the amounts it said are owed and might be unable to produce them. It also stated that some of the claims it sold might already have been extinguished in bankruptcy court. B of A has additionally cautioned that it might be selling loans whose balances are "approximate" or that consumers have already paid back in full. Maryland resident Karen Stevens was the victim of one such sale, which resulted in a three-year legal battle (see

Bank of America declined requests to comment for this story, other than to say through spokeswoman Betty Riess that it works with credit card customers to try to resolve delinquent debt issues. CACH did not respond to several phone and email messages seeking comment on the terms of its purchases.

Some industry observers said that the language in Bank of America's sales documents should be regarded as standard legalese intended to protect it against a disgruntled buyer's legal claims. And even though Bank of America refused to stand behind the accuracy of the records it sold, debt buyers are the ones who make the call to sue.

"The buyer has the primary responsibility to test the … quality of what they're buying," says Samuel Golden, a former OCC ombudsman who is a managing director at consulting firm Alvarez & Marsal in Houston, Texas.

Collectors' responsibilities aside, other banks' sales agreements suggest Bank of America's standards are emblematic of wider industry practice that raises risk management concerns. For less than $1.2 million a month — a rounding error on B of A's income statement — the company sold CACH accounts that raise regulatory and reputational questions about the accuracy of its records and its disclosures to courts.

Industry Practice

As the originators of credit card loans, banks are at the headwaters of the rivers of bad debt that flow into the collections industry. Over the last two years, Bank of America has charged off $20 billion in delinquent card debt. The bank settles or collects a portion of that itself and retires other accounts when borrowers go bankrupt or die. An undisclosed portion of the delinquent debt gets passed along to collectors. Once sold, rights to such accounts are often resold within the industry multiple times over several years.

Bank of America's caution that its card records may be incomplete or inaccurate suggests that documentation and accuracy problems may originate at the debt's source. Other banks' debt sale contracts acknowledge potentially large holes in their records as well.

One such example involves

Teri Charest, a spokeswoman for the bank, noted that the contract had expired and said that, regardless of such past contractual language, the bank scrubs its card data and that the claims it sells are accurate.

JPMorgan Chase, meanwhile,

The bank declined to comment. Palisades' chief counsel Seth Berman says the company has not bought Chase card debt in several years, but that its standards were always high.

The U.S. Office of the Comptroller of the Currency is already investigating JPMorgan Chase's handling of credit card debt records, as reported by American Banker

CACHing In

At Bank of America, records declared unreliable yet sold to CACH were used to file thousands of lawsuits against consumers, according to a review of hundreds of cases in the state courts where collection suits are typically filed. The overwhelming majority of cases end in default judgments, which are awarded to creditors when borrowers don't show up to contest the claims made against them.

In cases where debtors do challenge collections demands in court, the original bank-creditor must testify about the documentation supporting the claims. In several such instances, people identified as Bank of America employees have submitted affidavits attesting to the validity of debts sold by the bank to collections firms.

Even though Bank of America previously disavowed "the accuracy of the sums shown as the current balance," the sworn statements vouch for the borrowers' debts down to the penny and declare that the bank's "computerized and hard copy records" back the claims. There are other possible discrepancies, as well: the affidavits state that B of A "has no further interest in this account for any purpose," while the sales contracts reference a "revenue sharing plan."

The prospect that B of A was selling unreliable credit card debts did not deter CACH from buying them. A subsidiary of SquareTwo Financial, CACH does not collect debts itself. Instead, it operates like a restaurant franchiser, acquiring rights to the delinquent debts that are the raw materials of the collections business. It then works with law firms around the country that do the actual collections work, providing them with debt files, court witnesses and other services.

In thousands of cases in state courts, CACH has appended a single page from its purchase agreements with Bank of America attesting to its ownership of delinquent credit card debt. CACH has omitted from many such filings the more than 30 additional pages where Bank of America disclaims the accuracy of its debt records. Even so, attorneys affiliated with CACH have cited the reliability of Bank of America's records as the foundation for their collections lawsuits.

In the case involving CACH in Duval County, Florida, a person described as B of A "Bank Officer" Michelle Samse swore in an affidavit that "There is due and payable from WENDY CODY as of 9/18/2009 the sum of $12266.83." The Samse affidavit, typical of many others, went on to say "The statements made in this affidavit are based on the computerized and hard copy books and records of Bank of America, which are maintained in the ordinary course of business." Attempts to contact Samse and Cody through Bank of America switchboards and public records searches were unsuccessful.

Trust Us

The degree of precision attested to regarding Cody's debt is curious, considering that Bank of America declared it was unable to produce records to back it up. "[T]he original contract in this matter has been destroyed, or is no longer accessible," Samse's affidavit states. "This affidavit is to be treated as the original document for all purposes."

The affiliate representing CACH in the Cody case was Collect $outheast, which uses the phrase "Let us show you the MONEY!" in company promotions. Collect $outheast and Florida attorneys representing CACH in other cases did not respond to requests for comment.

Taras Rudnitsky, a consumer defense attorney in Lake Mary, Florida has regularly defended consumers against lawsuits filed by CACH affiliates in Duval County. He says he regularly demands that debt buyers file banks' sales agreements with the court and invariably runs into stiff opposition.

"In every single case I have involving a debt buyer, they refuse to produce a forward flow agreement," he says, referring to the term for sales contracts under which banks agree to sell a specific number of delinquent accounts in the future. "When push comes to shove, the case disappears."

Weak Link

For individual clients, dismissal of such a case is a victory, but such outcomes are the exception. In the vast majority of collections suits, consumers fail to respond to card payment demands and become liable for default judgments, says Peter Holland, who runs the University of Maryland Law School's Consumer Defense clinic and has collected some of the forward flow agreements. As a result, the questionable reliability of second-hand debt claims is failing to receive the attention it deserves, he says.

"The [terms of] forward flows are being hidden from the public and from the courts," says Holland. "When the banks say explicitly that they don't have the documentation, that's something courts need to know. When a bank says a balance is 'approximate,' that's something courts and consumers need to know."

To date, it is debt collectors who have been the main focus of complaints and lawsuits alleging wrongdoing. In the past year alone, collections firms have paid out a number of multi-million dollar settlements over allegations they robo-signed affidavits, failed to produce evidence to support payment demands and sued consumers over debts that were no longer owed.

According to a trade organization for the collections industry, much of the criticism of collectors' records stems from banks' failure to provide adequate documentation of debts.

"We're not getting what we need from the seller," says Mark Schiffman, a spokesman for the American Collections Association, which wants to see better recordkeeping and more documentation included in debt sales. "Consumer groups want to see original contracts and original documentation. That would make a lot of these debts disappear because a lot of that documentation may not exist."

Regulatory Interest

Washington regulators are beginning to look at what responsibility banks have for wrongful collections activity. But questions about jurisdiction and whether banks will get roped in remain open.

"Not enough information [is] flowing through to debt collectors," says Tom Pahl, an assistant director in the Federal Trade Commission's division of financial practices. Despite its concern, the FTC lacks the authority to regulate financial institutions

"We can't reach the banks to say 'Thou shalt file the following pieces of information with the loans,'" Pahl says. "We're trying to do most of this through either law enforcement, which is case-by-case, or by jawboning the industry."

The Consumer Financial Protection Bureau has jurisdiction over credit cards and last month announced plans to take a close look at the collections industry. The bureau's interest has been heightened by revelations of abuses by mortgage servicers, including robosigning of affidavits, according to spokeswomen Jennifer Howard.

The CFPB is "very concerned that the same shortcuts and violations may be occurring with other kinds of debt collection," she says.

The OCC, which likewise oversees banks, declined to comment on specific institutions' sales of credit card receivables. However, it expects banks to adhere to high standards regarding account records, especially in cases where institutions attest under oath to their accuracy, according to OCC spokesman Bryan Hubbard.

"There may be reasons it's hard to do. Large portfolios being bought. Systems integration. But banks are still accountable for maintaining accurate records," says Hubbard.