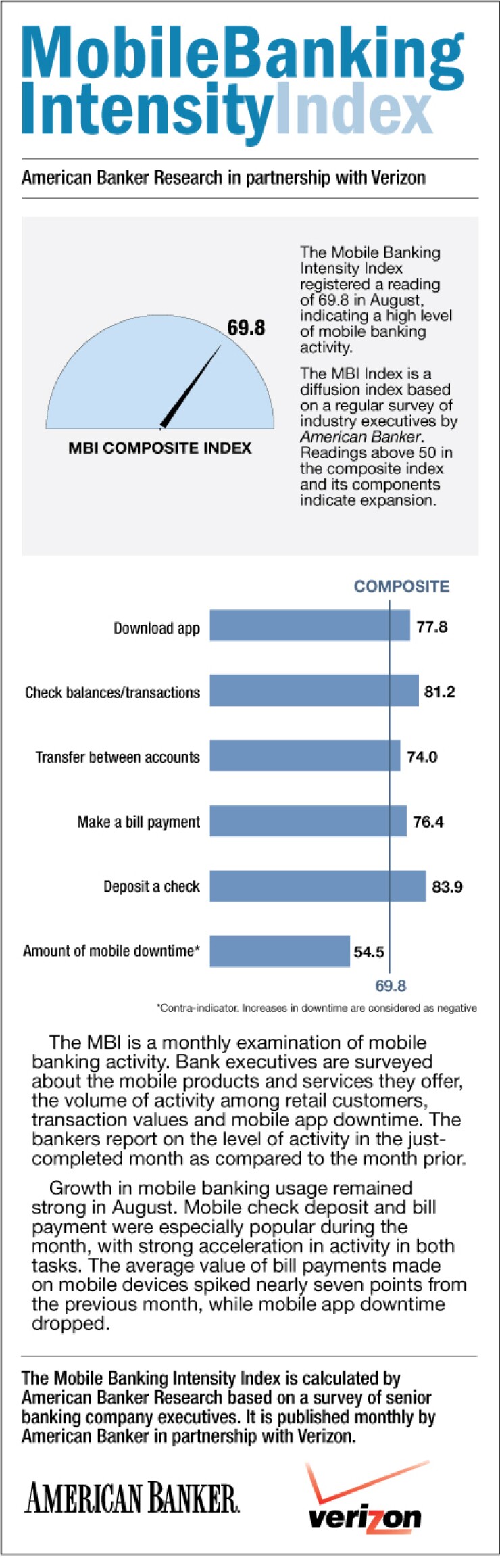

Consumers stayed glued to their smartphones and tablets in August, taking care of financial chores on their devices at a steadily increasing rate. The overall value reading of American Banker's Mobile Banking Intensity Index for the month was high: 69.8.

The index is a product of American Banker's regular surveys of banking executives and is published in partnership with Verizon. The MBII is a diffusion index. For context, readings above 50 in a diffusion index indicate expansion and readings below 50 point to contraction. The further from 50 a reading is, the stronger the indicated change. A reading of 50 suggests that activity was unchanged month to month. All the data in the index is compiled from a survey of 299 bank executives, all from institutions that offer mobile banking. The index values are calculated based on respondents' answers to questions about customer activity in certain aspects of mobile banking, such as checking account balances, transferring money between accounts and paying bills.

Why, after many years of existence, does mobile banking continue its upward trajectory? Several survey respondents noted that consumers are getting more used to it. "Adoption rate is increasing as people become more familiar and trust the technology," wrote one. "Customers are watching their balances more closely and using the aps with more confidence," said another. "It is the fastest growing channel we have," stated a third. "Mobile banking is relatively new, so growth is high," said a fourth, and many other respondents echoed that observation.

One banker speculated that cell phone network availability is driving customers to their smartphones: "Our mobile usage is increasing each month. We are seeing a migration into our mobile apps away from the mobile web access. Our market is a rural market with limited wired broadband coverage and increasing wireless broadband coverage from the major wireless carriers. We suspect that this limited wired coverage and increasing wireless coverage is why we are seeing an increase in mobile usage."

A couple of survey respondents mused about the effect mobile banking use is having on other retail channels. "Mobile is gradually taking over our online channel," one wrote. "Customer base loves it - wonder what it will do to branch optimization longer term," said another.

A few offered specific explanations for higher August activity:

"August increase is due to increased adoption along with the seasonality of purchases (e.g. back to school)," one wrote. "August is high vacation month - more mobility," stated another. "Volume tends to pick up as students head back to college," another offered. (On the other hand, one banker gave the late-summer month as an excuse for lower usage: "Dog days of August!")

A few bankers gave their branch staff props for customers' increased use of mobile banking. "Effort on customer education from the retail bankers, especially branch network," said one. "We are getting more and more calls to our platform personnel regarding usage questions concerning the app along with positive feedback from clients concerning the app," stated another. "Retail staff pushing the use of mobile banking has spurred activity," said a third.

Two spikes were captured by the Intensity Index, one in the average value of bill payments made over mobile devices, the other in the volume of checks deposited using mobile devices. "Seeing increased activity on bill pay and mobile deposits, as advertising has focused on mobile applications," said one banker. "Increased deposit limits on mobile devices in August," another reported.

The average transaction value of retail bills paid on handheld devices rose by almost seven index points and the volume of mobile bill payment was also higher. "Picture bill pay drove activity," one banker wrote (clearly from one of the few banks that offer this capability). "Bill pay volume is almost 2,000 transactions higher," reported another.