-

Rising home prices have emboldened some lenders to search for remaining underwater borrowers who have not refinanced. Wishful thinking? Maybe, but with home purchases scare, lenders have few other options.

March 28 -

Home equity lending increased for the first time last year but overall mortgage originations in January were the lowest since November 2008, according to a monthly analysis of loan-level data from tech vendor Black Knight Financial Services.

March 5 -

Bitter weather, the qualified mortgage rule's restrictive guidelines and the lingering effects of the foreclosure crisis have put a crimp in homebuying at an inopportune time for lenders.

February 24

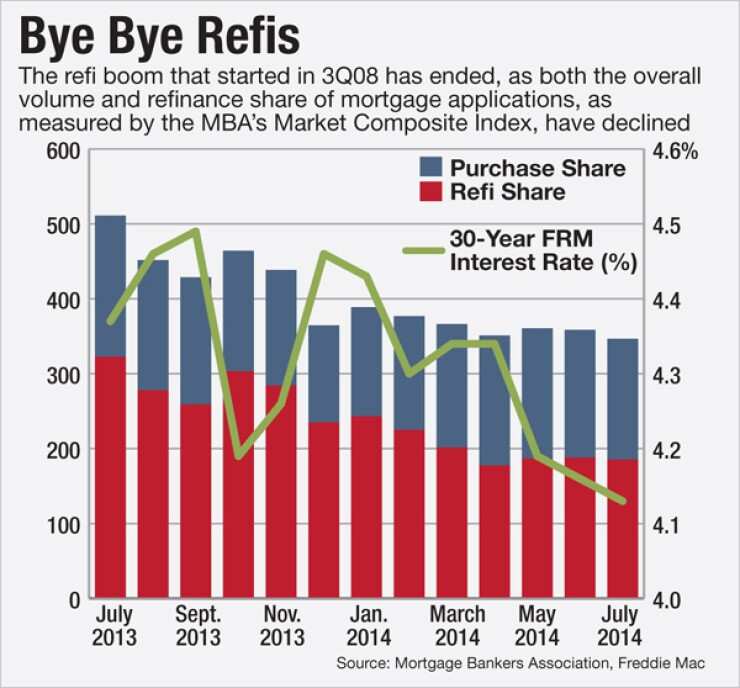

The share of mortgage applications for refinance loans has hovered above 50% since the first week in May, but that doesn't mean the mortgage industry is in the midst of another refinance boom, or even a boomlet.

In fact, Freddie Mac recently made its "official" call that the refinance boom ended in the second quarter of 2014.

"The housing market realized a significant shift in the second quarter of this year as refinance activity fell below 50% marking the onset of the first purchase-dominated market the industry has seen since 2000 and an end to the refinance boom that started in late 2008. We estimate over 25 million American borrowers refinanced their loans to the tune of over $70 billion in total interest payment savings," said Freddie Mac chief economist Frank Nothaft in a July 29 press release issued with the agency's quarterly refinance report.

But many industry observers said the secondary market agency is a year behind what's really been going on in the market. The rather rapid rise in mortgage interest rates in the spring of 2013 cooled both origination and refinance activity, leading many to claim the boom ended back then.

"You can point to last year, where we had a five to six week period where mortgage rates jumped almost a full percentage point and you saw a pretty quick retreat in refi volume after than happened," said Mike Fratantoni, chief economist at the Mortgage Bankers Association of America.

"The first six months of this year, rates have come down a bit from where they were in January," he added. "But we're in a space where most borrowers just don't have a lot of incentive to refinance."

Overall, mortgage production is down on a year-over-year basis. Refinance applications should be the main driver of a total production increase for that time frame.

"In order to have a refi boom, you have to have something that lifts the market," said Rick Sharga, executive vice president of Auction.com.

For the week ending Aug. 1, refi applications made up 55% of total app volume the highest level since March and up from 53% the previous week, according to the Mortgage Bankers Association.

There was a 4% increase in refi app volume, even though rates for the 30-year fixed-rate conforming mortgage gained two basis points over the previous week and for 30-year FRM jumbos, rates increased four basis points.

Interest rates were rather volatile at the end of that week. On July 31, the rate on the 30-year FRM as tracked by Zillow spiked at 4.23%, before retreating 20 basis points the next day.

"Rates temporarily jumped to the highest level in more than a month on the back of strong GDP growth figures, before cooling after weaker-than-expected jobs news," said Erin Lantz, vice president of mortgages at Zillow.

The recent rate movement likely brought consumers temporarily back into marketplace, but it's not the start of a new long-term wave. The average rate for 30-year conforming mortgages has steadily been above 4% for more than a year, and unless it drops below 4%, Fratantoni doesn't see the potential for a significant pick-up in refi volume.

With refinance activity plummeting for the better part of the last three quarters, Sharga suspects the timing of Freddie's declaration was tied to the slight cooling off of rates earlier this year and efforts by the Federal Finance Housing Agency to rekindle interest in the Home Affordable Refinance Program, currently scheduled to expire at the end of 2015.

"With all of that, we still haven't see refi activity come back up," said Sharga. "So this is putting a period at the end of a sentence and saying that it is pretty apparent to everybody involved right now that whatever refi boom we were looking at for the last couple of years is officially over at this point."

Freddie determines the beginning and end of a refi boom based on when the purchase share of mortgage applications exceeds 50%, based on the MBA's weekly mortgage applications survey, which includes data on both nonconforming and government loan applications.

Using that definition, the boom started in the third quarter of 2008. The nearly six-year duration is the longest refi boom since Freddie Mac started its quarterly refinance report in 1990. The refi share of applications fell below 50% during the week of May 2. But during the prior week, the MBA said total application volume was at its lowest point since December 2000. Interest rates later dipped to a six-month low, bringing the refi share of applications above 50% during the week of May 9, where they've remained ever since.

But it's difficult to define when exactly a refi boom begins and ends based on just the market share of refinance loan volume. If two periods of time have a similar refinance share but overall volume is down, it's hard to say the market is in the midst of a refi boom, said Sharga.

For example, the refinance share of total volume was 76% in the fourth quarter of 2012 and then dipped slightly to 74% in the first quarter of 2013, according to MBA data. But the dollar amount of overall volume dropped 12.23%, from $597 billion in 4Q12 to $524 billion in 1Q13, causing refi volume to slip by $65 billion.

A more indicative sign of a refi boom is when overall origination volume goes up year-over-year because of an increase in refinance activity, said Sharga.

MBA forecasts call for refinance origination volume to fall more than 60% year-over-year to $431 billion in 2014, with the refi share accounting for 43% of total originations, compared to a 63% refi share in 2013, according to the latest estimates released in July.

Since releasing its first 2014 forecast of $1.2 trillion in total originations in October, the MBA reduced its estimates in January, and again in May. Currently, the MBA forecasts $1.01 trillion in total volume for 2014. Last year, $1.1 trillion of the $1.8 trillion in origination volume were refi loans.

Total application volume is another important factor in defining the timing and duration of a refi boom. There are more refi apps right now than purchase apps because home sales have remained lackluster.

"The puzzle this year is that purchase [volume] has continued to be extremely weak and much weaker than many had forecast," Fratantoni said.

Besides lowering interest rates, consumers refinance because they need money. Since 2008, consumers who have conventional mortgages have taken $215 billion in cash from their homes when they refinanced, according to Freddie Mac, which added that in recent months, that number has been growing smaller.

For the second quarter, there were nearly $8 billion in cash-out refis, up from $5 billion from the first quarter, but down from $9.5 billion in the second quarter of 2013.

"Even with recent home price gains and rock-bottom interest rates, American households are not cashing out equity at rates we've seen historically," said Nothaft. "Regardless of the minimal level of cash-out refinance activity, when we couple it with lower mortgage rates and shorter terms homeowners have taken out through refinance over the past couple years, they have accelerated principal pay down and contributed to the rebound in home-equity accumulation."

MBA expects rates on 30-year FRMs to increase to 5% by the end of the year. However, some economists and market observers warn the political turmoil in the Middle East and Ukraine could bring money into the bond market, which in turn would drive interest rates down.

Especially when it comes to the dispute between Ukraine and Russia, those are the factors "that could lead to a flight to quality, a drop in rates," said Fratantoni.

"But you have to look at the other side, too. We had the first report on second quarter [U.S. economic] growth and that was very strong. We had a very strong jobs report from June," he continued. "If that pace of growth and job market improvement continues, you can see rates going up much faster than people have expected. So there are risks on either side of the consensus forecast of a slow increase in rates."

Most of the people who were eligible to refinance did so when rates were at rock-bottom. "Even with the modest rate increase that we've seen year-over-year, it just doesn't make as much sense for people who haven't refi'd to go through the trouble and the expense of doing so. They are just aren't going to save enough to make it worth their trouble," Sharga said.

But even with muted refi activity, there are still consumers in the market for these loans. For example, borrowers who previously couldn't qualify for the Home Affordable Refinance Program may now be eligible if they've improved their payment history, Fratantoni said. And those who had a nonagency mortgage could be refi candidates if the recent improvement in home prices restored them to a positive equity position. "If they intend to stay in the home they might be interested in refinancing," he said.

"Those are the main categories of refinance borrowers. You might see a little bit of a pick-up in cash-out refinancings, but that is going to be less important than in the past," Fratantoni continued. "People will have such a very low rate on their current mortgage that they might prefer to get a home equity line of credit or second mortgage to fund home renovations or another major expenditure."

There are still a large number of people who are eligible to refinance who have yet to do so, said Amy Crews Cutts, chief economist at Equifax and former deputy chief economist at Freddie Mac.

"I am not talking about the people who are barely on the edge of rates today. I'm talking about people who for the last several years have been in the money to refinance," she said.

Among the reasons this borrower segment is reluctant to refinance is that they do not want to bring their 30-year loan term back to the starting point, "which seems awfully silly when they have a 6% mortgage," she said. "Because if they paid that same payment (the one they have currently), they can turn that into a faster amortization then what they are currently doing."

The immediate impact of the rate increases in the summer of 2013 was that it pushed consumers into the marketplace. "They kept waiting for rates to go down. Last summer's rate increase caused a lot of people to realize it wasn't going to get better and they did refinance," Crews Cutts said.

"Going forward, the question we all have as economists is whether we will see single-digit refinance rates like we saw back in the early 2000s. We don't know that," she continued.

Depending on how rates move in the next year or so will determine how fast or even if the refi share could move below 10%, Crews Cutts said.

In the future, cash-out refinances are likely to become more popular as home values rise, "but it is hard to argue that you should trade-in your 3% mortgage for something higher," she said. "A lot of people are not interested in moving because they have very low mortgage interest rates today."