-

The latest directive, which takes effect in March, allows only U.S. citizens and nationals to seek government-guaranteed financing. It's drawing criticism from Democrats in Congress, small-business advocates and some lenders.

February 4 -

Bilt's new card caps interest rates at 10% for one year and Affirm is adding BNPL for rent as analysts predict the political environment will benefit fintechs.

January 16 -

Enova International, a nonbank lender in Chicago, plans to gain scale by taking over Grasshopper Bank's national bank charter. The deal already faces skepticism from critics of Enova's high-cost lending model.

December 11 -

The card network is making a digital wallet push following the Digital Markets Act, which dilutes Apple's control over mobile payments technology.

December 4 -

The Federal Reserve played a behind-the-scenes role in facilitating the sale of PacWest Bancorp, providing an enticement to private-equity interests to make a deal happen, according to agency records and recent comments by a prominent banking lawyer.

November 20 -

The company appears to be the first nationally chartered bank to offer crypto trading and traditional banking in the same app.

November 11 -

The megabank is cooperating with a government request for information related to how it decides which customers to bank. It is the second large U.S. bank — along with Bank of America — to disclose such a probe.

November 5 -

The U.K. bank's "Scam Intelligence" tool uses Google's Gemini to analyze images and texts for red flags, aiming to reduce losses from authorized push payment fraud.

October 30 -

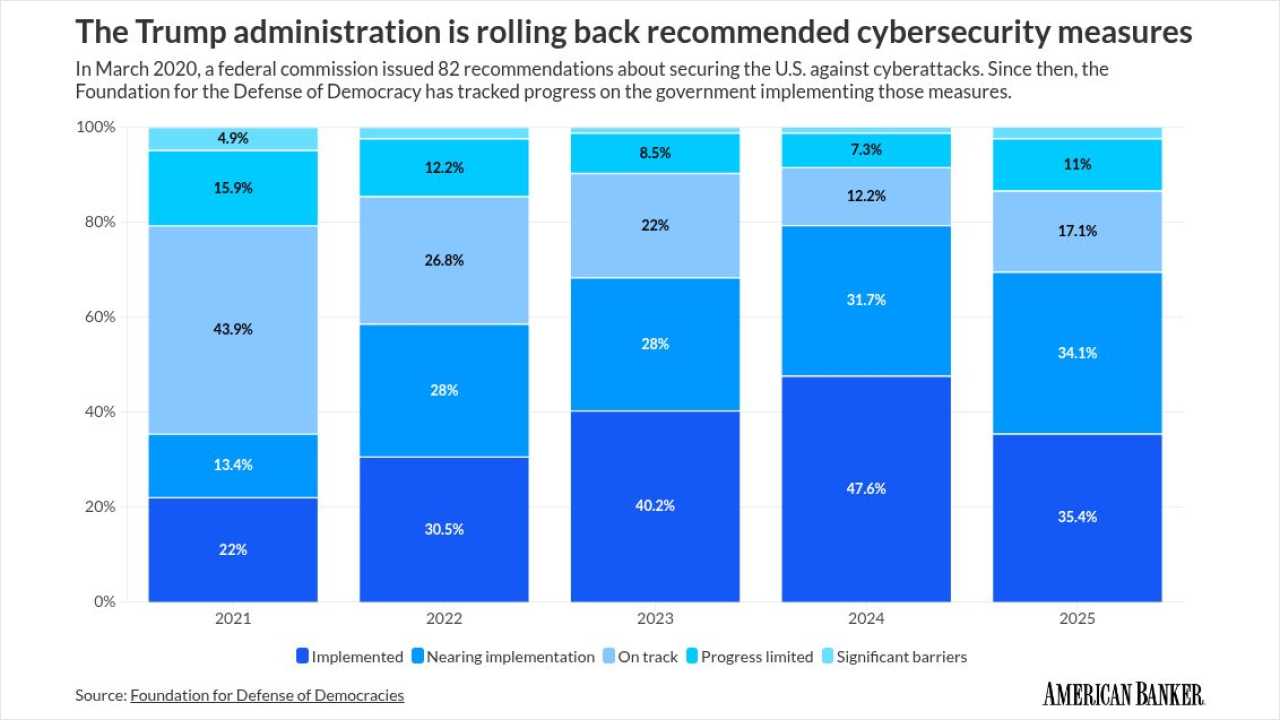

A think tank report details setbacks in U.S. cyber strategy, from shuttered partnerships and staff cuts to the expiration of key info-sharing laws.

October 24 -

A government shutdown and a single senator's hold prevented the renewal this week of a bipartisan law that helped banks and other firms defend against hackers.

October 3 -

Federal Reserve Governor Michael Barr warned that subjecting the stress testing models to the notice and comment process could lead them to "ossify."

September 25 -

Goldman Sachs Group Inc. President John Waldron criticized the growth of barriers to movement put up by countries around the world, amid rising concern among American firms about the Trump administration's decision to charge $100,000 for a key type of visa.

September 25 -

A critical U.S. cybersecurity law sunsets Sept. 30, and banks say losing it would weaken defenses against hackers.

September 6 -

Banks want to reclaim their position as the central node in the customer relationship by charging fintechs and data aggregators for access to permissioned customer data. How the legal questions about this are resolved will be a telling moment for all concerned.

August 18 Ludwig Advisors

Ludwig Advisors -

The executive order tells banking regulators to examine banks for signs of politically motivated account denials.

August 7 -

A White House working group is calling for updated crypto regulations, AI-powered fraud detection and clearer guidance for banks.

July 31 -

CIBanco SA, Intercam Banco SA and brokerage Vector Casa de Bolsa SA are all "of primary money-laundering concern," FinCEN said. Treasury Secretary Scott Bessent said they are "vital cogs in the fentanyl supply chain."

June 26 -

The Trump administration's fiscal 2026 budget carries over 7(a)'s $35 billion funding authority for a fourth consecutive year, even though lending has grown significantly

June 12 -

The bureau's Tuesday afternoon announcement follows an earlier statement that it would walk back a rule that places buy now/pay later loans under the Truth in Lending Act's Regulation Z, a move that will ease compliance for fintechs that offer installment loans.

May 6 -

Lower credit costs and better expense control helped the San Francisco-based titan offset the impact of lighter-than-expected revenue.

April 11