-

Renat Abramov, a former relationship manager in Brooklyn, bypassed know-your-customer protocols to open accounts for shell companies involved in a $14.6 billion scheme.

February 5 -

Prosecutors allege Curtis Weston and a bank insider used fraudulent loans to fund stock market trades, leaving the bank with $20 million in losses.

February 4 -

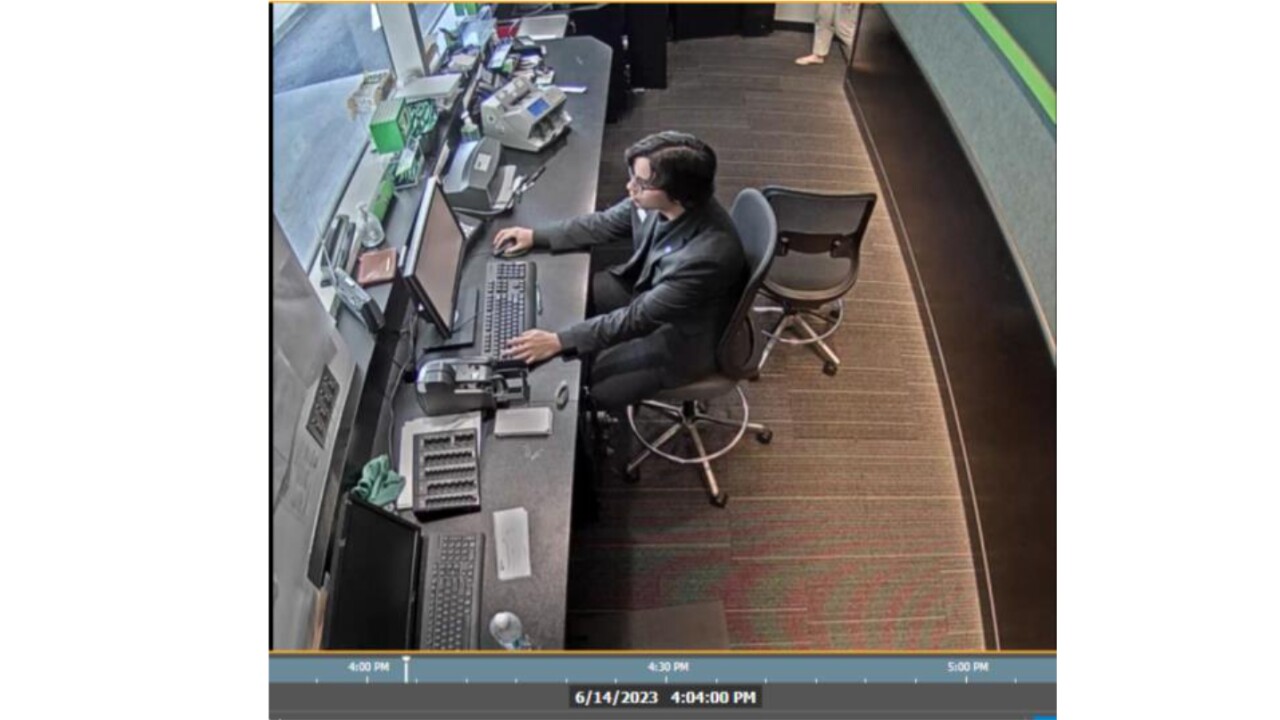

Court documents reveal how a teller used the drive-through window and work email to aid a scheme that bypassed TD's fraud defenses.

January 30 -

Prosecutors argued the 23-year-old courier knew he was aiding criminals, citing texts about "gold rushing" and scammer videos on his phone.

January 27 -

As the Trump administration signals interest in reforming AML regulations, the industry must come together in support of new rules that promote efficiency and effectiveness in the fight against financial crime.

January 26

-

TD Bank has said it's completed "the majority" of the action items for its U.S. compliance remediation.

January 23 -

The collapse of the illicit escrow marketplace disrupts a major hub for "pig butchering" scams, though experts warn the ecosystem will likely fragment.

January 21 -

As artificial intelligence is integrated into more and more core banking operations, bank boards of directors need to make sure business continuity plans account for the possibility of AI system failures.

January 2

-

It is long past time to revisit the regulatory regime implementing the Bank Secrecy Act. In a good sign, key elements of the Trump administration seem to be in alignment on reform.

December 22

-

Know-your-customer rules are a longtime fixture of bank compliance regimes, but as autonomous AI "agents" increasingly access banking systems, new rules for verifying their status are desperately needed.

December 12

-

While overall payments declined, the financial sector remained the top payer to cybercriminals, surpassing both health care and manufacturing.

December 5 -

The Canadian bank still has more work to do as it rolls out additional processes, technology and training. TD will also have to prove to regulators and the U.S. Department of Justice that its actions are sustainable.

December 4 -

While banks welcome the "whole-of-government" approach that led the effort, private sector takedowns remain difficult without federal warrants.

December 3 -

New guidance from the Office of the Comptroller of the Currency released Monday afternoon would streamline Bank Secrecy Act exams for community banks. The agency issued a separate request for information on consolidation and contracting power among core service providers.

November 25 -

Kunal Mehta, also known by the alias "Shrek," used shell companies and bulk cash drops to clean millions for a cybercrime ring that stole $263 million.

November 19 -

Senate Banking Committee Republicans, led by committee chair Tim Scott, R-S.C., introduced a bill that would raise the mandatory reporting threshold for certain currency transactions, a move meant to ease banks' anti-money laundering compliance obligations.

October 21 -

Coordinated sanctions target two networks behind so-called pig butchering scams, human trafficking and money laundering for North Korean cybercrime groups.

October 17 -

A new interagency guidance clarifies when banks must report suspicious activity, easing compliance workloads and narrowing the reporting requirements to focus on higher-value cases.

October 9 -

The Toronto-based bank announced enterprise-wide and business-specific revenue and expense targets, almost exactly one year after it was hit with more than $3 billion in fines and an asset cap for money-laundering-related blunders.

September 29 -

The Treasury Department's Financial Crimes Enforcement Network is seeking public comment on a survey of anti-money-laundering compliance costs from a variety of nonbanks, including casinos, insurers, lenders and other nonbanks, a possible precursor to deregulatory proposals down the road.

September 29