Challenger banks are hauling in venture capital at a faster pace in 2019, according to a new CB Insights report.

In 17 deals globally, challenger banks — generally speaking, digital-first firms that provide basic financial services — raised $649 million in the second quarter; that was up about 8% from a year earlier. Venture capitalists invested $1.5 billion in challenger banks in the first half of the year, a 15% increase from the same period in 2018, the research firm said in its report, issued Tuesday.

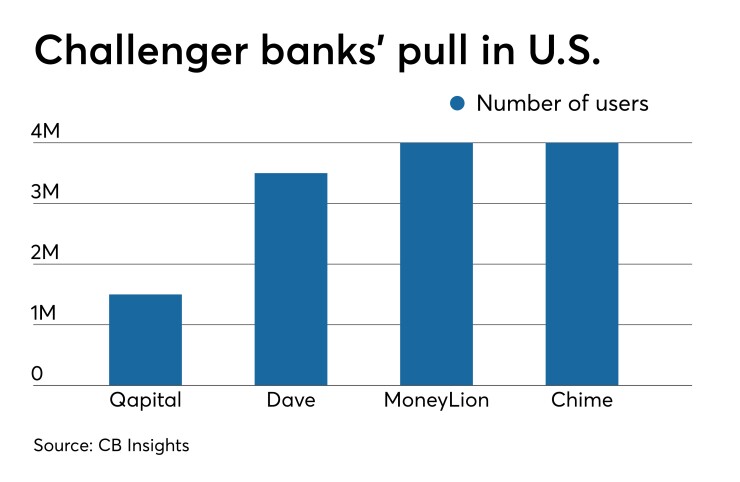

There are 25 challenger banks that each have more than 1 million users, the report said. The list includes companies like Credit Karma, Coinbase and Circle, which do not offer banking services; digital banks outside the U.S. like Revolut; and U.S. challenger banks like Chime.

CB Insights analyst Lindsay Davis sees two macro trends driving the flow of money to challenger banks. One is the open banking rules in Europe, which lowered barriers for challenger banks there such as Starling, Monzo and Revolut. The second is the relatively recent wave of consumer adoption of alternative providers of digital banking services.

When challenger banks like Simple and Moven first got into the market around 2010, “it was too early for people to go off and start trusting a new bank, when right after the financial crisis they were a bit rattled,” Davis said. That resistance appears to have faded.

But online lenders such as SoFi and LendingClub paved the way for today's startups, winning over consumers “by offering a product that was not only not available but also digital and transparently priced and really catered to the way that they wanted to have their products and services delivered to them,” Davis said.

Meanwhile, worldwide venture investment in all fintechs — a broader group of companies that includes bank tech and insuretech in addition to challenger banks — totaled $8.3 billion in the second quarter. There were 25 “mega-rounds” of more than $100 million, 14 of them in the U.S. The mega-rounds went to late-stage (Series D and Series E+) fintech startups.

“We see large players being established across key verticals in the U.S., across the main consumer pain points — online lending with SoFi, challenger banking with Chime,” Davis said. “These companies have proven there is a market for what’s thought of as a niche product, whether that was free [stock] trading or student lending, and they’ve been able to establish themselves beyond the initial minimum viable product and start to roll out multiline businesses.”

The companies winning the largest rounds of capital are targeting consumers and adding new financial products to their offerings. This is sometimes referred to as “rebundling,” and it is a practice borrowed from banks.

“Banks break even on a customer when they have three to five products they can cross-sell in addition to a checking account," Davis said. "Otherwise that customer is not a draw for them."

As they add on products, fintechs can accommodate consumers at different stages in their life, she observed.

When she changed jobs, for instance, Davis did not need a student loan, “but I certainly needed an [individual retirement account] to roll a 401(k) into,” she said. “My first entry into the fintech market might be different from somebody else’s, but if I can, through rebundling, get access to a high-yield savings account or a daily cash management account, that’s a good place. Consumers are pulling fintechs and investors into this direction.”

Sometimes this is happening through partnerships with banks and other fintechs.

“It wouldn’t make sense for a Betterment to offer student lending, versus partnering with a lender,” Davis said. “Their customers have already graduated, and a smaller cohort might go to graduate school.”