TCF Financial and Chemical Financial were doing fine as separate companies.

Still, the merger of the two companies, which closed well ahead of schedule on Thursday, created a

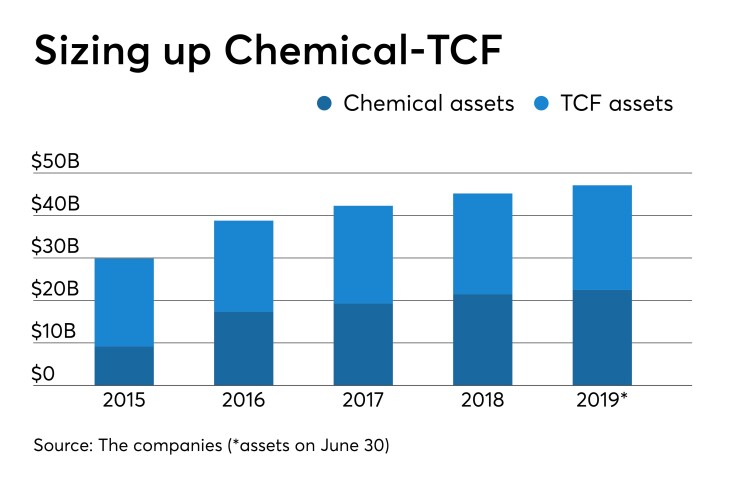

The $3.6 billion bank merger — the largest announced this year after BB&T-SunTrust — also combined TCF’s national lending platform with Chemical’s well-established commercial lending operations.

“We had two well-managed banks, both with momentum,” Craig Dahl, president and CEO of the new TCF, said in an interview. “This transaction will accelerate the strategic plan of both banks by two years. Nothing else we contemplated would have had the same impact.”

“We’re a high-growth bank,” added David Provost, TCF’s executive vice chairman and the former president and CEO of Chemical. “Loans are growing in the high single digits.”

The merger of the similar-sized companies comes at a time when the economy is healthy and loan demand is relatively strong.

At the same time, competition is fierce for loans and deposits, pressuring pricing and net interest margins. Most banks are also realizing the need to invest heavily in technology and infrastructure to compete more effectively.

While the immediate focus will be a seamless integration, Dahl said TCF is “acquisition-ready” if the right target suddenly becomes available.

Dahl and Provost discussed these and others issues in a recent interview. Here is an edited transcript of the conversation.

What’s the status of the integration now that the deal has closed?

CRAIG DAHL: It is early in the integration efforts. But when we announced the transaction, we were pointing to a late third quarter or early fourth quarter close, and so to be able to close Aug. 1, we’ve moved the time frame up roughly two months. So that should be some indication of how well this is going. And we’ve had no [unusual] regulatory hurdles to cross.

Customer and talent retention are critical components of mergers. What is your focus on that front?

DAVID PROVOST: There is very little customer overlap, so our customer-facing people and our customers are not really affected in that sense. … But there is a lot of benefit. TCF had a great leasing platform and Chemical did not. On the other hand, TCF did not have a trust and wealth management product, and Chemical was very proficient in that. So rolling each other’s products out in the other’s footprint is going to be very effective.

Do you anticipate more regional banks merging or buying out competitors to get similar benefits of scale?

DAHL: With the scale … the investments that each bank was making in technology, in the brand, in marketing, we are now only going to have to make those investments once for one bank, not two. … We’re going to spend less [per customer] and this was a big part of the strategic value of this deal.

PROVOST: In our industry, scale is very important. With this [deal], both of us doubled our size. That is a very big competitive advantage. We would think that other banks will take advantage of opportunities, but you have to have two teams that can work together, and you have to have strategic value that works for your shareholders and your customers. But we would expect more.

The Fed just cut its benchmark rate. What impact will that have on TCF and what does it say about the economy?

PROVOST: We’re going to be pretty asset neutral … so it’s not going to have a big effect on us. There’s a margin compression story that all banks are having and we’re not immune. … What does it say for the economy? I think we have a robust recovery, especially in the Midwest, and this just keeps the momentum going.

DAHL: I would add that the consumer is always the bellwether we’re watching. And the consumer continues to be strong and we continue to have no cracks in our armor with consumer credit. So we believe the economy has more room to run here with the lower rate.

You mentioned margin pressure. How do you counter that? Loan volume?

DAHL: You’ve hit it exactly right. We’re going to work to offset compression with asset growth. And we continue to be optimistic about the markets we operate in and the assets we generate. That is the first immediate offset.

Having said that, we believe deposit pricing over the past year and a half has remained rational, and we expect deposit pricing will decline as well. That’s our second opportunity to [improve] the margin. … It’s going to take time for CDs to roll over, but they will roll over at a lower rate, so we’re confident on that side as well.

Any signs of credit weakness? Any concerns?

PROVOST: We’re always cautious. We’ve both been through cycles a number of times. But right now, there are no pockets of concern. Our charge-offs and past-dues are at record-low levels.

DAHL: We continue to have strong employment figures in all of our markets, and those bode well, both for the consumer and our commercial accounts.

We hear a lot about competition on pricing and terms. What are you seeing?

PROVOST: What we’ve found over the last year is that the credit competition has become much more rational … compared to what we saw a year or so ago. People are not going out on a limb [on terms]. Now, we do compete on price. There are only so many good customers, and price is where you compete for them, and that is a little challenging sometimes.

A diverse loan portfolio is important. What are your expectations for loan composition?

DAHL: When you look at the first [reported] quarter of our consolidated numbers, you’re going to see 40% commercial, 40% consumer and 20% national lending. That’s a concentration split that we’re very comfortable with.

Back to dealmaking. How do you think about future M&A for the new TCF?

DAHL: We’re acquisition-ready.

PROVOST: It is not something we’re going to do right away; obviously, we have to get the new bank consolidated. But you never stop having conversations because it takes years to develop those relationships. Craig and I first met in 2015, and it takes a long time to build a relationship. So we’re going to continue to build those relationships, because you never know when the right opportunity is going to open up.

We’re always talking to a lot of people.