-

Nicolet Bankshares has agreed to buy MidWestOne Financial in an $864 million, all-stock deal. The acquisition will move the Wisconsin-based buyer into Iowa and the Twin Cities, while also allowing it to vault past a key regulatory threshold.

October 24 -

Dallas Turner, a linebacker for the Minnesota Vikings, sent $240,000 via wire transfers after scammers convinced him someone was impersonating him.

July 14 -

The move brings state-chartered banks and credit unions in sync with their federal counterparts by enabling them to open checking accounts for consumers who have had accounts closed for writing bad checks.

June 7 -

The Minnesota credit union's deal for Brainerd Savings & Loan comes about 11 months after it bought Neighborhood National Bank in Minnesota.

January 25 -

The deal is a sign of further consolidation among Twin Cities-area credit unions, following another combination announced in May.

January 14 -

The credit union now has a community charter to serve seven counties in addition to several select employee groups.

December 1 -

The Minnesota-based institution is allowing children of some employees to attend school virtually in their branches in order to make it easier for parents to work during the pandemic.

October 15 -

Steve Ewers, who has held several positions in information technology, will replace retiring President and CEO Tammy Heikkinen, who has led the Duluth, Minn.-based institution for 12 years.

October 13 -

A new initiative from the Minnesota Credit Union Network to help deepen share of wallet is believed to be the first of its kind and could be a model for credit union leagues in other states.

October 1 -

Mesaba, which is also based in Minnesota, is the parent of American Bank of the North and Lake Bank.

July 1 -

Some credit unions have closed branches as demonstrations continue following the death of George Floyd last week.

June 1 -

TruStone Financial and Firefly Credit Union have announced plans to merge, pending regulatory approval and charter changes.

May 5 -

The St. Paul, Minn.-based institution will provide a 20% bonus to member-facing staff who are at additional risk during the outbreak since they are "essential employees."

March 31 -

Tammy Heikkinen, who has led the institution since 2008, will stay on until her successor joins the credit union.

March 9 -

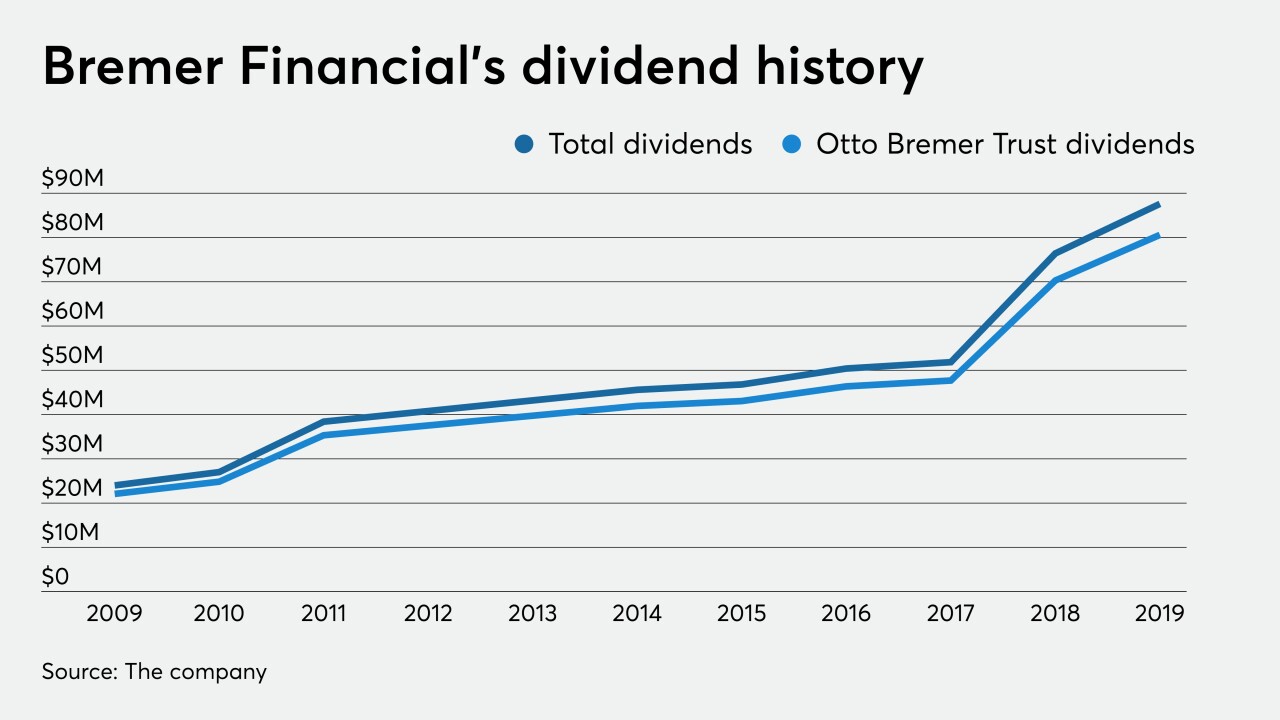

The Minnesota bank is locked in a bitter legal battle to preserve its independence. Its foe? The charitable organization set up by its founder.

February 28 -

The company claims that its biggest investors is taking steps to seize control, oust the board and find a buyer.

November 25 -

The program will be called Bucks for Buckeyes and will be offered in partnership with the Minnesota Credit Union Network.

October 30 -

The Minnesota Credit Union Network worked with two brewers to create and sell a strawberry milkshake cream ale in an effort to boost the industry's profile and raise money for financial literacy.

October 25 -

Their challenge is creating a viable, profitable product that doesn't get flagged for being predatory.

September 26 -

Jay Gostonczik will head the Minnesota-based institution when Richard Nesvold retires during the first quarter of 2020.

September 12