California Republic Bancorp in Irvine is pressing the accelerator on plans to expand its indirect auto lending business despite increasing industry concerns that the sector may be overheating.

The $1.7 billion-asset company, which has securitized nearly $4 billion in auto loans in the past four years, is looking at ways to transform its 10-state operation into a nationwide venture, President John DeCero said.

DeCero, along with Chief Executive Jon Wilcox and Executive Vice President Mark Rebal, founded California Republic in December 2007 with an initial $52 million in capital. The executives worked at Western Financial Bank before its 2006 sale to Wachovia, specializing in commercial credit and indirect auto lending.

-

Consumers increasingly fell behind on their payments in several loan categories in the third quarter as economic growth cooled.

January 12 -

Credit risk, interest rate risk and cybersecurity concerns pose growing risks to banks in the first half of 2016, according to a semiannual risk report issued Wednesday by the Office of the Comptroller of the Currency.

December 16 -

Huntington Bancshares in Columbus, Ohio, has brought on industry veteran Tom Wirth to fill the newly created position of auto finance product and strategy director.

December 3

"A solid combination" exists with commercial banking, which generates core deposits, and indirect auto lending, which produces high-yielding assets that can be packaged and sold, DeCero said. "We understand the value of that."

A number of banks have significant dealings in indirect auto, including Wells Fargo in San Francisco, which bought Wachovia in 2008, and Ally Financial in Detroit. At the same time, several banks, including Investar Holding in Baton Rouge, La., ASB Bancorp in Asheville, N.C., and Brookline Bancorp in Boston, have gotten out of the business.

Those that have dropped out have pointed to a number of difficulties.

Regulators have repeatedly expressed concerns over the past two years about banks' exposure to indirect auto loans, with industry observers issuing pointed warnings about subprime loans. Earlier this month, Fitch Ratings reported that more than 5% of securitized subprime auto loans were at least 60 days past due, marking the highest delinquency rate in 20 years.

Getting out is not on California Republic's agenda.

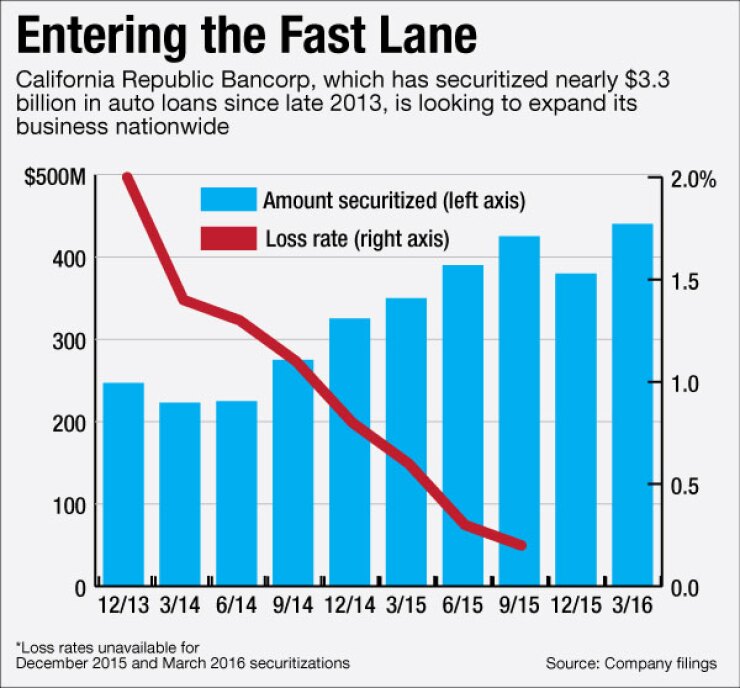

The company recently completed a $440 million securitization of auto loans, pushing it over $3.7 billion in securitizations over the past four years. That amount, however, is a drop in the bucket next to the $50 billion in auto securitizations that the company's executives have handled over their careers.

California Republic, which records a gain on the sale of the loans, also brings in an annual fee for servicing the underlying receivables. Last year it earned $14.4 million from loan sales and $18.4 million from loan servicing fees.

The company "could handle a lot more" business, DeCero said. "We have as much experience as any of the largest lenders in the country. It would be a challenge to find a group that has done more. The continuity of this team is special."

One of the crucial lessons California Republic's team has learned is that a borrower's cash flow is as important as a credit score in forecasting a loan performance. The company's sweet spot is borrowers who have a payment-to-monthly-income ratio below 8%, DeCero said.

"Our borrowers' average time on the job is eight years," DeCero added. "The cars we finance are typically their primary vehicle, so they're an important piece of their lives. These people pay."

California Republic is also focused on keeping strong relationships with auto dealers.

"We like to be the first or second choice after their captive financer," DeCero said. "We don't like relationships where we do one or two deals a month. We like to get 30, 40 or more loans from a dealer. That way they know we have each other's backs."

So far, California Republic's credit metrics are holding up.

Net losses on nearly $2.5 billion in loans the company securitized from November 2013 to September 2015 have totaled $20 million, or a rate of about 0.8%, based on data from the Securities and Exchange Commission. The net chargeoff rate for the $381 million in auto loans that the company held on its books was 0.47% on Dec. 31.

The S&P/Experian auto default index, in comparison, was 1.05% in February.

California Republic has "really mastered the product niche," said Daniel Wheeler, a lawyer at Bryan Cave in San Francisco who does not represent the company. "They do indirect lending really well and the securitization market trusts their paper."

Wheeler said he sees little risk in California Republic's expansion plan. "Once you've evolved a process, your people are well-tested and your system is well-tested, there's no reason not to scale in my view," he said.