When it comes to servicing mortgages, SunTrust Banks and Flagstar Bancorp are zigging while much of the banking industry is zagging.

Over the last several years, many banks have either exited the business of servicing residential mortgages or severely curtailed their exposure. They have done so as new rules have required them to hold more capital against mortgage servicing assets and an unprecedented wave of refinancing, spurred by rock-bottom interest rates, have cut into servicing fees. Additionally, the Consumer Financial Protection Bureau has teed up more rules to provide expanded protections for consumers, increasing banks' compliance costs.

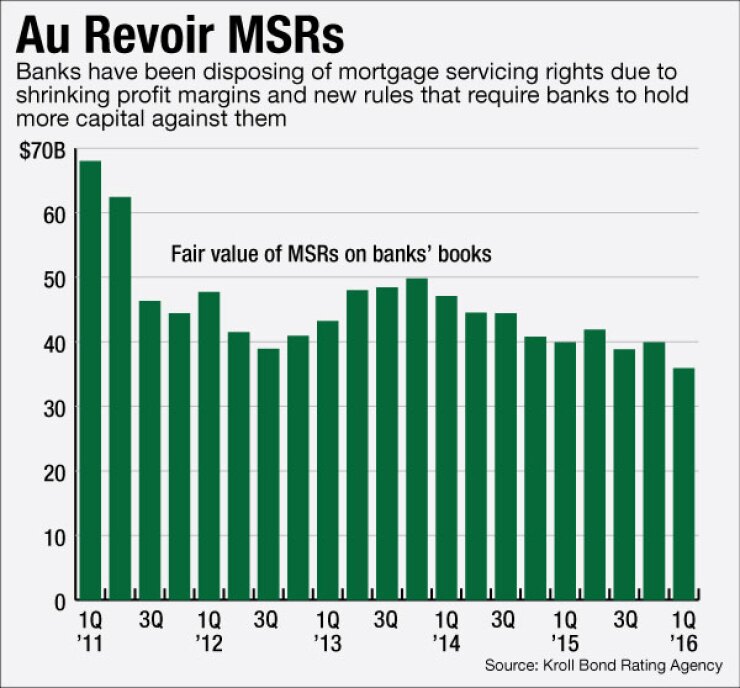

The upshot is that banks held just $35.9 billion of mortgage servicing rights at March 31, down from nearly $70 billion in the first quarter of 2011, according to Kroll Bond Rating Agency. While the drop can be attributed in part to declining values of mortgage servicing rights, it is also largely a result of banks' moving the assets off their books. Bank of America has been particularly aggressive in shedding its MSR assets; at June 30 it had just $2.3 billion of servicing rights on its books, or 85% less than what it had at the end of 2011.

Most of the assets have been gobbled up by nonbank financial firms, but a handful of banks, including the $195 billion-asset SunTrust, in Atlanta, and the $14 billion-asset Flagstar, in Troy, Mich., are also eager to acquire or retain servicing assets. SunTrust, for example, bought $8 billion worth of servicing rights in the first quarter.

Aleem Gillani, SunTrust's chief financial officer, said at a recent investor conference that the mortgage servicing rights the bank has acquired have helped to boost its fee income and return on equity. The deals have also brought in scores of new clients who, down the road, may need other banking services, Gillani said.

Flagstar has built enough scale in the mortgage business, and has developed the needed technology infrastructure, to operate in the space efficiently, said Christopher Whalen, senior managing director at Kroll Bond Rating Agency.

Both companies continue to collect millions of dollars in servicing fees. In the second quarter, SunTrust's servicing fees rose 73% to $52 million from a year earlier. Flagstar's rose 24% to $21 million. Neither SunTrust nor Flagstar has provided estimates on future rates of servicing revenue.

SunTrust and Flagstar both have specific reasons for beefing up in mortgage servicing, but not all banks are in position to do so because their operations are too small to be cost-effective or they don't have enough capital flexibility, said Terry McEvoy, an analyst at Stephens.

SunTrust, for example, is in "the exact opposite" position of big banks because SunTrust has the capacity to add MSR assets without violating capital requirements, McEvoy said. The Basel III capital rules limit banks to holding MSR assets of no more than 10% of total capital and raised the risk weighting on MSRs to 250% from 100%. Both were intended to force banks that hold large mortgage portfolios to maintain a larger cushion if loans went bad.

Flagstar, meanwhile, "is focused on subservicing, where you don't hold the mortgage servicing right as an asset, but you're still servicing the loan for others," McEvoy said in an interview. "That's an attractive option for other banks looking to outsource their servicing."

Flagstar, which had roughly $300 million of mortgage servicing assets on its books at June 30, signaled its commitment to expanding its servicing business this week when it announced that it had hired Don Klein, a former Ocwen Financial executive, as senior vice president of business development for subservicing.

First South Bancorp in Washington, N.C., is another bank looking to add servicing assets. In July the $961 million-asset First South acquired an MSR portfolio with a total unpaid principal balance of $84.6 million. President and Chief Executive Bruce Elder said he believes mortgage servicing gives First South a competitive advantage in rural markets it serves, like Kinston and Rocky Mount, N.C., where competing banks don't do servicing.

"Having our customers have to make their mortgage payment across the teller line, we think helps give us a competitive advantage," Elder said in an interview. "That's a great cross-selling opportunity."

SunTrust, Flagstar and First South want to continue expanding their servicing portfolios, but they're still struggling with a declining value of the MSR assets they hold on their books. That's partly because MSRs lose value when interest rates are low and consumers refinance their mortgages or make prepayments, which can reduce the overall fee income that the servicer receives.

The fair value of SunTrust's MSR assets fell 24% to $1.06 billion in the second quarter from a year earlier. Flagstar's MSR assets dropped 5% to $301 million in the same period.

That decline in value partly reflects the high cost to banks of servicing residential mortgages and creates the threat of banks' continued exit from the business, Whalen said. That, in turn, could raise consumers' costs for buying a home, he said.

"The good news is that SunTrust and Flagstar want to stay in servicing," Whalen said in an interview. But some smaller banks or nonbank servicers could fail or voluntarily leave the business, he said.

The problem is evident in the strategies adopted by the largest banks, Whalen said. B of A, JPMorgan Chase and Wells Fargo have all reduced their MSR portfolios, dumping nonperforming and high-risk mortgages, but retaining higher-quality jumbo mortgages that have less risk of default. That reduces the number of companies available to service less-desirable mortgages, Whalen said.

"Strategically we have been working to just have a higher-quality book," Barry Sommers, JPMorgan's CEO of consumer banking, said at the company's annual investor day earlier this year. "We had an opportunity to acquire some servicing last year, which we felt great about. We had an opportunity to sell some servicing that we felt great about selling."

The fact that megabanks are exiting the business creates the perfect opening for a bank like First South, Elder said.

"When everyone is racing to the exit door, that opens doors for you to stay in the business," Elder said.