BancorpSouth could be one step closer to escaping its M&A limbo.

Now that the Tupelo, Miss., company is in talks with two federal agencies to settle a yearlong probe of its fair-lending practices, the final legal obstacles to its expansion plans may be eliminated.

The $13.8 billion-asset BancorpSouth in January 2014 agreed to buy a pair of community banks in Texas and Louisiana, but those deals had to be put on hold after it sustained a regulatory one-two punch: the lending probe and an enforcement action for shortcomings in anti-laundering compliance.

-

The $13.8 billion-asset company said Monday after the market closed that it earned $21.2 million, down roughly 26% from a year earlier.

January 25 -

BancorpSouth in Tupelo, Miss., reported higher second-quarter profit, as an increase in loan volume offset lower yields on loans and leases.

July 20 -

BancorpSouth in Tupelo, Miss., has again extended the deadline to complete its acquisitions of Central Community in Temple, Texas, and Ouachita Bancshares in Monroe, La.

July 1

BancorpSouth resolved the anti-laundering matters with banking regulators last spring, and a fair-lending settlement with the Justice Department and Consumer Financial Protection Bureau could clear the way for approval of its acquisitions. But the outcome is far from certain, experts said.

If the terms of the settlement are harsh and prompt further delays, the two sellers — Ouachita Bancshares in Monroe, La., and Central Community Corp. in Temple, Texas — could walk away from the table, said Kevin Fitzsimmons, an analyst with Hovde Group.

"That's always a risk," Fitzsimmons said. "It's unfortunate that it's lasted this long."

BancorpSouth said a little over a year ago that the CFPB was investigating its lending practices, but details of any potential violations have not been made public.

It disclosed the settlement talks Monday along with its fourth-quarter results, but executives declined to comment on the timing of a potential settlement during a call with analysts

Tuesday morning.

The executives emphasized that the company cannot guarantee whether a settlement would allow BancorpSouth to move forward on M&A.

"We don't know," said Dan Rollins, BancorpSouth's chairman and chief executive. While the company is "committed to completing these merger transactions," the terms of the settlement could make it too "onerous" to move forward with them, he said.

The company has been dealing with multiple legal issues simultaneously.

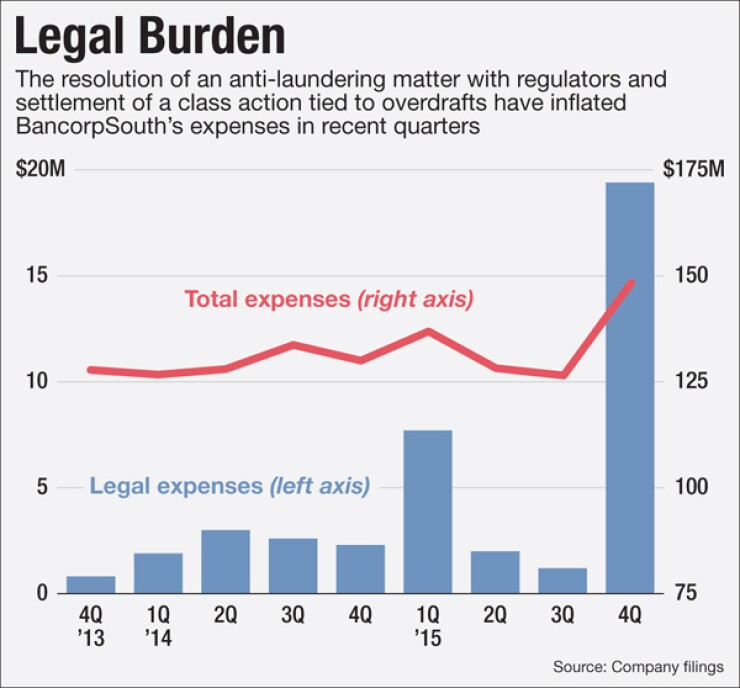

Earlier this month, BancorpSouth agreed to pay $24 million to settle a lawsuit tied to its overdraft fees on debit cards and ATM transactions. The

Legal costs had jumped in some prior quarters, too, as the company worked through the enforcement action tied to its compliance with the Bank Secrecy Act. It had to invest money to beef up its anti-laundering compliance staff and procedures as part of a consent order from the Federal Deposit Insurance Corp. In April, BancorpSouth was released from the order.

The BSA order and lending probe forced the company to twice delay the deadlines for its M&A deals.

The company said last summer that it would complete them by Dec. 31.

Now that the deadline for the mergers has passed, however, the two sellers are allowed to terminate the merger agreements without penalty, Rollins said on the investor call.

"I think [Ouachita and Central Community] are committed to completing these merger transactions," Rollins said.

Calls to Ouachita and Central Community were not returned Tuesday afternoon.

While a timing — and terms — of a potential settlement remain unclear, news of the settlement talks are a positive step forward for the company, Fitzsimmons added.

"We have to be closer to getting clarity," he said.