JPMorgan Chase has invested heavily in courting midsize businesses since the crisis, poaching top bankers, opening new commercial banking offices and preparing for a surge in business lending that has never completely arrived.

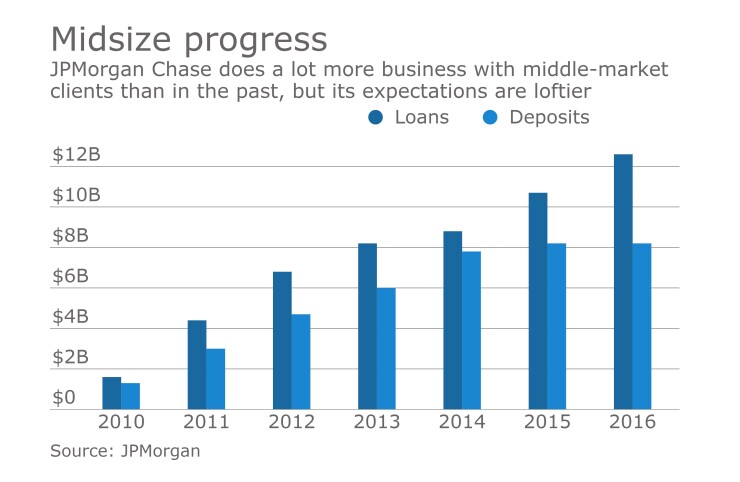

The expansion has moved at a deliberate pace, with sporadic announcements of new offices and such, but JPMorgan officials say the growth over time has been striking — loans to clients with annual revenue between $20 million and $500 million have increased more than sevenfold since 2010 to $12.6 billion. The number of middle-market clients has tripled, to 2,220. JPMorgan will also have a presence in the largest 50 cities by yearend.

Still, despite the rising optimism among business owners following the election of Donald Trump, the rate of commercial loan growth has been lackluster in recent months,

“The message from [CEO] Jamie [Dimon] at the beginning of this was build a 100-year business. Hire the best people. Draw a circle around the best clients, and over time we’ll have substantial scale,” Petno said. “Don’t measure yourself in near-term loan growth — if you do that it will be a disaster.”

One factor holding back loan growth is that many clients have been “rushing” to the debt markets to lock in rates, Petno said. He also noted that commercial loan growth has been decelerating steadily for years, not just in the short term.

But if Republican leaders make good on promises to lower corporate taxes and provide a lighter regulatory touch, midsize businesses are expected to invest and borrow more. JPMorgan has been preparing for this moment for years, Petno said.

During the fourth quarter, commercial loans grew 6% across the industry, compared with just over 8% a year earlier,

“We’re not sure what will happen in Washington, but we believe we are very well placed to participate in any acceleration of economic activity” in the years ahead, Petno said.

The comments come as President Trump has promised to reinvigorate the economy, projecting a sustained growth rate of at least 3% — a level that

The middle-market expansion at JPMorgan also illustrates how the competition to bank midsize customers is heating up. It’s a business regional banks in particular often describe as their bread-and-butter. Fifth Third Bancorp, for instance, is growing its middle-market lending business in Charlotte, N.C. —

While JPMorgan is several times larger than many of its peers, expanding the business in new markets has still been a challenge at times. In some cases, persuading top bankers to leave their current companies has been difficult, Petno said.

“There’s not a banker tree where you can go and pick off three or four bankers,” Petno said. “The good ones are entrenched in their banks, they are hard to get out — and there aren’t as many as you would think.”

It also simply takes time for the New York company to get up and running in a new market.

But Petno emphasized that the investments JPMorgan has made in recent years have positioned the company to capitalize on growth among midsize manufacturers, technology firms and other companies whenever businesses are ready to invest more.

He pointed to the company’s growth in California as an example. JPMorgan entered the market for midsize business lending through its acquisition of Washington Mutual in 2008. It now has 13 commercial lending offices in the state in a range of industries, including technology and agriculture.

Loans to midsize companies have risen to $2.3 billion from $450 million in 2008.

“Pick the manufacturing company that has fully depreciated equipment and has been waiting to invest in its business,” Petno said. Once businesses have a better sense of the fiscal policy changes ahead, “there’s a tremendous amount of capital” ready to be deployed, he said.