It took five years, $11 billion in lending commitments and 20 new hires, but BBVA Compass has finally earned the “outstanding” Community Reinvestment Act grade it has coveted.

The Birmingham, Ala., bank revealed this week that it received the top rating from the Federal Reserve Bank of Atlanta after its 2018 CRA exam. Rey Ocañas, BBVA Compass’ director of communications and responsible banking, said it’s a milestone the bank has been working toward since 2013, when

“We set out to challenge ourselves to make sure that every new product, every lending investment and service would have insights on achieving excellence, and as a byproduct get this outstanding rating,” Ocañas said. “We didn’t want a satisfactory rating.”

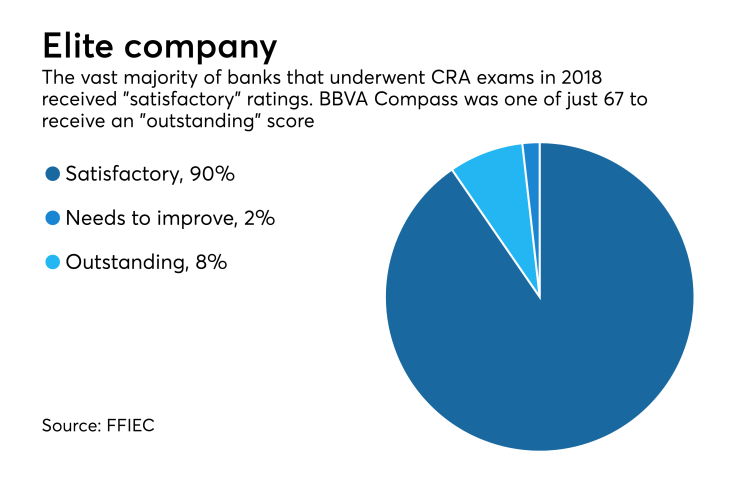

It’s rare for banks to receive either needs to improve or outstanding grades on their CRA exams. Less than 2% of 876 banks examined in 2018 were graded needs to improve and 7.6% of banks earned outstanding ratings, according to the Federal Financial Institutions Examination Council. Save for one bank that received a “substantial noncompliance” grade, the other 90% of banks examined in 2018 earned satisfactory ratings.

BBVA Compass’s 2013 downgrade was for the period covering the prior two years. In public documents, regulators cited low levels of community development loans and community development services as some of the reasons for the downgrade.

The $91 billion-asset company began its turnaround by creating an advisory board made up mostly of community development and housing advocates and tasked it with helping bank officials find more community-development opportunities within its seven-state footprint.

For example, the bank made a $10 million construction loan and an $11 million equity investment in a Colorado housing project with units set aside specifically for homeless veterans. BBVA Compass, the U.S. subsidiary of the Spanish banking giant Banco Bilbao Vizcaya Argentaria, also made a $17.5 million construction loan and provided a $12 million low-income housing tax credit to a Houston housing project for low-income families.

The new advisory board also provided feedback on how to better tailor new products and services to the needs of low- and moderate-income consumers. One new product that emerged from those discussions, Ocañas said, is a mortgage that includes closing cost assistance for low- and moderate-income borrowers.

The bank also hired 20 new staff members as part of the effort, mainly in community relations roles.

“Not every bank reacts the same way to getting a poor rating,” said John Taylor, president of the National Community Reinvestment Coalition and a member of BBVA’s advisory board. “Their response is the response we’d hope that every bank would have if they didn’t get a good grade on CRA.”

Still, as regulators

“There are no set guidelines that say this loan or this investment has prior approval before you even flip the switch on a transaction,” he said. “I think we’ve invested very thoughtfully, but certainly it would be better for the community and banks if banks knew that a certain type of activity or investment or service would definitely count for CRA.”

Banks have plenty of incentive to pass the CRA exam: Without at least a satisfactory rating, a bank is constrained from opening new branches, making an acquisition or merging with another institution.

In some cases, a bank may have “softer” reasons to strive for an outstanding rating if it has growth ambitions, said Warren Traiger, senior counsel at Buckley LLP.

“Banks submitting applications to regulators can face public protests, and an outstanding rating demonstrates responsiveness to the convenience and needs of its community, which are factors regulators consider in their review process,” he said. “It also is a sign of the bank’s commitment to its community, which lends credibility in discussions with community advocates.”

An outstanding rating also provides a bit of cushion against a potential downgrade. After all, it’s better to go from an “outstanding” to a “satisfactory” than from a “satisfactory” to a “needs to improve.”

Still, as CRA exams are administered currently, most banks will never earn higher than a satisfactory rating.

Ken Thomas, the president of Community Development Fund Advisors in Miami, said that any improvements to the 42-year-old law should include incentives that might encourage banks to shoot for outstanding ratings. For example, regulators could consider lowering the cost of borrowing from the Federal Reserve or Federal Home Loan banks or reducing deposit insurance premiums for banks with outstanding ratings, he said.

“In CRA one of the biggest problems is there’s no motivation for an outstanding rating,” Thomas said. “I’m saying, provide some financial benefit.”

Thomas said that banks shouldn’t have to make multibillion-dollar commitments to attain an outstanding rating. Good public policy should encourage banks to do right by their communities without having to make such hefty investments, he said.

“Just do your normal safe and sound lending to your entire community, and if you do a good job, you should be able to get a fair rating and with some strong community development investments and services, maybe it’s outstanding,” he said. “Banks that are doing M&A need to know that if they just focus on lending to their entire community that should be fine.”