WASHINGTON — The Federal Deposit Insurance Corp.'s third-quarter earnings report was stacked with good news: record earnings and lending, fewer troubled loans and higher interest and noninterest income.

Yet there was one statistic that is likely to fuel more calls for help from Washington. The total number of FDIC-insured institutions fell below 6,000 during the quarter, dropping 78 to 5,980.

It was a continuing sign of the industry's consolidation — and likely more ammunition for those arguing that a glut of regulations has raised compliance costs, forcing banks to sell.

"The fact that there are now fewer than 6,000 FDIC insured banks is a testament to the regulatory suffocation of our nation's precious community banking system and the Congress' seeming inability to provide the meaningful relief to reverse this trend," said Camden Fine, president of the Independent Community Bankers of America.

It was a small dark spot on what otherwise was a glowing report card.

"It wasn't a flashy quarter, but it was very, very solid," said James Chessen, the chief economist at the American Bankers Association. "It's hard to find real negatives in the performance."

Banks do now face an uncertain political environment, as Donald Trump's election was unexpected and raises questions about what happens next. But early signs are trending in banks' direction, with Trump likely to usher in an era of tax cuts and deregulation. That could free up even more lending that has been holding back ahead of the election results.

"There was uncertainty certainly expressed by banks' business customers throughout the election… and they didn't know which way eventually it was going to go," Chessen said. "Uncertainty tends to freeze business decisions."

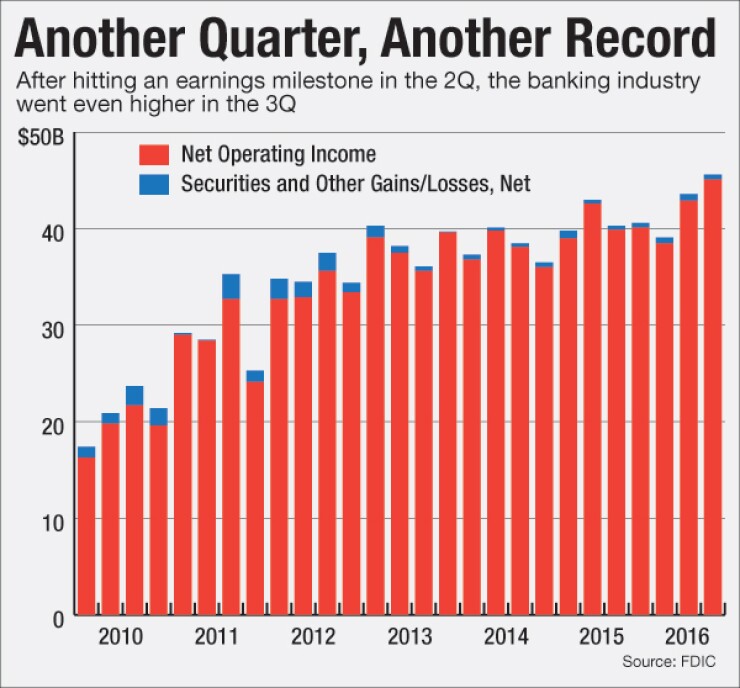

Of the litany of good news in the FDIC's Quarterly Banking Profile, which noted that banks earned a record $45.6 billion during the third quarter, loan growth stood out. Total lending reached a record $9 trillion. Loan balances rose year over year — by 6.8% — but also over the previous quarter — by 1.2%.

And in another positive sign for the industry, community bank lending was particularly strong.

"The largest increases were in commercial and industrial loans, residential mortgages and nonfarm nonresidential real estate loans," FDIC Chairman Martin Gruenberg said during a press conference on the QBP. "Annual loan growth at community banks of 9.4% continued to outpace the rest of the industry. Loan growth at community banks was led by commercial real estate loans, residential mortgages and C&I loans."

Small banks' lending to businesses rose by nearly 3% from a year earlier to $298.3 billion.

Loan performance was "exceptional," Chessen said. Banks have "done a very good job making money in an uncertain time."

Following are other findings from the report.

Income was up across the board

Net interest income jumped significantly during the third quarter, by $10 billion, accounting for much of the industry's new earnings record. To be sure, much of that appeared to be a result of one-time "accounting and expense items" at three large institutions, the FDIC said.

Still, noninterest income was also up, by $1.2 billion. More than 60% of banks reported higher quarterly earnings and only 4.6% of banks were unprofitable in the third quarter, down from 5.2% a year earlier. The average return on assets was 1.10%, up from 1.03% a year earlier.

Banks kept expenses in check

Total noninterest expenses were $1.1 billion higher than a year earlier, suggesting banks have a handle on their expense growth. The average efficiency ratio, which measures noninterest expenses as a percentage of net operating revenue, improved to 57.5% during the third quarter — the lowest level in more than six years.

Asset quality appears steady

Loans 90 days or more past due declined for the 25th time in the last 26 quarters, dropping by $2.5 billion to $134 billion. Noncurrent residential mortgage loans fell by $2.7 billion while noncurrent home equity loans fell by $386 million. That was more than enough to offset the $1 billion increase in noncurrent credit cards and $154 million increase in past due commercial and industrial loans.

At the same time, however, chargeoffs rose for the fourth consecutive quarter, jumping 17% to $10.1 billion from a year earlier. It was the fourth quarter in a row that net chargeoffs have experienced a year-over-year increase. Net chargeoffs of loans to C&I borrowers rose $946 million, while credit card chargeoffs were $658 million higher.

Banks once again put money into reserves

As loans grew, the industry boosted reserves to cover potential future losses. The 34% increase in loss provisions — to $11.4 billion — from a year earlier was the ninth time provisions have risen year over year. That helped contribute to a small increase in loan-loss reserves, which rose 0.3% from the previous quarter to $122 billion.

"Part of the increase in provision expenses was associated with loan growth and the related credit risk in those new loans," Gruenberg said. "Another part was due to the increase in credit risk associated with loans to borrowers that depend on the energy sector."

With the increase in loss reserves and decline in noncurrent loans, the so-called coverage ratio rose during the quarter from 89.2% to 91.1%, the highest level since the end of 2007.

The insurance fund continues to recover

The FDIC's insurance fund grew by $2.8 billion during the quarter to $80.7 billion. The ratio of FDIC reserves to insured deposits rose by 1 basis point to 1.18%. Meanwhile, the FDIC "Problem List" of troubled institutions fell by 15 to a total of 132 institutions.

FDIC still sees signs of worry

While the report card was solid, the FDIC did see some cause for concern. As it has in the past, the agency warned about interest rate risk.

"The banking industry continues to operate in a challenging environment," Gruenberg said. "Low interest rates for an extended period have led some institutions to reach for yield, which has increased their exposure to interest rate risk, liquidity risk and credit risk. Current oil and gas prices continue to affect borrowers that depend on the energy sector and have had an adverse effect on asset quality. These challenges will only intensify as interest rates normalize."