-

The Financial Stability Board's "total loss-absorbing capacity" proposal would require big banks to hold a minimum amount of capital and debt instruments to be used to shoulder the costs of a failure.

November 10 -

Trade groups press federal banking regulators to make the Basel III capital rule less onerous.

November 13 -

On a day when the banking agencies finalized the new liquidity measure for large institutions, they also issued rules dealing with swaps margin requirements and how institutions calculate their overall leverage exposure.

September 3

WASHINGTON International regulators are gearing up to make significant changes to capital requirements over the next few years in a shift so massive that some observers have already begun talking about under a new name: Basel IV.

Over the next three years, regulators are poised to make sweeping alterations to the existing Basel III international accord, including raising the risk-based capital ratio, revising risk weightings, and moving away from model-based assessments as part of a revamp of the capital requirements for operational, market and credit risk.

"The sum total of all of these is a really new capital regime. It's effectively Basel IV," said Karen Shaw Petrou, managing partner of Federal Financial Analytics, the first analyst to use the term.

The Financial Stability Board detailed many of these changes in a communiqué to the G-20 ahead of its meeting last month in Australia, but few have seized on just how sizable they would be.

The stability board said it will issue a plan for total loss-absorbing capacity a standard that includes capital and convertible debt and is designed to help make it easier for regulators to seize a failing behemoth. Regulators are calling for TLAC to be at least twice the Basel III total risk-based capital of 8%.

It will make that change at the same time that the board revamps how banks rely on internal risk models to determine capital requirements and implements new standards to "enhance the resilience of banks' funding and their stock of liquid assets," according to the communiqué.

Additionally, the Basel Committee is still finalizing work on capital requirements governing trading books, operational risk and credit risk, Petrou said.

Taken together, it's a seismic shift, analysts agreed.

"What this does is create a floor, and that floor may be appropriate for some and may be unduly high for others," said Gregory Lyons, a partner at Debevoise & Plimpton. "It is a significant move away from allowing institutions with sufficient robust risk management to use their own personal experiences to re-evaluate their capital adequacy."

Petrou points to specific changes she expects to see soon from the Basel Committee. For one, she said it will likely raise the risk-based capital ratio to 10% from 8%.

At the same time, however, the Basel Committee plans to overhaul risk weightings, which received relatively small changes under Basel III. Those changes will reduce reliance on internal or external models and move toward tougher capital standards.

Regulators are making changes because of the flaws with models and risk weightings exposed by the financial crisis and subsequent international events. Basel II, for example, famously assigned a zero capital requirement for sovereign debt. Such "howlers," Petrou said, are the kind of blind spots that regulators want to avoid.

The end result is a shift away from risk-based capital rules and toward simple, hard-line capital ratios, Petrou said. It also means the international capital system, which has long been focused on modeling and risk weighting, is moving closer to the U.S. one, which has continued to rely on a simpler leverage ratio in addition to more risk-based measures.

"We are dragging the Europeans [and] Japanese kicking and screaming away from risk-based capital to a leverage-based, simple model of regulatory capital, even for the most complex financial instruments," Petrou said. "There's a book, and you look it up and that's the capital you have to hold."

Notably, neither the Basel Committee nor regulators are likely to call the changes underway "Basel IV," or indeed give it a name at all. That's partly because the idea of a Basel IV would be unpopular with banks, especially considering Basel III is still being finalized and implemented.

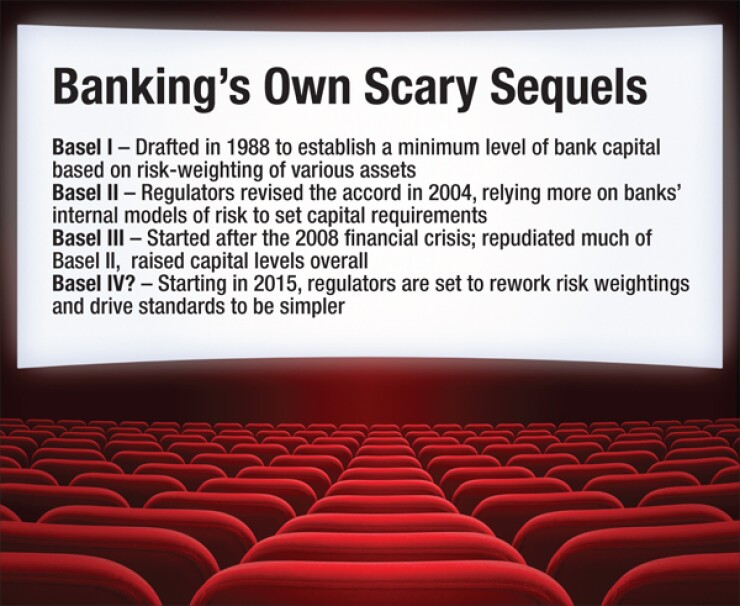

But the Basel accords have a history of incomplete implementation. Basel I was drafted in in 1988 to establish a minimum level of bank capital based on risk-weighting of various assets. Basel II came along in 2004 to revise and update Basel I's framework, but limited capitalization requirements to on-balance-sheet assets, resulting in banks especially European banks holding very large positions in sovereign debt.

The U.S., however, did not fully implement Basel II after a bitter fight over the issue between the Fed, which at the time pushed for more reliance on internal models, and the Federal Deposit Insurance Corp., who worried capital requirements would fall too far, too fast. Basel III, which was developed in the wake of the financial crisis, sought to extend capital requirements to off-balance-sheet assets, but largely ignored the risk weightings. That work comprises much of the thrust of what Petrou dubs Basel IV.

Lyons said the transition from one regime to another can be vague, but the changes are substantial enough in this case for the name to apply.

"You end up with kind of a fuzzy line as to when a new regime has started," Lyons said. "I think you could certainly consider this to be a new [regime]. You can call that Basel 3.5 or Basel IV, or you can call it a more strict implementation of Basel III. I think fundamentally the regulators have less faith in internal models than before."

But Mayra Rodriguez Valladares, managing principal of MRV Associates, said calling the pending changes Basel IV may be going too far, arguing it's not on par with the wholesale reconstruction of the international standards in the same way it was between Basel II and Basel III. Still, Valladares said the changes are a major milestone one that she expects banks will fight strenuously.

"This is the biggest news to come out of the Basel committee, because whatever they propose whether it's a floor, whether it's making changes in formulae, whether it's demanding that banks be more transparent about how they come up with risk weighted assessments there will be a big battle, because banks are really going to push back," Valladares said.

Valladares sees the most critical change to the fact that the Basel Committee wants to require banks to be more transparent in the way they decide how much risk they are assuming. Under the current Basel rules, banks have fairly wide latitude in deciding how to assess credit risk or operational risk, and are not obligated to disclose how they arrive at their conclusions. A regime that mandates greater disclosures thereby allowing regulators and the public to compare one bank's capitalization accurately with another would do more to stave off the next crisis than higher capital alone, she said.

"[Transparency is] much more important than these floors," Valladares said. "If banks are forced to explain more how they come up with these things, people can have more information that can be meaningful. Then all these ratios would really mean something."

Lyons said the international regulators' approach is consistent with a philosophy that more capital reserves reduce risk, which U.S. regulators especially have subscribed to since the financial crisis. But the approach tends not to account for the constraining effect that such an approach can have on banks, and by extension on economic growth and activity.

"If your position is that more transparency and more capital are always better, then this approach makes sense," Lyons said.

For banks just now getting adapted to the Basel III capital rules, the idea of an entirely new philosophy governing global loss absorbance may feel experimental. But Petrou said the Basel IV framework is the outgrowth of political expedience on the one hand and market adaptation on the other. By putting greater restrictions on banks, regulators have pushed the riskiest activities to unregulated entities so called shadow banks that the Financial Stability Board has also indicated it wants to bring under its capitalization regime.

"I think vivisection is a very good analogy," Petrou said. "It takes so long for the rules to change that by the time they are creeping into existence, the markets have changed."

U.S. regulators have long favored a leverage-based capital regime and have been implementing such a regime on their own. In September, U.S. regulators finalized a supplementary leverage ratio for the biggest banks; they also took a harder line than the Basel Committee in a final liquidity rule.

But Petrou said the move toward simple, hard-line capital requirements poses its own risks.

"There are a lot of unintended consequences," Petrou said. "Simple is good when simple is right. If simple is wrong and finances complicated, then you will make significant mistakes and concentrate them in the banking system, because everyone will make the same mistake at the same time."