Forget for a moment that JPMorgan Chase bombed a key regulatory test and reported a sizable earnings decline Wednesday, and look more closely at the underlying numbers: the nation's largest bank posted solid results in bread-and-butter banking.

It's a good sign for the big and regional banks that are set to report first-quarter results over the next few weeks, given that many observers had already written off the quarter (and, in some cases, the year) for lenders and other U.S. businesses. What it means for community banks is more debatable.

Perhaps more certain is that JPMorgan appears to be weathering low interest rates just fine.

-

In declaring that five U.S. banks' resolution plans were "noncredible," regulators provided new details on exactly what each institution did wrong, as well as what Citi and others did right. Here's what they said.

April 13 -

The partnership with OnDeck will allow the megabank to approve and fund loans in as little as a day, according to CEO Jamie Dimon. Meanwhile, OnDeck is eyeing similar partnerships with other banks.

April 12 -

Yes, all the big banks are paring their balance sheets to comply with new rules and axing expenses to please shareholders, but JPMorgan is simultaneously targeting affluent cities for branch and deposit growth.

February 23

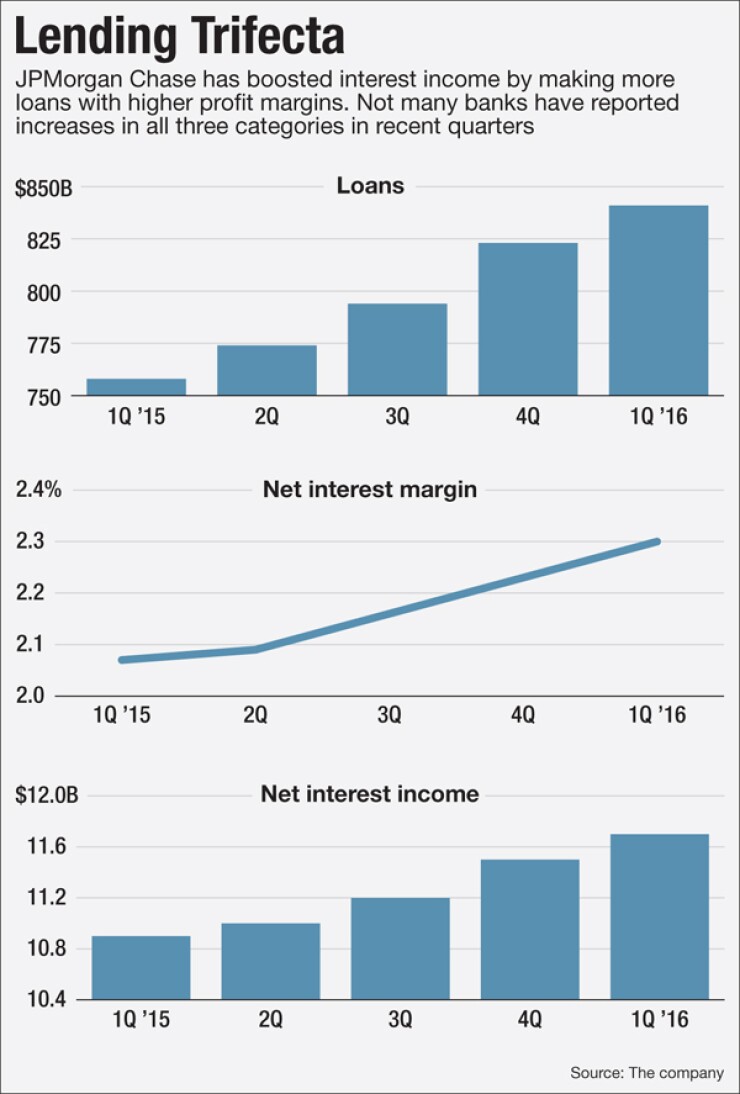

Net interest income rose 7% from a year earlier, to more than $11 billion. The net interest margin expanded by 23 basis points, to 2.30%. Total loans grew by double digits, fueled by major gains in auto, mortgages and commercial real estate.

To be sure, higher credit costs and lower trading fees were a drag on profits. The company boosted its set-aside for bad oil loans by more than $500 million. If oil prices stay low, it could increase reserves by an additional $500 million over the course of the year, executives said.

Yet the pep in JPMorgan's core units suggests that the economy may be stronger than it appears, despite recent market turmoil, analysts said. After a string of quarters of weak revenue growth for banks, JPMorgan's combination of higher margins and loan expansion could be the upbeat sign that the industry has waited for.

"I think it's a positive message — but maybe not to the extent that it is for JPMorgan," said Jeff Harte, an analyst with Sandler O'Neill. "It suggests that the lack of additional rate hikes might not be as much of a revenue" crunch as banks had initially thought.

Other analysts were more skeptical. JPMorgan's strong results could be a sign that the megabank is stealing market share from its smaller competitors, according to Gerard Cassidy, an analyst with RBC Capital Markets.

"We will see what the industry shows" in the coming weeks, Cassidy said. JPMorgan's strong push into mobile banking, in particular, could be a sign that it's attracting business from smaller competitors, he added. JPMorgan's mobile customer base grew by 19% from a year ago, to 23.8 million users.

Overall, JPMorgan beat estimates for what analysts had predicted to be a lackluster quarter for the company. Shares had climbed nearly 5% in midafternoon trading.

Solid performance in JPMorgan's loan book helped the company overcome an otherwise tough morning.

Just hours after JPMorgan released its quarterly results, the Federal Reserve Board and Federal Deposit Insurance Corp.

Wells Fargo, Bank of America, State Street and Bank of New York Mellon also flunked the regulatory test. All five banks

"We're going to do everything possible to fix this issue," Jamie Dimon, the company's chairman and chief executive, said during a conference call with reporters.

Overall, profits at the $2.4 trillion-asset company declined 7% from a year earlier, to $5.5 billion. Lower trading fees, mostly from stock market declines earlier this year, weighed down the first-quarter results.

Chief Financial Officer Marianne Lake emphasized that, despite dismal performance in trading and asset management, JPMorgan's consumer businesses are growing at a rapid clip.

"We have the belief that the U.S. economy is continuing to move in the right direction [and] that the consumer is on solid footing," Lake said during a conference call with analysts.

Loans grew across the company. Residential mortgages rose by 37%, to $172 billion, in part because of the company's push into jumbo loans. Auto loans grew 13%, to $62.9 billion. Consumer and business loans rose 6%, to 22.9 billion.

"Loan growth helps, and they've been growing loans faster than we expected," Harte said.

A range of factors also helped to expand the company's net interest margin, according to industry analysts.

In addition to making more loans, JPMorgan has spent the past year shedding noncore, higher-cost deposits. Total deposits have shrunk 3%, to $1.3 trillion, as the company has turned its focus to smaller retail clients.

JPMorgan's business model as a megabank also gave its margin a boost. A large portion of the company's balance sheet — nearly 20% — includes cash that is deposited at banks or with the Fed. Yields on those short-term deposits grew at a faster rate than other assets, following the rate hike in December.

For instance, the average rate on deposits with banks increased 22 basis points, to 0.51%. The average rate on loans, meanwhile, declined 2 basis points, to 4.26%.

Still, JPMorgan's rapid loan growth pushed some analysts to worry if the company is overexposing itself to risky markets.

Throughout the call, analysts pressed JPMorgan executives on the company's rapid growth in commercial real estate — a business that regulators have warned is getting overheated.

The company expanded commercial real estate lending by 18%, but executives said underwriting remains strong.

"We haven't changed our geography, and we haven't changed our risk appetite," Lake said.

One analyst agreed. JPMorgan is "not showing any weakness" when it comes to credit quality, according to Paul Miller, an analyst with FBR Capital Markets.

"CRE is fine. Everybody is overly concerned about CRE," Miller said, noting that the company had an "OK quarter" overall.

The biggest concern JPMorgan's growth in CRE is the potential for losses in the next couple of years, when the market is widely predicted to turn, Cassidy said.

"In the best markets, the worst loans are made," Cassidy said.

Executives were also pressed on looming risks in the auto market. The company has pulled back from subprime originations, and credit quality remains strong for car loans, Lake said.

Focusing on borrowers with higher credit scores will likely make JPMorgan immune to broader downturns in auto loans, the company said.

"I do think you'll see issues in the market," Dimon said.