Maybe the demand for commercial loans is not as lackluster as bankers had thought.

For weeks, bank executives have been warning investors and analysts that commercial loan growth in

But so far this earnings season — and it is still early — the numbers are not looking so bad.

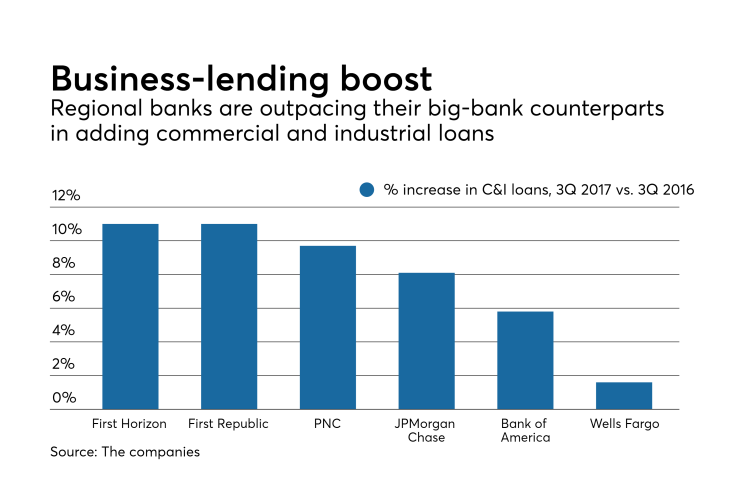

On Friday, regional banks PNC Financial Services Group in Pittsburgh and First Horizon National in Memphis reported solid growth in commercial and industrial loans, both on a linked quarter basis and year-over-year.

Meanwhile, Bank of America rode modest growth in business lending and increased yields on its commercial loans to its highest quarterly profit in six years.

Marty Mosby, an analyst at Vining Sparks, said that the early results from banks’ earnings announcements show that businesses are willing to take on at least some bank debt. Corporate tax cuts would be nice, but businesses have decided

“The hesitation was there for the first half of the year. Now you’re seeing a lot of working capital investments,” Mosby said. “These are a lot of things that were being delayed but that needed to be done. Now they’re getting done.”

At B of A, commercial loan balances increased 1.7% from the second quarter and nearly 6% year over year, to $296 billion, from a year earlier. At the $375 billion-asset PNC, C&I loan balances increased 2.5% quarter over quarter and 10% year over year to $111 billion. The growth was fueled by loans to the financial-services sector, which increased 52% to about $11 billion.

PNC achieved that loan growth by nurturing business relationships over time, Chairman and CEO William Demchak said during a conference call, in response to an analyst’s question about whether the growth was sustainable. He added that it’s difficult to predict where PNC would see commercial loan growth in any given quarter.

“We put low guidance on loan growth and get comfortable with the notion that if we just keep growing clients, it’ll show up,” he said.

Commercial loan demand has not fully bounced back on a national scale, but bankers are certainly encouraged by the pockets that are showing strength.

PNC, for example, is getting its best results from its newer markets in the Southeast and Chicago

"The growth rates in those markets ... are running at about two times" the growth rates in PNC's legacy markets, said Robert Reilly, PNC's chief financial officer. "They're a big part of our loan growth story on the commercial side

Other regional banks are also reporting increased demand in certain sectors.

The $21 billion-asset Bank of the Ozarks in Little Rock, Ark., said its corporate loans specialty group originated $114 million of loans during the quarter.

At the $30 billion-asset First Horizon, C&I loans increased by 5% from the second quarter and 11% year over year, to $12 billion. “Areas of particular growth in the quarter [were] loans to mortgage companies, asset-based lending, private client and our core commercial lending businesses,” BJ Losch, First Horizon’s chief financial officer, said during a Friday conference call.

To be certain, commercial loan demand remains spotty across the country. Indeed, some analysts have speculated that the growth banks are reporting is less a function of increased demand than it is banks simply poaching others' customers.

Demchak acknowledged that PNC has been luring business away from some of its rivals and when asked Friday if that meant regional banks or the country’s largest banks, he said, “All of the above.”

He then added that the bank is seeing “an acceleration in what we are getting from some of the larger banks.”

One large bank that has seen a decline in commercial lending is Wells Fargo. Its C&I loan balances at Sept. 30 were down 1% from three months earlier and up only 2% year over year, to $327.8 billion.

A range of factors had an impact on the lackluster results. Among them was a spate of paydowns on the $27 billion-asset commercial loan book that Wells acquired in March 2016 from GE Capital, according to company executives.

In an interview Friday, Chief Financial Officer John Shrewsberry said the bank is not seeing a huge demand for “incremental borrowing” in its markets, so it has to pick and choose which credits to go after.

“We are competing vigorously in every market that we’re in, but there’s something left in terms of risk-taking on the part of our customers to expand their business, or acquire other business,” he said.

Lower-than-expected growth in earning assets has prompted Wells officials to dim their efficiency outlook for the full year.

Wells had previously expected to report an efficiency ratio just shy of 61% for 2017 as it looks to

Demand also remains tepid in some specific segments of commercial lending, such as technology upgrades, Mosby said.

“We still need to see businesses make more fixed investments in technology, things that will grow their business,” Mosby said.