A picture is worth a thousand words, but a simple voice-activated transaction can involve more than twice that amount, according to Michelle Moore, head of digital banking at Bank of America.

“We learned there are over 2,000 different ways to ask us to move money,” Moore said in discussing several takeaways from the rollout this year of Erica, BofA’s artificial-intelligence-powered virtual assistant. “We never envisioned this.”

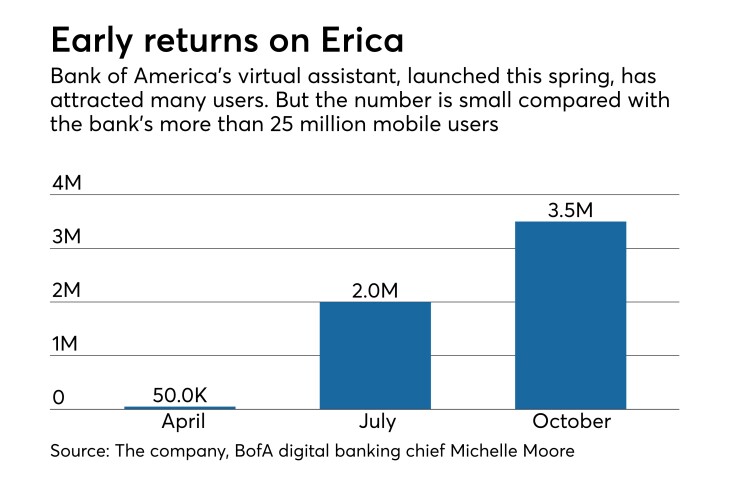

Since mid-March, Erica has attracted 3.5 million customers, and it continues to evolve as the bank evaluates its impact and mulls new features, Moore said Wednesday at the BAI Beacon conference in Orlando, Fla.

“Erica has been a very good success for us,” Moore said. “Erica was a way to provide personalization at scale. It has brought excitement to Bank of America.”

She offered tips for banks that want to develop voice assistants. They need to start by figuring out the answer to this question, Moore said: Can they build one in-house, or should they buy the technology? Erica was mostly built in-house.

For an in-house virtual assistant, start by assembling a solid tech team that can think of all the different ways to ask a finance question and then can bake them into a virtual assistant, she said.

Once the product is live, there must be a system in place to monitor usage data and make quick adjustments to fix problems. Respond to feedback from customers immediately during the rollout stage, she said.

“Customers don’t have the patience,” Moore said. “They are

And lastly, educate the consumer and bank representatives about what the virtual assistant can and cannot do, she said. Bank of America spread the word about Erica through branches, call centers, its mobile app and emails to customers.

Erica provides basic finance information such as routing numbers, FICO scores and balances, and it can offer insights on customer spending habits. One of the things customers love about Erica is that when the virtual assistant cannot answer a question, they are referred to a call center representative without having to have their identity verified again.

Bank of America is still polishing Erica’s reactions to some basic questions and will add more capabilities over time, Moore said. For example, a customer who asks Erica why a check is on hold will not get an answer and be routed to a customer agent … for now.

In other words, the technology remains a work in progress.

“Why did something happen?” Moore said. “We have a lot of ‘why’ questions to work through.”