The real estate adage “location, location, location” is playing a bigger role in headquarters decisions tied to bank M&A.

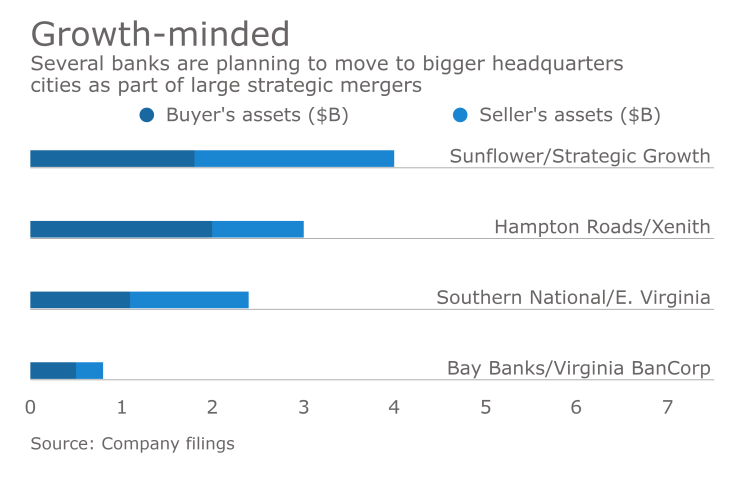

Several deals unveiled in the last year have involved an acquirer moving its corporate offices to the seller’s city or an agreement to relocate both merging banks to an entirely new metropolitan area.

Sunflower Financial will relocate from Salina, Kan., to Denver

Hampton Roads Bankshares moved its headquarters from Virginia Beach to Richmond last year

There are several reasons banks are willing to pack up the moving van as part of a strategic acquisition. For starters, many want to build a bigger name for themselves in growing markets.

Richmond is a case in point.

Bay Banks of Virginia and Virginia BanCorp offer another example of banks relocating to Richmond as part of

Richmond “has got some great growth potential,” said Frank Scott, Virginia BanCorp’s president and CEO. “There’s a lot of competition, but we feel there’s still a need for a strong community-oriented bank, which is what we want to be.”

The population around Richmond should top 1 million by 2020, according to the Greater Richmond Partnership, a local economic development group. The market’s $60,000 median household income is 11% higher than the comparable national figure. About 58,000 businesses operate around Richmond, including more than 4,100 that opened last year.

The market is slowly growing for the nearly 40 banks that do business in the city. Total deposits rose by 15% from mid-2011 to mid-2016, excluding a large Capital One Financial office, based on data from the Federal Deposit Insurance Corp. Only one institution – Bank of America – has more than 10% of the deposit market share.

“We’re the Atlanta of 30 or 40 years ago or the Charlotte of 20 years ago,” said Randall Greene, Bay Bank’s president and CEO.

“We’re kind of the up-and-coming thing,” added Greene, who will retain his titles after the merger. “Our commercial market will remain strong, our economy is well diversified. You’ve got to be crazy not to come to Richmond if you’re in the surrounding areas.”

Richmond was a common tie that brought Bay Banks and Virginia BanCorp together, added Scott, who will become the combined company’s chairman.

Virginia BanCorp wanted to add to the two branches it had in the city, but felt hamstrung by escalating compliance costs. Bay Banks was also eager to keep growing after entering Richmond in February 2014.

There are others reasons for moving a growing bank to a bigger headquarters city.

Having corporate offices in a major metropolitan area can make a company more accessible to financial analysts, key brokers and investors.

“I definitely think being located in a larger metropolitan area is important for a public bank stock over the long run,” said Chris Marinac, an analyst at FIG Partners in Atlanta.

“For the longer-term attraction of investors [who are willing to pay] a larger premium to tangible book value and core deposits, a metropolitan area is ideal and ultimately seems to be a component of many community banks’ growth,” Marinac added.

Marinac pointed to several key corporate shifts in recent years, including State Bank Financial’s relocation to Atlanta from Macon, Ga., and Prosperity Bancshares’ move to Houston from El Campo, Texas.

A move can also help a company intent on hiring lenders and high-level executives.

Bay Banks, for instance,

“The key is having a community bank that can deliver a high-value proposition, offering sophisticated credit with a desire to build a market, bring in relationships, invest in the community and do all the things a true community bank does,” Armstrong said. “That’s the reason I feel really good about joining” Bay Banks.

Of course, moving to a market adds a layer of complexity to a deal. In the case of Bay Banks, the objective is to have the entire executive team, including Greene and Scott, working in Richmond “on day one,” Greene said.

“We’re doing our best to stay on top of everything,” Scott added. “We’ve hired some industry experts in different areas to help us check off the boxes, and while we’re trying to be as thorough as we can, there’s probably going to be a box that’s left unchecked. … There are a lot of boxes.”