The National Credit Union Administration is planning to weigh in on the hotly contested issue of credit unions buying banks.

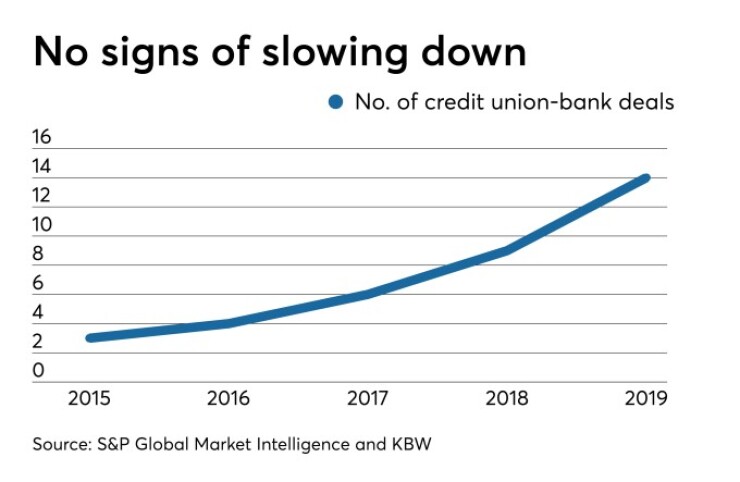

Until recently, it was somewhat rare for a credit union to buy a bank. But since 2015, 36 deals have been announced, with 14 happening this year alone. It’s a trend experts expect to continue.

NCUA Chairman Rodney Hood said via Twitter earlier this month that the regulator will “consider a rulemaking on this issue to add even more transparency to the process" sometime this year.

Credit union observers hope that any rule could help clarify how these deals will be reviewed by the NCUA and make the process smoother. But any rulemaking will also give bankers, who are vehemently opposed to this trend, a chance to air their grievances and potentially influence the process.

“I do think regulation could be helpful here, and I can’t believe I’m saying that,” said Michael Bell, a lawyer at Howard & Howard in Royal Oak, Mich. “Some codified guideposts and some structure is helpful.”

Consolidation is likely to continue, including more banks selling to credit unions, said Tom Rudkin, principal in mergers and acquisitions at DD&F Consulting Group. This is driven in part by smaller banks deciding they need to get significantly larger through a merger of equals or possibly selling to another bank or credit union.

Management at these banks has an obligation to get the best deal possible for shareholders. That means talking to a variety of potential buyers, including credit unions.

“That’s what’s driving the process,” Rudkin said. “The banking industry has significantly changed. Banks feel that they have to be closer to $2 billion in assets to give returns to their shareholders. That's increasing the number of the transactions between banks and credit unions.”

Credit unions’ appetite for these deals doesn’t seem to be slowing, either. About a third of respondents to a recent survey from West Monroe Partners said

Despite the uptick in the number of these deals, regulation hasn’t necessarily kept up, industry experts said. There are rules in place for when a bank buys a credit union — which hasn’t happened in years — and when two credit unions merge.

Because of that, it makes sense to have a more-codified process for how the NCUA reviews and processes credit unions' applications for buying banks.

Currently, credit union buyers submit an application to NCUA that includes pro forma numbers for the institution once the transaction is completed. For federally chartered credit unions, these deals have to be structured as purchase-and-assumption agreements that are more complex and costly to complete, said Richard Garabedian, a lawyer at Hunton Andrews Kurth who has worked for banks and credit unions.

For instance, under a purchase-and-assumption agreement, the bank may have to recognize a taxable gain. Credit unions often pay more to buy the bank to ensure any taxes paid are covered and not simply taken out of the purchase price.

For state-chartered credit unions, how these acquisitions are handled vary by state.

Meanwhile, the bank must file a merger application with the Federal Deposit Insurance Corp. since it will be transferring its deposits to an entity that isn’t FDIC insured. The FDIC already has a codified process in place to handle those deals, such as having 60 days to act on a merger application, that helps the transaction go smoothly, Bell said.

It is uncertain what any new regulations could say about credit unions buying bank,s but credit union observers are hopeful it would mainly provide standard procedures for completing the deals, such as guidance on what the NCUA wants in an application, time frame for reviewing the deal or whether an onsite visit is required, Bell said. Right now, these transactions are dealt with mostly at the regional level, leading to differences in how they are handled, he added.

“I think if a rule can come out and help make the process more efficient and reliable, it only helps,” said Bell, who has worked on a number of the credit union-bank deals.

Garabedian would like it if federally chartered credit unions no longer had to complete these transaction as purchase-and-assumption agreements, though he isn’t sure the NCUA would go that far.

“If the NCUA wanted to streamline it, they could allow direct mergers if a federal credit union is the buyer,” he added. “That would make it less costly for the credit union and the bank but I’m not sure if Rodney Hood will do that.”

According to an NCUA spokesperson, the proposed rule “will be intended to add even more transparency to the process when credit unions acquire bank assets.”

Hood, a Republican, was appointed by President Trump to the NCUA board; he

“I strongly believe in the free market system, and I want to empower credit unions, especially when it comes to being responsive to local needs and serving the communities where they operate,” Hood wrote on Twitter earlier this month.

That gives hope to industry observers that any rule wouldn’t necessarily inhibit these transactions.

“I think he’s in favor of a free enterprise system in letting the free markets determine values and structures and pricing,” Rudkin said.

However, bankers have used the issue of credit unions buying banks as a rallying cry. Laura Lee Stewart, president and CEO of Sound Community Bank,

“There should be significant guardrails surrounding these deals that are increasing in pace and aggressively marketed to bankers," Ken Clayton, head of the office of legislative counsel for the ABA, said in a statement.

Clayton said in the statement that these deals eliminate a tax-paying entity and lack transparency since deal pricing isn’t normally disclosed. Usually an acquisition’s price isn’t publicly disclosed if it involves a privately held institution.

“These takeovers also illustrate how so-called ‘field of membership’ requirements are a fiction for many large credit unions because they swallow up bank customers that share no common bond at all,” Clayton added. “We believe these are the sorts of questions — and many more — that NCUA and members of Congress should be thinking about when considering the parameters that should surround these deals.”

To take into account dissenting voices, the NCUA may first issue an advanced notice of proposed rulemaking — rather than just starting with a proposed rule, Garabedian said. It has done that in the past with other hot button issues, such as supplementary capital. Taking that step allows the agency to get more expansive comments from interested parties before crafting the actual regulation.

“I think the NCUA is very attentive to the banking groups’ observance of what is going on,” Garabedian said. “It raises interesting policy issues I’m sure the NCUA is considering. … The bankers will have comments and the NCUA will probably pay attention. What they do with that, I don’t know.”