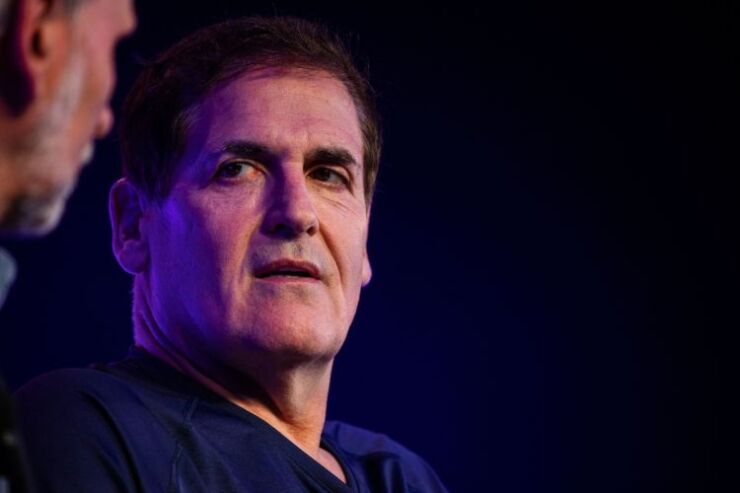

Dave, a banking startup that’s been backed by investors including Mark Cuban and Capital One Financial, agreed to go public in a deal with a blank-check firm that values the company at $4 billion.

Dave also secured a private placement, alongside the transaction with VPC Impact Acquisition Holdings III, of $210 million from investors including Tiger Global Management, Wellington Management and Corbin Capital Partners, the companies said Monday in a

Dave launched in 2017 with the goal of helping consumers avoid overdraft fees, an effort it says has led customers to circumvent nearly $1 billion in those charges. Such

The startup is one of the latest fintech firms to go public through a merger with a SPAC. Acorns Grow, an investing startup,

Dave and VPC Impact Acquisition Holdings’ transaction expands the relationship between the startup and Victory Park Capital, which backs the blank-check company. Victory has previously invested in Dave and provided a $100 million credit facility to the banking firm in January. Dave also created a spending account and debit card with no monthly fees, called Dave Banking, last year.

Dave was advised by Centerview Partners and Orrick, Herrington & Sutcliffe. The blank-check company sought advice from Citigroup, Jefferies Financial Group and White & Case.