-

The regional bank recorded $130 million of legal charges during the fourth quarter in connection with the resolution of a legal battle involving overdraft fees. Its earnings also took a hit from $63 million in employee severance costs.

January 21 -

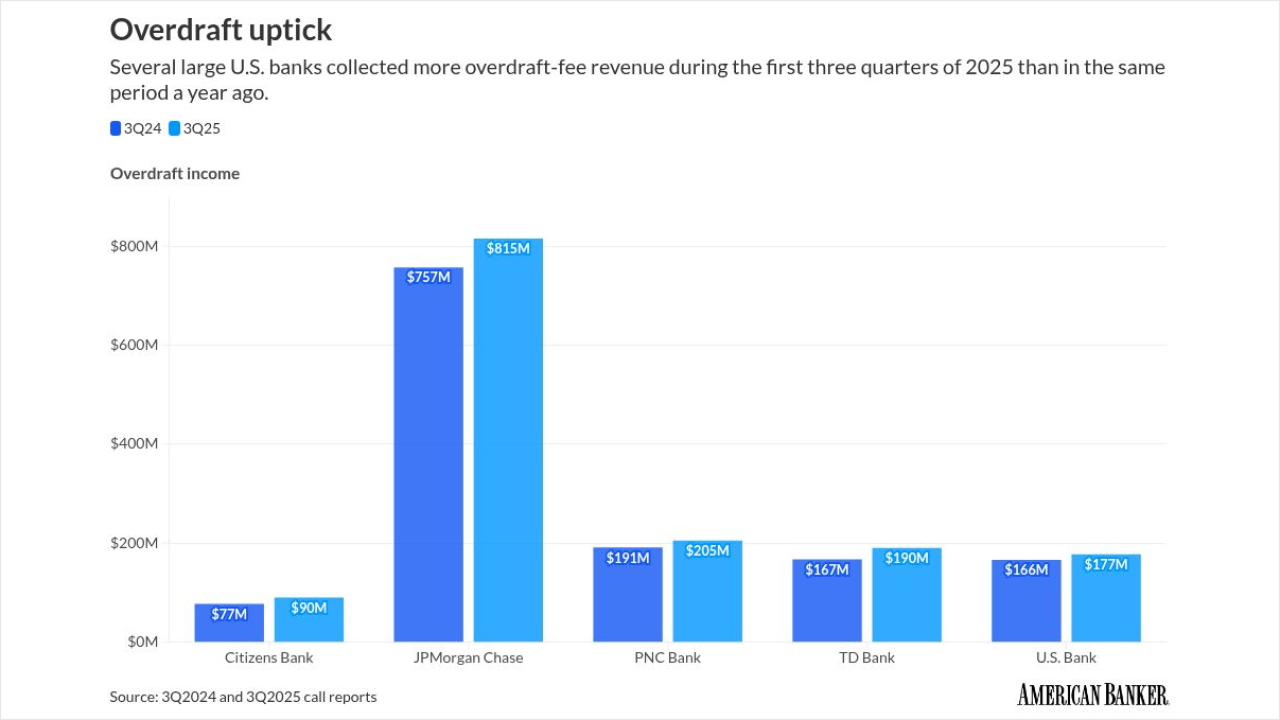

Several large U.S. banks reported an uptick in overdraft-related income for the first three quarters of 2025. Economic pressure on consumers may be to blame, some banks and industry observers say.

January 9 -

Democratic lawmakers, led by Senate Banking Committee ranking member Elizabeth Warren, D-Mass., press 21 institutions for fee data after a federal agency halted disclosure requirements.

December 2 -

Three lawmakers led by Senate Banking Committee ranking member Elizabeth Warren, D-Mass., are beginning to assess the impact that the Trump administration's posture toward the Consumer Financial Protection Bureau has had on overdraft fees.

September 2 -

Navy Federal Credit Union will not pay a $15 million fine or $80 million in restitution to service members who were illegally charged surprise overdraft fees when their accounts had sufficient funds.

July 2 -

Eliminating overdraft charges is Stearns Bank's latest move to limit fees that its customers pay. CEO Kelly Skalicky says deposit service fees aren't a good business model.

May 6 -

Congressional Review Act resolutions to nullify the Consumer Financial Protection Bureau's overdraft and larger participant rules now go to President Trump for his signature.

April 9 -

A group of 24 state attorneys general Wednesday called on House members to reject a Senate-passed Congressional Review Act resolution repealing the Consumer Financial Protection Bureau's overdraft cap.

April 9 -

The Senate voted 52-48 to overturn the Consumer Financial Protection Bureau's rule that would cap overdraft fees at many banks at $5.

March 27 -

Americans spent 49% more on overdraft-related fees in 2023 than previously estimated, according to new research, which finds that credit unions were largely responsible for the previously uncounted revenue.

March 25 -

A pair of Congressional Review Act resolutions directed at the Consumer Financial Protection Bureau's overdraft and larger participant rules are expected to make it to President Donald Trump's desk.

March 6 -

Consumer advocates MyPath and the Mississippi Center for Justice have been allowed to intervene in a banking industry lawsuit challenging the CFPB's $5 overdraft fee cap for large financial institutions after the bureau declined to defend the rule.

March 5 -

The heads of both the House and Senate banking committees introduced a Congressional Review Act resolution to undo the Consumer Financial Protection Bureau's overdraft rule, a measure that only needs a simple majority in both chambers to pass.

February 13 -

The House Financial Services Committee released a draft resolution under the Congressional Review Act to cancel the Consumer Financial Protections Bureau's rule limiting bank overdrafts to $5 in most cases.

February 4 -

The Michigan-based institution lowered overdraft and nonsufficient fund fees to 99 cents amid a torrent of regulatory rulemaking and action related to overdraft.

January 27 -

The New York Department of Financial Services has proposed several changes to overdraft fees including banning banks from charging more than three overdraft or nonsufficient funds fees per consumer per day.

January 22 -

While the Consumer Financial Protection Bureau seeks to cap overdraft fees, banks and credit unions are fighting the effort. Nuances that don't fit either side's narrative can get lost in the rhetoric.

December 19 -

Bank trade groups filed a motion for a preliminary injunction to stop the Consumer Financial Protection Bureau's $5 overdraft fee rule from going into effect late next year.

December 19 -

The populist strain that has long animated the left wing of the Democratic party seems to have migrated to the Republican center, benefiting President-elect Donald Trump in this year's election. We're about to find out whether right-wing populism is as earnest as its left-wing predecessor.

December 17 American Banker

American Banker -

There are many ways for the incoming administration to overturn the Consumer Financial Protection Bureau's final rule slashing overdraft late fees to $5. But the politics of nullifying the rule is a challenge to an administration that promised lower prices.

December 17