Alan Kline is the former editor-in-chief of American Banker. Previously he oversaw its consumer finance and national/regional banking coverage. He also helped direct coverage of the annual Most Powerful Women in Banking rankings.

-

TD Bank announced Thursday that it is doing away with the Penny Arcade coin-counting machines that are stationed in more than 1,000 of its branches along the East Coast.

By Alan KlineMay 19 -

EverBank Financials first-quarter profits more than doubled from the same period last year as strong loan growth more than offset a sharp drop in income from servicing mortgages.

By Alan KlineApril 27 -

Ally Financial reported strong loan and deposit growth in the first quarter, but a shift in the makeup of its automobile loan portfolio forced the Detroit company to nearly double its loan-loss provision from a year earlier.

By Alan KlineApril 26 -

Paragon Commercial Bank, Unity Bancorp and Nicolet Bankshares have found success by radically rethinking their strategies.

By Alan KlineApril 25 -

Opus Bank in Irvine, Calif., reported a profit of $17.1 million in the first quarter, up 56% from a year earlier, as strong loan growth more than offset higher expenses and an uptick in problem loans. Its earnings per share climbed 50%, to 51 cents.

By Alan KlineApril 25 -

Citizens Financial Group in Providence, R.I., said Thursday that its first-quarter earnings increased 7% from the same period last year, to $223 million, as strong commercial loan growth offset a dip in fee income. Earnings per share increased 8%, to 41 cents.

By Alan KlineApril 21 -

Competitive pricing and softening demand at the high end of the apartment- and condo-building market had executives at BankUnited, Signature and New York Community answering tough questions about their growth projections and diversification strategies.

By Alan KlineApril 20 -

Signature Bank in New York reported record profits in the first quarter as strong loan, asset and deposit growth more than offset increased expenses and deterioration in its portfolio of taxi-medallion loans.

By Alan KlineApril 20 -

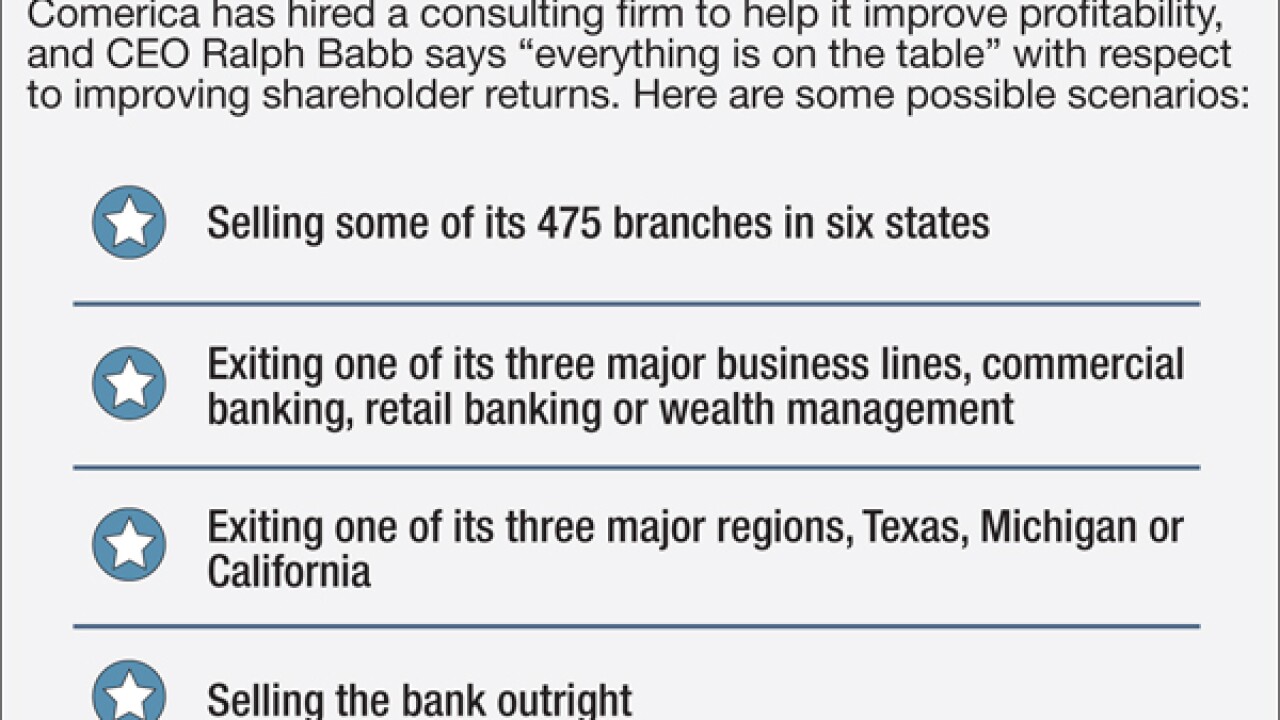

After another disappointing quarter, Comerica is promising big changes in its ongoing quest to improve returns to shareholders. It appears to be considering all options, including selling off business lines and perhaps even merging with another institution.

By Alan KlineApril 19 -

Comerica reported a steep decline in first-quarter profits as weak energy prices forced the Dallas company to sharply boost its reserves for loan losses.

By Alan KlineApril 19