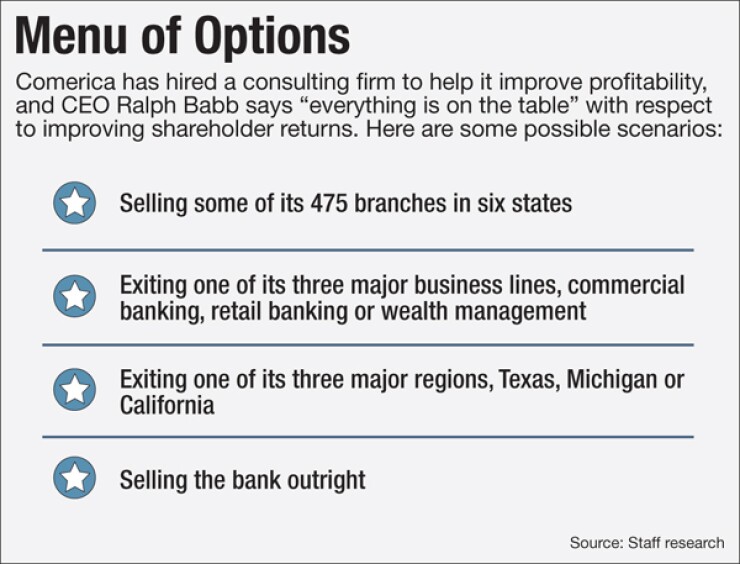

Comerica is promising big changes ahead that could involve selling off major assets or even the bank itself In the wake of another disappointing quarter.

The Dallas company said Tuesday that it has brought in an outside consultant to review its operations, and Chairman and Chief Executive Ralph Babb told analysts that, when it comes to improving returns for Comerica's frustrated shareholders, "everything is on the table."

Babb declined to provide specifics, but he did not shoot down analysts' suggestions that the $69 billion-asset Comerica could exit one of its business lines or a major market. Comerica has large operations in Texas, California and Michigan and a handful of branches in Florida and Arizona.

-

Bank earnings season is just getting underway, but a consistent theme around energy lending is already emerging credit quality is going to get worse and weigh on profits the rest of the year.

April 14 -

Lenders repeatedly reassured skeptics that their credit risks from the energy slump were under control. But more oil and gas companies are filing for bankruptcy, and more of them are said to be drawing down their credit lines signaling that the worst may be yet to come.

March 2 -

Ralph Babb, the chief executive of Comerica in Dallas, tells a research analyst the company may consider in-market and out-of-market deals — its first since taking over Sterling Bancshares last year.

September 7

Without being asked, he also hinted at the possibility that Comerica could merge with another institution if it fails to produce desired returns for investors. Comerica has not generated a return on equity in the double digits since before the financial crisis and, in the quarter that ended March 31, its ROE slumped to 3.13%, from 6.08% just three months earlier.

"I know that we must earn our right to remain independent every day, and our management team and board are committed to doing what is in the best interests of shareholders," Babb told analysts on an earnings call.

Comerica is an active lender to energy companies, and its recent woes can be traced directly to falling oil and gas prices.

Before markets opened Tuesday, Comerica announced that its first-quarter profits plunged 55% from the same period last year, to $60 million, as it sharply boosted reserves to cover potential losses on loans to oil and gas firms. It marked the fifth straight quarter that Comerica was forced to increase its loan-loss provision and the company said Tuesday that it expects to continue building its reserves throughout the year.

Babb told analysts that Comerica has already taken a number of steps to reduce overhead, including renegotiating vendor contracts and shedding real estate. It also did not give pay raises to its top executives last year.

Still, Babb acknowledged that more drastic cuts are necessary and said the board decided to bring in Boston Consulting Group "to look at everything again … and make sure we are not missing things."

Comerica is also counting on the consulting firm to help it find new revenue streams, Babb said.

"We are going to look at all opportunities not only for expenses, but also for revenue and what makes sense for us longer term," Babb said.

Analysts generally cheered the bank's decision to undertake the performance review, though some wondered why it has taken so long and why it needs outside help.

"The company has generated returns below the cost of capital for every one of the past eight years, [and] consensus forecasts predict that will continue for the next two years," said Mike Mayo, an analyst at CLSA, noting that investors have been frustrated with Comerica since long before its energy troubles surfaced. "It needs a greater sense of urgency than simply hiring a few outsiders to tell them how they can become more efficient and grow revenues better."

In a research note Monday, Mayo was especially critical of the bank's decision to increase its exposure to the energy sector via shared national credits. He noted that back in 2002, after the bank suffered losses on shared credits to media and telecommunications firms, Comerica vowed to keep shared credits to no more than 20% of loans. Shared credits made up close to 22% of its loans at March 31.

Mayo said he believes that Comerica could be a takeover target and, as such, recently raised his rating on the bank's stock — for the first time in 20 years — to outperform. He cited Comerica's weak performance and larger banks' growth ambitions as potential motivators to a deal.

Mayo also suggested that Comerica could boost returns for shareholders by exiting a geographic market or one of its key business lines so that its assets fall below $50 billion and it is no longer considered a systemically important financial institution.

"I think we are in a 12-month period where Comerica needs to show dramatically improved performance or consider an effective plan B," he said.

Others, though, are not so sure that Comerica is ready to do anything too drastic, like exiting California or another major market.

"While it appears nothing is outside of consideration at Comerica, I highly doubt it sells off its core competencies or healthy and growing areas of the bank. It's still too early for that in the optimization process," said Dallas Salazar, the CEO of Atlas Consulting, an energy consulting firm in Dallas.

Scott Siefers, an analyst at Sandler O'Neill & Partners, agreed that Comerica's primary focus appears to be on rebuilding its earnings power. Yet even if Comerica succeeds at trimming costs or finding new revenue streams, its performance will hinge to a large degree on the direction of energy prices and interest rates.

"On the call, they alluded to a goal of generating a double-digit ROE, but they suggested it's possible that the program won't get them all the way there," Siefers said. "It remains to be seen if investors will be satisfied with the end result."