-

While the $1.9 billion of bonds are not guaranteed by the government, most of the underlying loans could have been sold to Fannie and Freddie, and the transaction accomplishes the same thing as the GSEs' risk-transfer deals.

March 16 -

Market volatility and new regulatory burdens are thinning the ranks of commercial mortgage lenders that underwrite loans for securitizations. Activity is slowing down as a result, and it is unclear if banks and insurers will fill the void, especially outside the largest cities.

March 4 -

Competition among lenders for commercial mortgages has driven down interest rates, margins and underwriting standards, and now it's helped drive one lender out of the business.

February 11 -

Lenders argue that the GSEs would be better off buying more loans that are already insured, rather than transferring credit risk after holding them for a time. But Freddie Mac's Kevin Palmer says certainty of reimbursement is more important than the timing of risk transfers.

February 2 -

Forget "bigger is better." Several private-equity-backed lenders are making loans to small landlords, who represent the biggest chunk of the home-rental market and get less help from Fannie Mae and Freddie Mac than they once did.

November 9 -

It could take six months or more before people who deal in collateralized loan obligations receive more explicit regulatory guidance on "skin in the game" rules.

September 21 -

Income-based repayment, a federal government effort to relieve student-loan debt burdens, has roiled a normally tranquil securitization market, as investors can no longer be sure of when they'll be repaid.

September 8 -

CLO managers have long lobbied against proposed rules requiring them to keep "skin in the game" of these deals, arguing that such a requirement would increase the cost of financing for U.S. companies.

December 19 -

The final Volcker Rule is much friendlier to syndicated lenders and collateralized loan obligations than earlier versions. However, some banks will still have to divest some CLO holdings, and leveraged lenders face other regulatory challenges.

December 17 -

A proposal that managers of collateralized loan obligations keep "skin in the game" could force them to shorten no-call periods on CLOs. An alternative would hurt banks that arrange these deals.

September 26 -

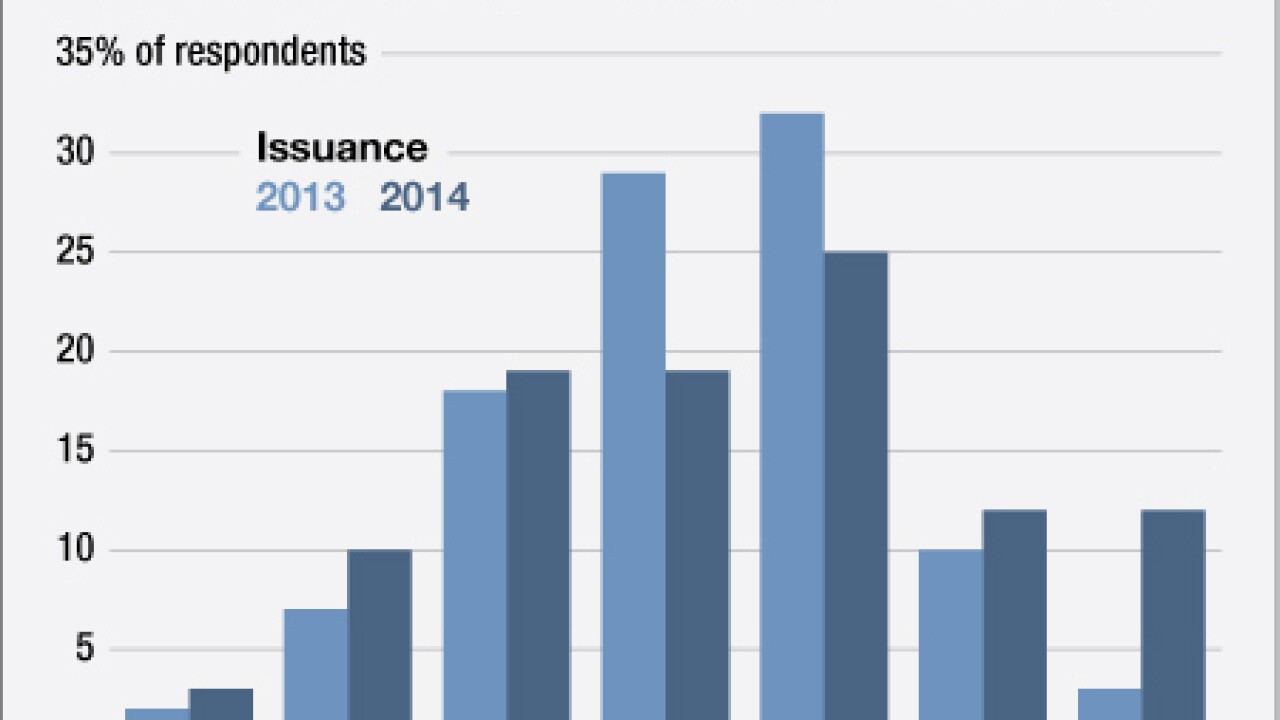

Institutional loan volume is expected to hit $500 billion or more this year or next as investors look to capitalize on higher interest rates. However, the prospects for leveraged lending by banks is murkier, according to a survey by the Loan Syndications and Trading Association.

September 19 -

Banks are providing less warehouse financing for collateralized loan obligations, so CLO managers have dusted off an old financing tool, delayed draws, to keep pace with demand.

July 8 -

Banks bulked up on collateralized loan obligations again in the first quarter for risk management and other purposes. But new deposit insurance rules are expected to deter them from buying more.

June 17 -

An effort to overhaul commercial bankruptcy laws is in its early stages, and creditors in the syndicated loan market sense a threat to some of their most important tools for guarding collateral.

November 16 -

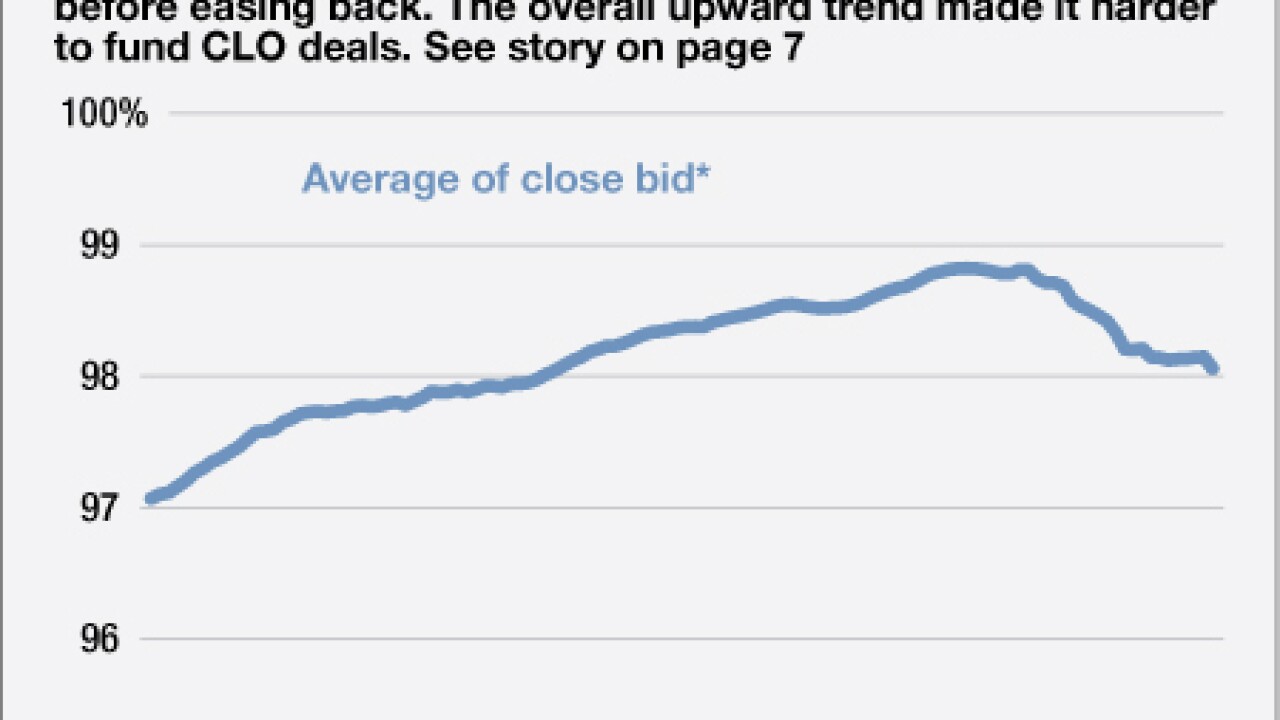

Borrowers are taking advantage of demand for loans to reprice deals they originally brought to market as recently as a few months ago.

October 10 -

Flickers of life in the housing market are prompting homebuilders to seek revolving lines of credit from banks for the first time in several years. They are getting them, and money from the debt and equity markets, too.

September 17 -

Banks and institutional investors in loans caught a break when the SEC and CFTC decided not to define loan participation agreements as swaps under Dodd-Frank. A decision otherwise would have ended business as usual.

July 25 -

Robert Drain, a U.S. bankruptcy judge for the Southern District of New York, thinks the Supreme Court justices were right to leave leeway for the courts to deny lenders the ability to use their debt as currency in auctions.

June 22 -

Collateralized loan obligations are gaining new life as a way for nonbanks to finance loans to midsize businesses. NXT Capital's chief financial officer, Neil Rudd, explains how in detailing a recent deal.

May 15 -

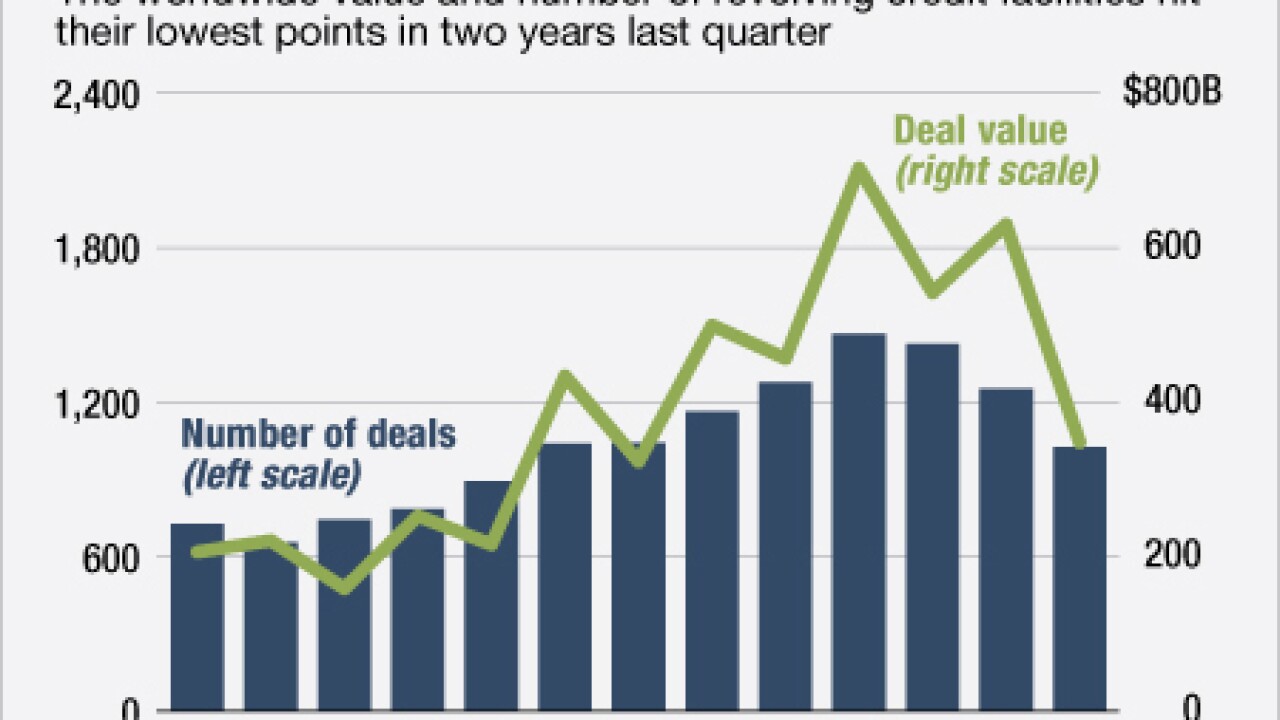

Revolving credit lines hit their lowest point in two years in the first quarter. The decline underscored that competing forms of financing have become more affordable.

April 20