-

Top executives at the nation's largest bank spoke Tuesday about shifting dynamics in the credit card business, Federal Reserve independence, the bank's plan to increase spending in 2026 and its large portfolio of loans to nonbank financial institutions.

January 13 -

President Trump said he would prohibit large institutional investors from buying single-family homes. While the executive couldn't bar such investments on its own, a legislative ban could gain bipartisan support.

January 7 -

Last year highlighted the risks for banks in lending to nondepository financial institutions. A new approach by Trump-era regulators could change the playing field.

January 2 -

A new report from the Basel, Switzerland-based Financial Stability Board found that nonbank financial institutions grew considerably faster than banks in 2024 and now control more than half of the world's financial assets.

December 16 -

Comptroller of the Currency Jonathan Gould said in an exclusive interview with American Banker Monday that regulators must bring more new entrants into the banking industry, establish a level playing field between banks and fintechs, and shore up supervision amid mounting legal scrutiny.

November 25 -

Federal Reserve Gov. Stephen Miran reiterated his view that monetary policy has become more restrictive than economists think, but expressed increased urgency that the central bank take strong corrective action.

November 20 -

Comptroller of the Currency Jonathan Gould said Tuesday that chartering compliant fintechs is "the only way" to level the playing field between banks and nonbanks. His comments come as the Office of the Comptroller of the Currency weighs new trust charters and stablecoin rules.

November 4 -

The Consumer Financial Protection Bureau is rescinding two rules issued under former CFPB Director Rohit Chopra that required nonbanks to register court orders, plus terms and conditions of contracts.

October 28 -

The Consumer Financial Protection Bureau received pointed pushback from banks in their public comments on a proposed rule that would slash the number of nonbanks being supervised in four key markets.

September 24 -

A proposed rule published Tuesday in the Federal Register would limit the Consumer Financial Protection Bureau's ability to designate nonbank entities for supervision.

August 26 -

A non-bank lender won't ever compete with a bank on price, but can offer flexible underwriting and faster origination times, according to a veteran originator.

June 12 -

JPMorganChase CEO Jamie Dimon said he wouldn't invest in the private-credit business if he were in different shoes. Meanwhile, an executive at Zions Bancorp. predicted that the sector's rapid growth will end badly.

June 12 -

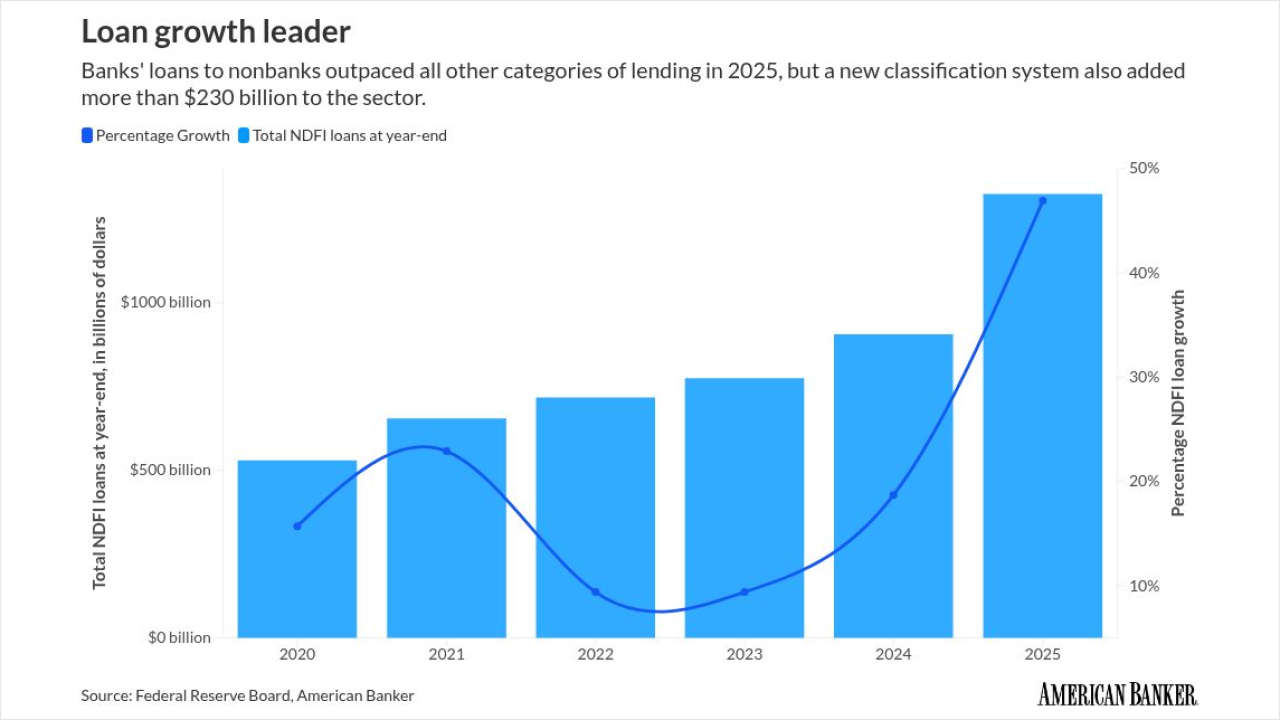

Banks that are financing the rise of nonbank competitors have been losing market share in commercial lending. But by getting in on the action, the same banks are also seeing some payoff.

June 5 -

The Consumer Financial Protection Bureau said it will not enforce or supervise nonbank financial firms that miss upcoming compliance deadlines for the nonbank registry of repeat offenders.

April 11 -

The Financial Stability Board plans to publish a consultation report next year suggesting how authorities could monitor vulnerabilities and use policy measures to address systemic risk from nonbank financial intermediaries' leverage.

November 18 -

The Consumer Financial Protection Bureau's nonbank registry to address repeat corporate offenders goes live this week, but some experts have raised concerns about redundancy and costs for nonbanks.

October 16 -

A recommendation to give Ginnie Mae expanded authorities is drawing focus in the reactions to a Financial Stability Oversight Council report on nonbank risks.

May 17 -

The new Financial Stability Oversight Council report also recommends an expanded Ginnie Mae PTAP facility and an industry-funded liquidity resource.

May 10 -

The memorandum creates channels for sharing information about nonbanks between the Federal Housing Finance Agency and the Conference of State Bank Supervisors.

April 10 -

Non-depositories now dominate home lending, but many of these firms were untested until they had to grapple with the current rising rate environment. How they fare could significantly impact the rest of the mortgage market and, more specifically, the Government National Mortgage Association.

February 16