Allissa Kline is a Buffalo, New York-based reporter who writes about national and regional banks and commercial and retail banking trends. She joined American Banker in 2020 and previously worked for more than a decade at Buffalo Business First, where she covered banking and finance, insurance and accounting. Kline started her journalism career at the Observer-Dispatch in Utica, New York. She graduated from Colgate University and the S.I. Newhouse School of Public Communications at Syracuse University.

-

Three weeks after completing its "merger of equals" with Synovus Financial, Pinnacle Financial Partners said it plans to hire 225 to 250 revenue-generating bankers in 2026 across its newly expanded Southeast footprint.

January 22 -

The regional bank recorded $130 million of legal charges during the fourth quarter in connection with the resolution of a legal battle involving overdraft fees. Its earnings also took a hit from $63 million in employee severance costs.

January 21 -

The Cleveland-based bank announced changes Tuesday to its board of directors, including the appointment of a new lead independent director. Last month, activist investor HoldCo Asset Management urged the bank's board to not re-nominate its longtime lead independent director.

January 20 -

The Huntsville, Alabama-based regional bank is well positioned to defend its Southeast footprint, according to CEO John Turner. It's hiring more bankers in growth markets, it has strong brand recognition and it has a long history in its core markets, he said.

January 16 -

The investment banking giant reported an 18% increase in net income for the fourth quarter and stuck to its 2-year-old financial targets, even as it exceeded some of them.

January 15 -

A week after President Trump demanded a 10% cap on credit card interest rates, top executives at big banks protested the idea in blunt terms.

By Nathan PlaceJanuary 14 -

The megabank's net income declined by 13% during the fourth quarter as a result of a $1.2 billion pretax loss on sale related to the divestiture of its remaining operations in Russia.

January 14 -

The custody bank reported a strong fourth quarter, as it continued to push forward with its new operating model. The momentum contributed to the bank's decision to lay out new financial targets, including a goal to achieve a return on tangible common equity of 28% in the next three to five years.

January 13 -

Banks will start reporting their fourth-quarter earnings on Tuesday. But it's what bankers say about the next 12 months that will probably attract the most interest from industry observers.

January 12 -

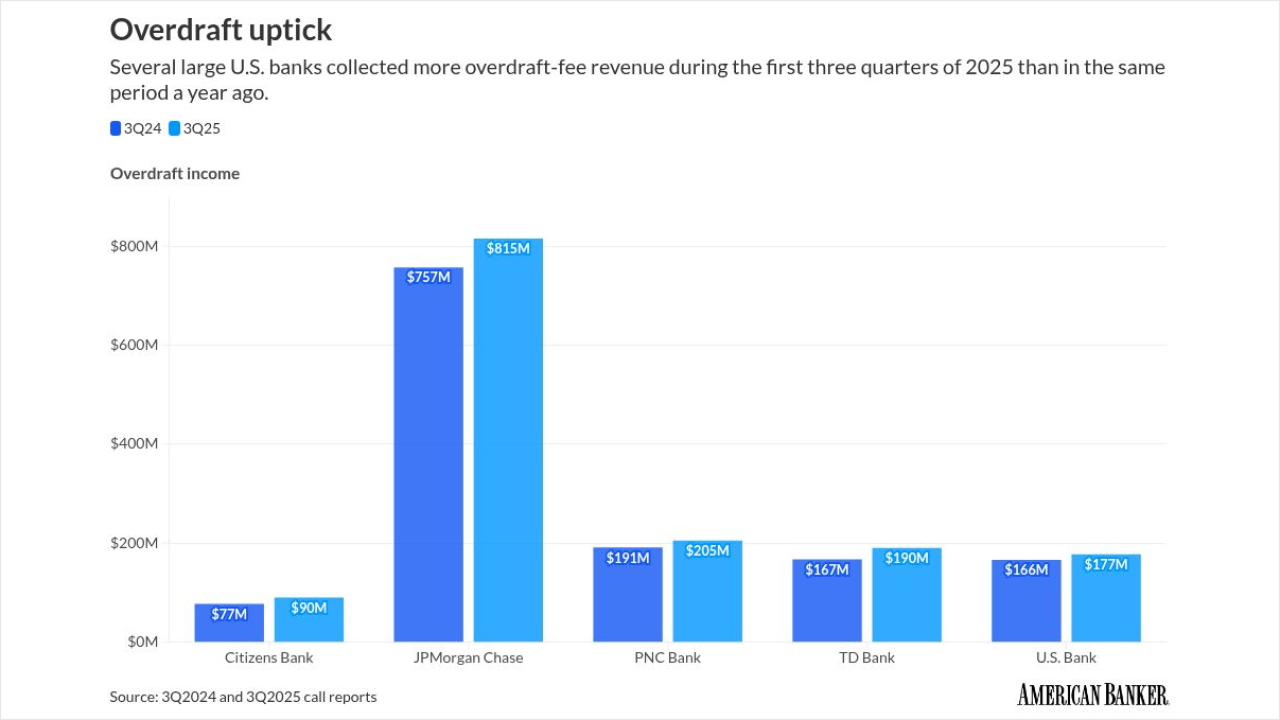

Several large U.S. banks reported an uptick in overdraft-related income for the first three quarters of 2025. Economic pressure on consumers may be to blame, some banks and industry observers say.

January 9 -

The Kansas City, Missouri-based bank completed its first bank acquisition in 12 years on New Year's Day. Now it's focused on retaining and growing FineMark Holdings' high-net-worth clients in markets such as Southwest Florida, South Carolina and Arizona.

January 7 -

Cockroaches, crazy work and shots in the butt: Here are some of the most quotable bank CEOs of 2025.

December 24 -

Ida Liu, who resigned from Citi earlier this year, will join HSBC on Jan. 5 as the CEO of the private bank. Liu will be tasked with accelerating the growth of the private bank "at a defining moment for wealth," she said in a LinkedIn post.

December 22 -

The megabank cleared a regulatory hurdle when the Office of the Comptroller of the Currency freed it from a July 2024 amendment to a consent order. Two other orders, one from the OCC and the other from the Federal Reserve, remain in place.

December 18 -

Daryl Byrd, who led Iberiabank until it was acquired by First Horizon, has assembled an investor group to acquire MC Bancshares and its subsidiary, MC Bank & Trust Co. in Morgan City, Louisiana. Byrd will become CEO.

December 17 -

The New York megabank, which completed the sale of a 25% equity stake in its Mexico retail business, has been exiting certain international markets as part of CEO Jane Fraser's focus on being a simpler, smaller bank.

December 16 -

Enova International, a nonbank lender in Chicago, plans to gain scale by taking over Grasshopper Bank's national bank charter. The deal already faces skepticism from critics of Enova's high-cost lending model.

December 11 -

A survey compiled by the American Financial Services Association showed deteriorating business conditions during the third quarter of this year. The outlook for subprime borrowers was particularly grim.

December 8 -

The Canadian bank is determined to grow its U.S. business organically, CEO Darryl White said Thursday. But with so much excess capital, analysts wondered about the bank's appetite for M&A.

December 4 -

Royal Bank of Canada now expects to achieve an annual return on equity of at least 17% by 2027, executives said Wednesday, up one percentage point from the bank's earlier goal.

December 3