-

Brian Moynihan and Bill Demchak raised concerns Tuesday about the conduct of data aggregators, and particularly how well they protect customer data. The comments come amid reports that banks have been trying to strangle aggregators' access to their systems.

November 17 -

The forthcoming "overnight bank funding rate" should give banks and researchers a more accurate picture of funding costs, but it is not clear whether the rate is part of the Fed's effort to reform Libor.

November 12 -

The Financial Accounting Standards Board has postponed the release of a rule to overhaul how banks calculate loan losses.

November 12 -

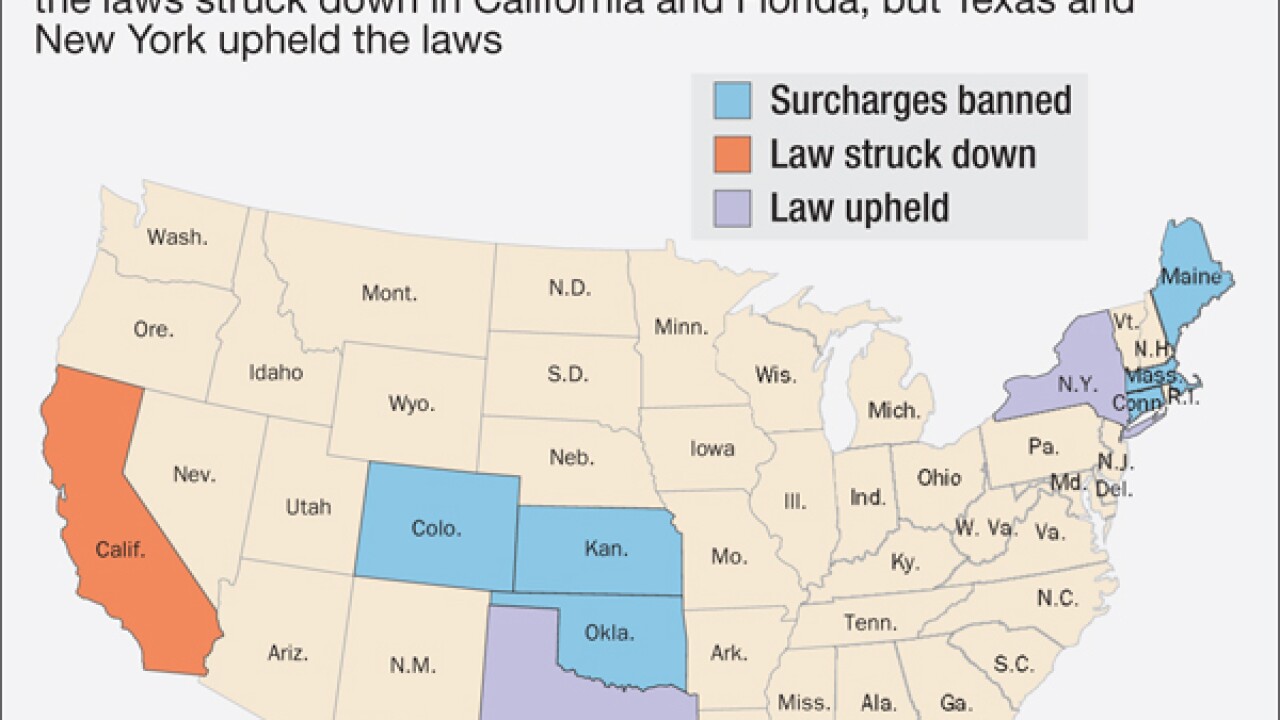

Florida overturned a ban on credit card surcharges on the grounds that it violates merchants' free speech. Some lawyers doubt that this unusual strategy has legs, but it has worked in a surprising number of courts.

November 6 -

Florida overturned a ban on credit card surcharges on the grounds that it violates merchants' free speech. Some lawyers doubt that this unusual strategy has legs, but it has worked in a surprising number of courts.

November 6 -

Florida overturned a ban on credit card surcharges on the grounds that it violates merchants' free speech. Some lawyers doubt that this unusual strategy has legs, but it has worked in a surprising number of courts.

November 5 -

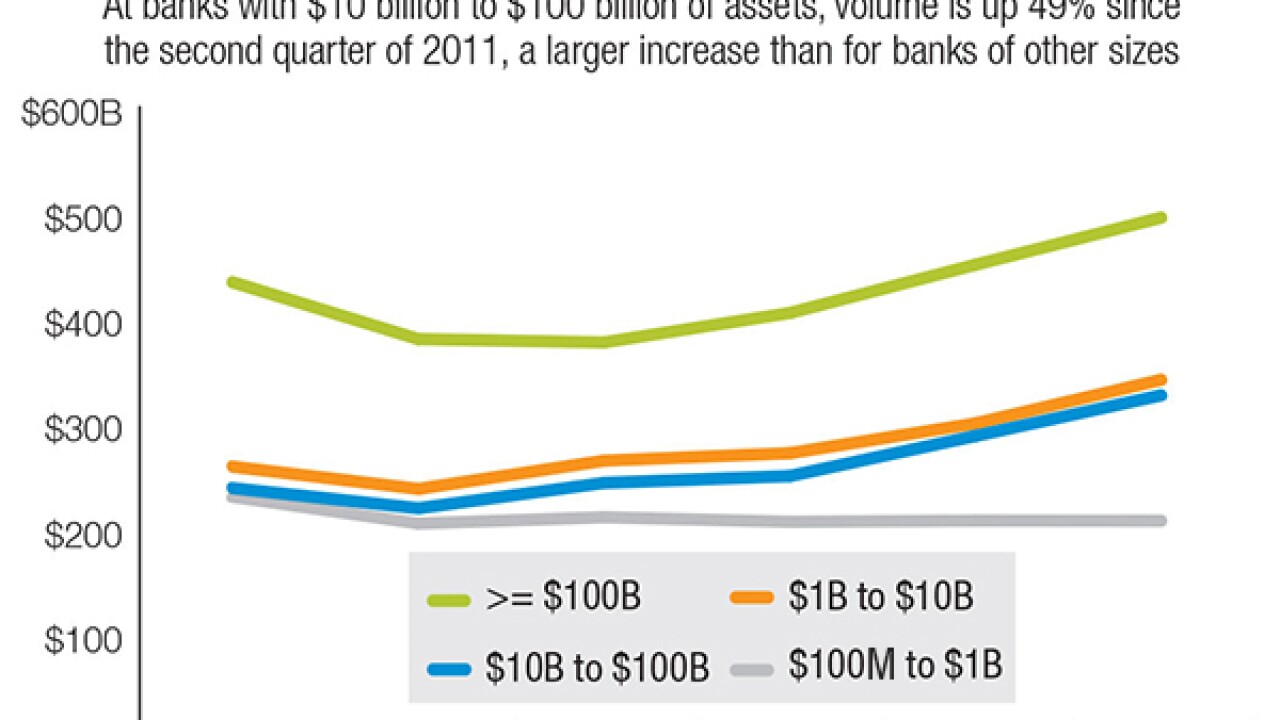

Automobile lending reached its highest level ever at the end of the third quarter while showing few signs of credit weakness, the credit bureau Experian reported Wednesday.

November 4 -

Automobile lending reached its highest level ever at the end of the third quarter while showing few signs of credit weakness, the credit bureau Experian reported Wednesday.

November 4 -

Hedge funds that invested in CertusBank have sued its former management team, claiming they misappropriated millions and doomed the bank with wasteful spending. Certus closed shop last week after losing nearly $200 million of its $500 million in startup capital in less than four years.

November 4 -

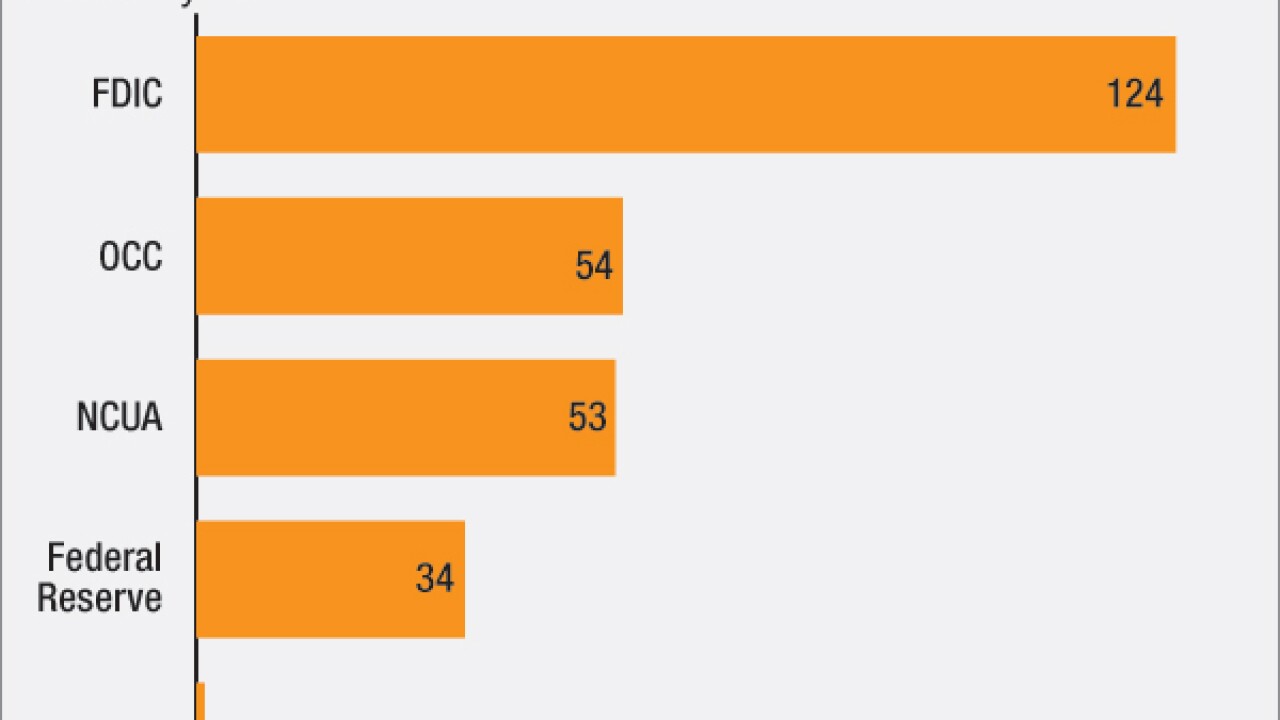

Banking regulators have been coy about whether they approve serving marijuana businesses, but lately one regional Fed bank has taken a strong position against the practice. But there are nearly three dozen Fed-supervised banks serving pot companies one of many seeming inconsistencies in an opaque and confusing regulatory policy.

November 3 -

Banking regulators have been coy about whether they approve serving marijuana businesses, but lately one regional Fed bank has taken a strong position against the practice. But there are nearly three dozen Fed-supervised banks serving pot companies one of many seeming inconsistencies in an opaque and confusing regulatory policy.

November 3 -

HSBC Holdings' plan to trim and sharpen the focus of its North American business unit in an effort to boost its profit appears to be paying off.

November 2 -

Banks have added so much capital in the past several years that they're better protected from declines in real estate values than they were before the financial crisis.

November 2 -

KeyCorp's deal to buy First Niagara is a return to significant M&A for a company that has long been content to stay on the sidelines. But getting such a deal approved is tougher than ever, and will test Beth Mooneys regulatory juice.

October 29 -

Ally Financial in Detroit drew more deposits into its online bank last quarter, which helped improve its lending margin even as profits declined.

October 29 -

Nobody thought it would be pretty, but last quarter's results were even worse than expected, and low fee revenue is largely to blame. Trading and mortgage banking were particularly bad, and few of the big banks managed to offset the declines.

October 28 -

UMB Financial in Kansas City, Mo., reported lower third-quarter profit, due to weaker revenue from its Scout Funds arm and merger costs.

October 28 -

The third quarter showed the kind of solid results Citizens Financial hopes to achieve as a public company split off from Royal Bank of Scotland, but much work remains for Chief Executive Bruce Van Saun. He spoke with American Banker about what went right this quarter and how he's working to change the company's culture.

October 23 -

Citizens Financial Group in Providence, R.I., managed to build up lending and hold its margins relatively steady last quarter, leading to a healthy gain in profits.

October 23 -

CIT also plans to sell peripheral businesses to simplify its structure, less than three months after the close of its $3.4 billion deal for OneWest Bank.

October 21