-

Consumer credit is better than ever before, even as Americans households have started levering up. But the big question for banks looking to re-commit to consumer lending is how.

January 5 -

Relations between banks and providers of personal financial management tools have soured of late amid reports that some banks block PFM sites' access to their customers' information during peak traffic periods. Aggregators say they are working to address banks' concerns, but they also are urging banks to invest in more server capacity to keep pace with customer demand.

December 31 -

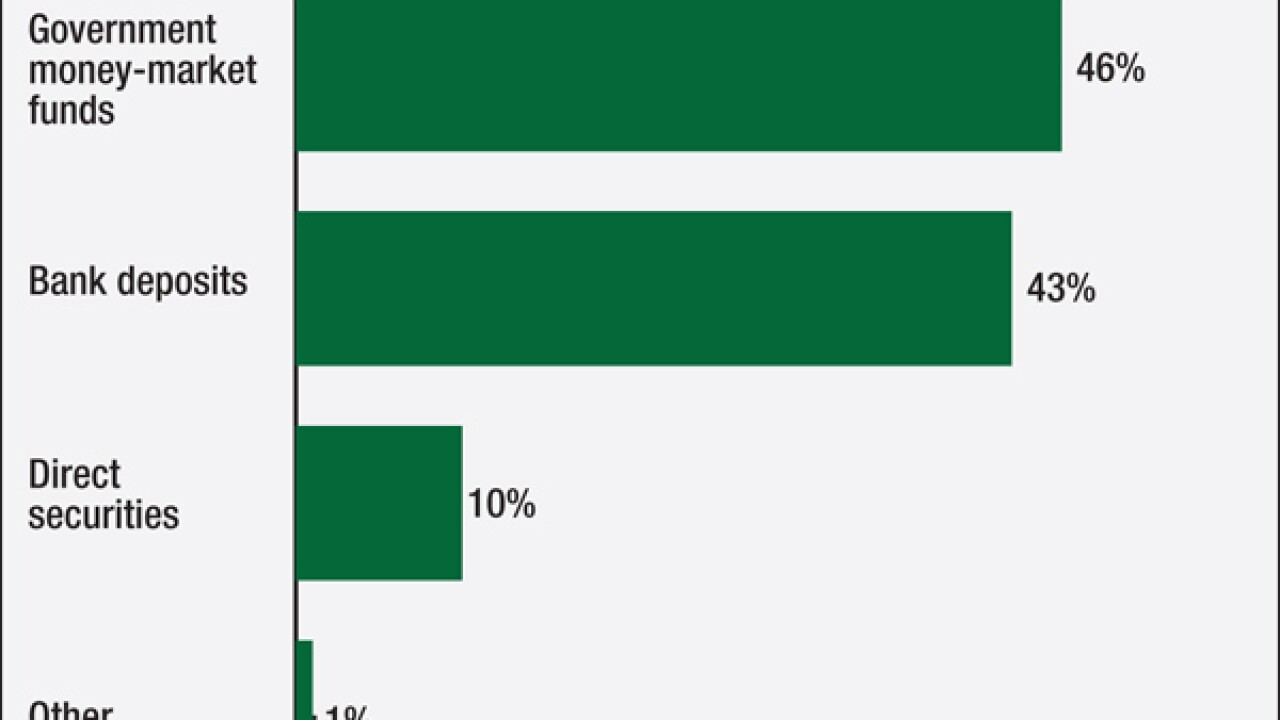

An overhaul of money-market funds, years in the making and fiercely opposed by the financial sector, will take effect in 2016. There's little debating that the new rules will be bad for some banks, but they could also create new opportunities for small and mid-sized banks in need of cheaper funding.

December 30 -

The legal status of marijuana is likely to shift dramatically next year, with around ten states considering some form of decriminalization. But banks will likely have a longer wait until the rules around serving marijuana businesses are cleared up.

December 17 -

Despite strong calls for action, issue may languish until after the presidential election.

December 11 -

Bankers appear set to get their long-awaited rate rise, but the top executives of the biggest banks still have lukewarm expectations for the coming year, according to forecasts laid out by the top brass from JPMorgan, Wells Fargo, PNC and others.

December 8 -

Target has agreed to pay $39 million to settle loss claims from a two-year-old data breach that were brought by MasterCard and a group of financial institutions, according to court documents filed Wednesday.

December 2 -

Target has agreed to pay $39 million to settle loss claims from a two-year-old data breach that were brought by a group of financial institutions, according to court documents filed Wednesday.

December 2 -

Banks are losing auto finance market share to captive lenders and finance companies, according to a new report from the credit bureau Experian.

December 2 -

Add retail customers to the list of groups raising concerns about possible high-pressure product-sales tactics at Wells Fargo; many of them are considering jumping ship in response, according to a new survey of customer attitudes at big banks. However, Wells' rivals shouldn't celebrate they are at risk of losing customers, too, for a variety of reasons.

December 1 -

Brian Moynihan and Bill Demchak raised concerns Tuesday about the conduct of data aggregators, and particularly how well they protect customer data. The comments come amid reports that banks have been trying to strangle aggregators' access to their systems.

November 17 -

The forthcoming "overnight bank funding rate" should give banks and researchers a more accurate picture of funding costs, but it is not clear whether the rate is part of the Fed's effort to reform Libor.

November 12 -

The Financial Accounting Standards Board has postponed the release of a rule to overhaul how banks calculate loan losses.

November 12 -

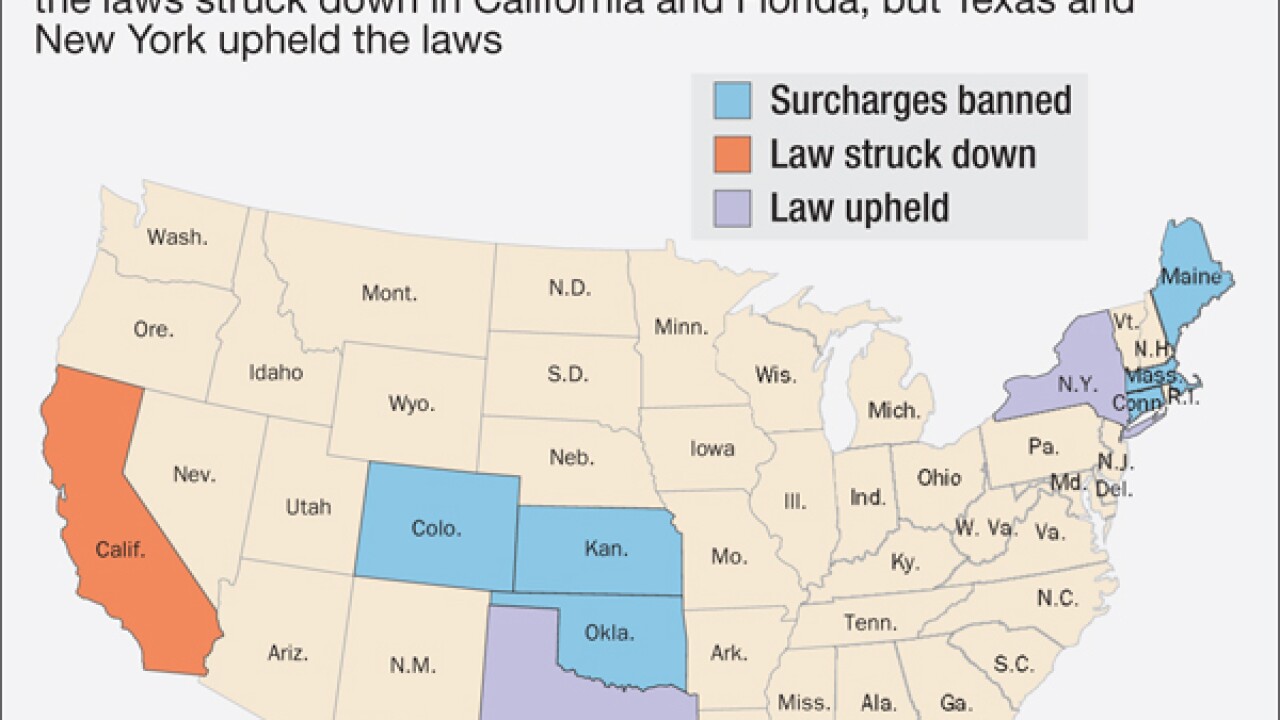

Florida overturned a ban on credit card surcharges on the grounds that it violates merchants' free speech. Some lawyers doubt that this unusual strategy has legs, but it has worked in a surprising number of courts.

November 6 -

Florida overturned a ban on credit card surcharges on the grounds that it violates merchants' free speech. Some lawyers doubt that this unusual strategy has legs, but it has worked in a surprising number of courts.

November 6 -

Florida overturned a ban on credit card surcharges on the grounds that it violates merchants' free speech. Some lawyers doubt that this unusual strategy has legs, but it has worked in a surprising number of courts.

November 5 -

Automobile lending reached its highest level ever at the end of the third quarter while showing few signs of credit weakness, the credit bureau Experian reported Wednesday.

November 4 -

Automobile lending reached its highest level ever at the end of the third quarter while showing few signs of credit weakness, the credit bureau Experian reported Wednesday.

November 4 -

Hedge funds that invested in CertusBank have sued its former management team, claiming they misappropriated millions and doomed the bank with wasteful spending. Certus closed shop last week after losing nearly $200 million of its $500 million in startup capital in less than four years.

November 4 -

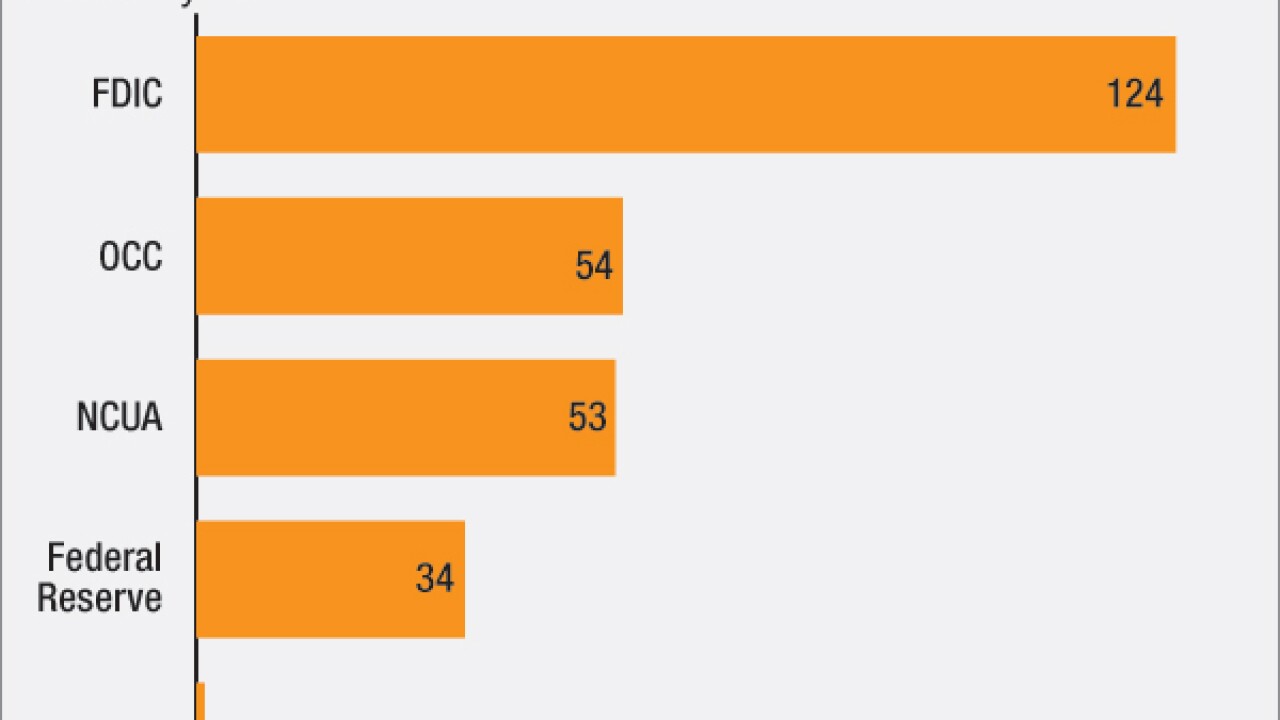

Banking regulators have been coy about whether they approve serving marijuana businesses, but lately one regional Fed bank has taken a strong position against the practice. But there are nearly three dozen Fed-supervised banks serving pot companies one of many seeming inconsistencies in an opaque and confusing regulatory policy.

November 3