Frank Gargano is a Queens-based data reporter for Arizent.

-

The closing date for the Florida credit union’s purchase of Heritage Southeast Bank was pushed into 2022 to allow more time for regulatory approval.

October 29 -

With two new prohibitions, the total now stands at 22 for the year so far.

October 29 -

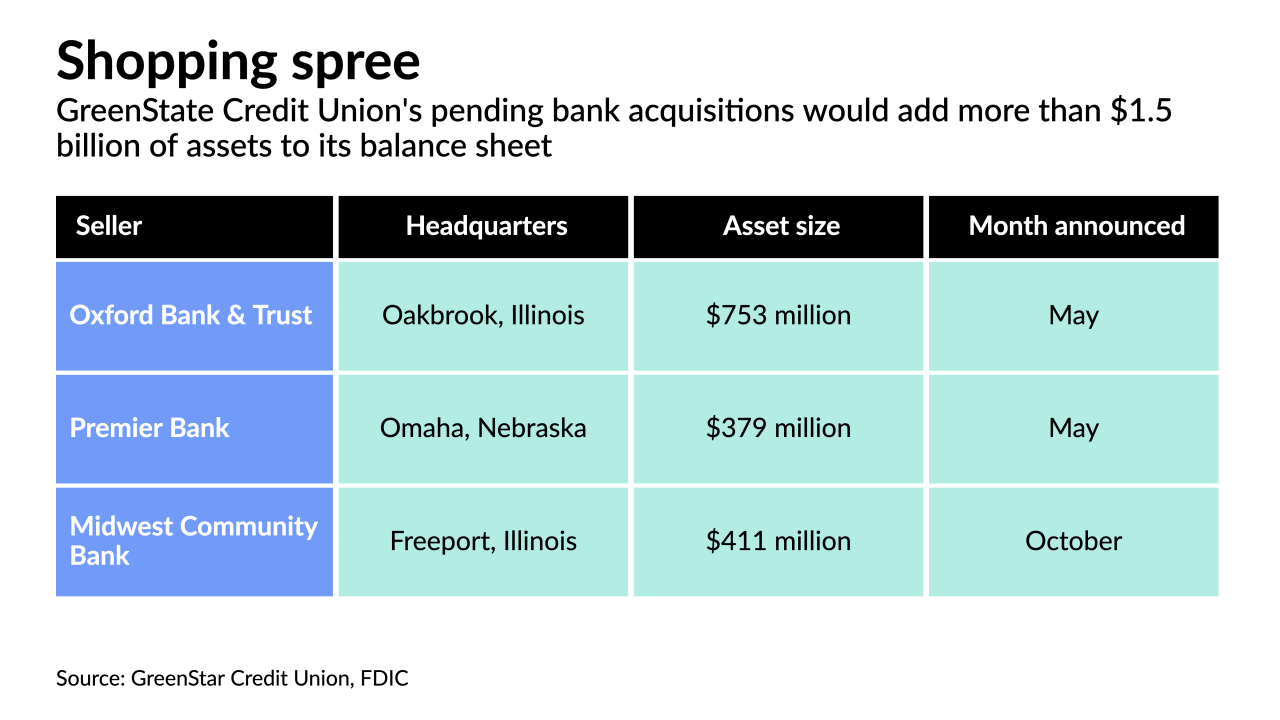

GreenState Credit Union has announced three bank deals this year. Its CEO says purchasing banks can be easier than merging with rival credit unions, though the state's banking regulator has made it difficult to do so within Iowa.

October 28 -

Through the Excelsior Linked Deposit Program, participating institutions can offer financing to consumers at a recuced interest rate.

October 26 -

The credit union’s agreement to acquire Midwest Community Bank in Illinois follows two other bank deals it announced this year.

October 26 -

Temenos and Mbanq created a platform to offer technology and compliance services to credit unions via application programming interfaces.

October 25 -

Finastra, a technology vendor to credit unions and small banks, is adding the Bakkt digital asset app to its platform. This will allow clients' customers to buy, sell and hold digital assets like Bitcoin.

October 19 -

Shane Berger, who has been at the helm of Beehive for nearly 37 years, will hand over his responsibilities to Craig Gummow on Jan. 4.

October 15 -

Combined, the two would have over $11 billion of assets and nearly 80 branches serving members of the armed forces across five states and in Italy.

October 15 -

After extending its deadline for request for comment on cryptocurrency by a month, the National Credit Union Administration heard from credit unions and other organizations that want clarity on the boundaries the agency plans to set.

October 14 -

Laurie Butz, a senior vice president at another Wisconsin credit union, will replace longtime CEO Tom Young, who is retiring.

October 8 -

The credit union is working with CUSO Financial Services, a unit of Atria Wealth Solutions, to add secure document uploading and other features to its website.

October 6 -

Through these partnerships, lenders can diversify their portfolios and even help members recoup their investment by selling or gaining credits for excess energy.

October 6 -

A leading voice for community banks, Stewart is a past chair of the American Bankers Association and serves on the board of the Seattle branch of the Federal Reserve Bank of San Francisco.

October 6 -

David Pickney, who joined the institution in 2010, saw Texas Trust grow from six branches to 22 and more than double its assets to $1.7 billion.

October 4 -

The National Credit Union Administration issued two prohibition orders and two notices of prohibition, bringing the yearly total to 20.

September 30 -

The $63 million-asset Texas Federal Credit Union in Dallas is combining with the $1.6 billion-asset Texas Trust Credit Union in nearby Arlington.

September 30 -

Dora Financial aims to reduce racial and economic disparities in access to banking.

September 29 -

Kenneth Orgeron, who was appointed acting president and chief executive after the recent departure of Jim Hayes, will remain at the helm of the Maryland credit union.

September 29 -

With an estimated $28.6 million in excess funding for 2021, the regulator chose to direct a portion of that sum to hiring and cyber protections.

September 23