Ian McKendry is the Congress reporter for American Banker. He previously covered the Federal Deposit Insurance Corp., anti-money laundering and cybersecurity. Before joining American Banker he was an economic reporter for Market News International.

-

A survey due to be released Wednesday reveals a wish list for anti-money-laundering specialists to help ease their process of assessing customer risk.

By Ian McKendrySeptember 30 -

WASHINGTON The Federal Deposit Insurance Corp.'s inspector general has cleared a senior attorney for the agency who had been accused of giving false testimony to lawmakers over the agency's role in "Operation Choke Point."

By Ian McKendrySeptember 21 -

Community banks are hoping regulators' recent decision to drop certain items from call reports is just the beginning of supervisory efforts to streamline the forms to reduce their burden.

By Ian McKendrySeptember 18 -

WASHINGTON The Federal Deposit Insurance Corp.'s involvement in the Justice Department's Operation Choke Point was minor, the agency's inspector general said Thursday.

By Ian McKendrySeptember 17 -

Federal Deposit Insurance Corp. Vice Chairman Thomas Hoenig said favorable leverage-ratio treatment for certain derivatives would undermine postcrisis capital reforms.

By Ian McKendrySeptember 16 -

One of the top anti-money-laundering regulators warned credit unions Tuesday that many do not appear to be properly following reporting requirements.

By Ian McKendrySeptember 15 -

WASHINGTON One of the top anti-money laundering regulators warned credit unions Tuesday that many do not appear to be properly following reporting requirements.

By Ian McKendrySeptember 15 -

The digital currency industry reacted warily to a model framework for regulating such firms released Tuesday by the Conference of State Bank Supervisors, arguing the language is too vague and treats digital assets like normal money.

By Ian McKendrySeptember 15 -

WASHINGTON Virtual currency made another significant step Tuesday toward becoming legitimate in the eyes of regulators as the Conference of State Bank Supervisors finalized a model regulatory framework for the nascent industry.

By Ian McKendrySeptember 15 -

Under the Dodd-Frank Act, the agency must issue a proposal that would require large banks to bear the brunt of raising the DIF reserve ratio higher once it reaches a statutorily imposed minimum. With the fund rapidly increasing, the agency is likely to put out a plan by the end of 2015 sparking a debate over what the FDIC might do.

By Ian McKendrySeptember 11 -

WASHINGTON Federal bank regulators said Tuesday that they are taking steps to ease the regulatory burden on community banks by eliminating or revising certain call report line items.

By Ian McKendrySeptember 8 -

The New York licensing process for virtual currency companies is stoking fears that firms which do apply could inadvertently open themselves up to prosecution.

By Ian McKendrySeptember 3 -

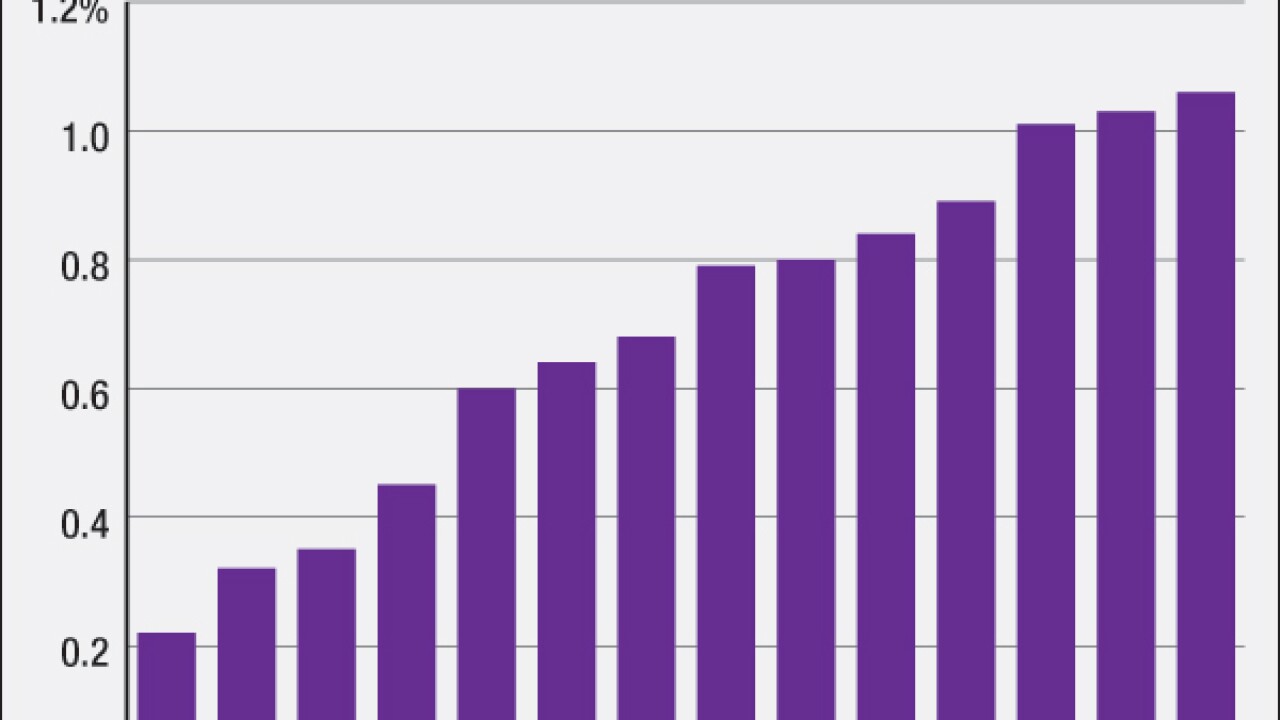

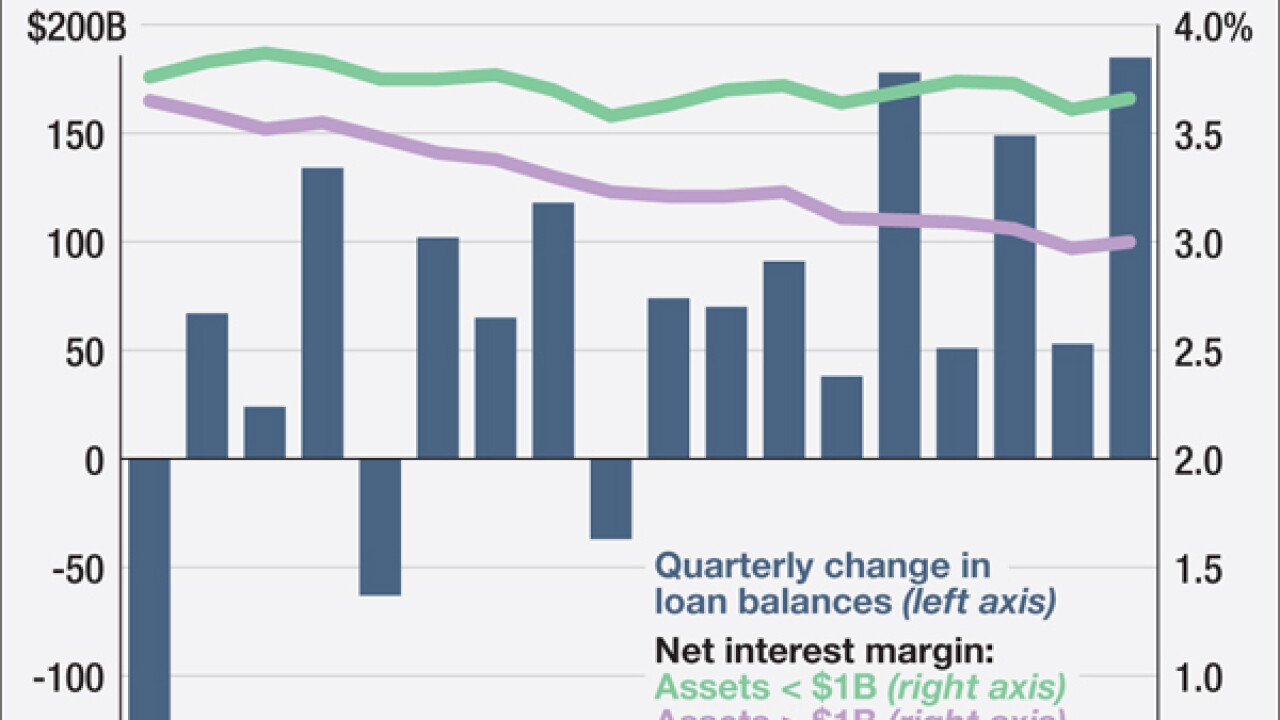

The Federal Deposit Insurance Corp.'s second-quarter industry update showed steadily rising loan balances making up for persistently tight net interest margins.

By Ian McKendrySeptember 2 -

U.S. banking earnings in the second quarter rose 7.3% from a year earlier to $43 billion as institutions enjoyed higher revenues and lower noninterest expenses, the Federal Deposit Insurance Corp. said Wednesday.

By Ian McKendrySeptember 2 -

A foreign bank that sued the U.S. Treasury's Financial Crimes Enforcement Network won a preliminary injunction suspending an action that would have cut off the bank's access to dollar funding.

By Ian McKendryAugust 28 -

WASHINGTON The Federal Deposit Insurance Corp. will provide an update on bank performance on Sept. 2 when it releases the Quarterly Banking Profile for the second quarter of 2015.

By Ian McKendryAugust 26 -

The largest bank in Tanzania has sued the U.S. Treasury Department to halt a rule that designates the bank as a "primary money laundering concern," which cuts off its access to dollar funding and may prove to be a death sentence for the institution.

By Ian McKendryAugust 26 -

WASHINGTON A Federal Deposit Insurance Corp. publication on Monday advised banks to include cyber risk in standard disaster-planning and business-continuity exercises as part of general strategic-planning discussions.

By Ian McKendryAugust 24 -

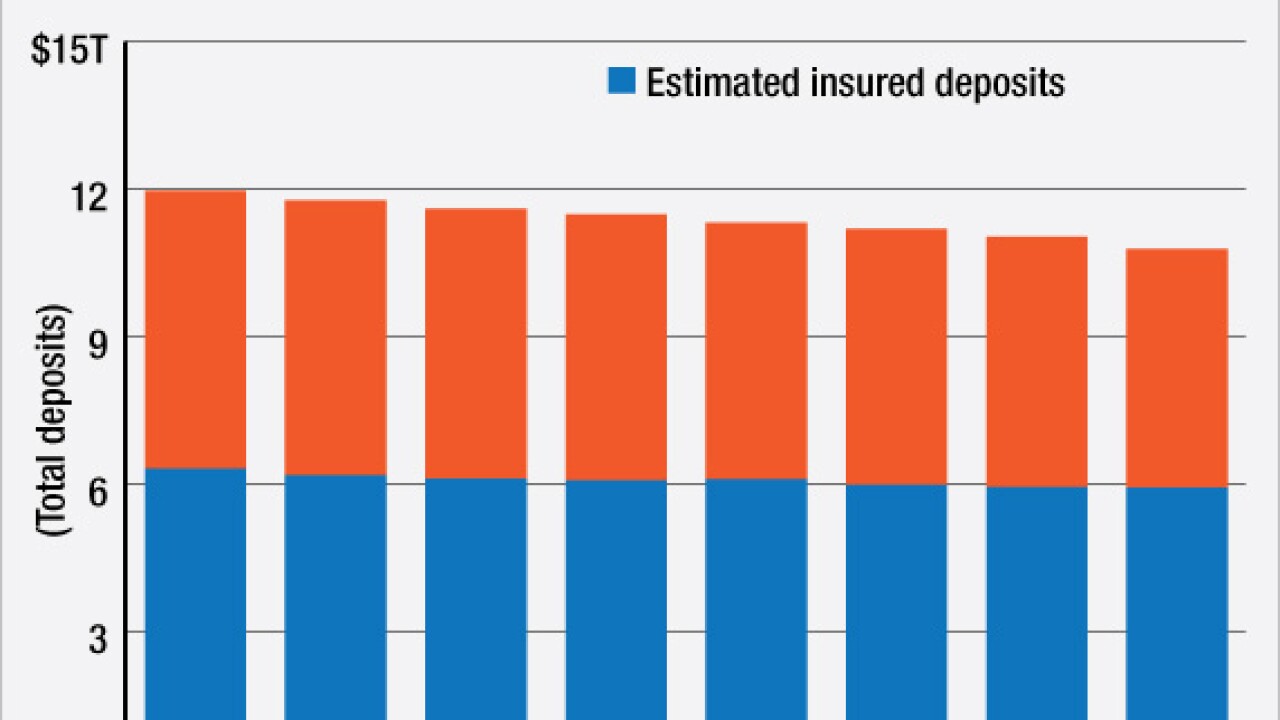

The FDIC wants to enlist banks to help determine which customers are insured and uninsured, but some say the FDIC is passing what should be its responsibility on to the industry.

By Ian McKendryAugust 17 -

A tip from a whistle-blower led regulators to crack down on Citizens Financial Group for ignoring discrepancies between customer deposit slips and the amount actually placed into the bank and similar actions against other banks could be on their way.

By Ian McKendryAugust 12