-

Applications for small business and commercial real estate loans are rising, creating some optimism among lenders — and more temptation to loosen standards to land those borrowers.

By Jim DobbsMay 13 -

Lenders including Howard Bancorp and First Carolina Bank are shunning acquisitions as a route into new markets, to avoid overpaying for targets and inheriting potential loan problems.

By Jim DobbsMay 5 -

The company had delayed a vote set for late April to give it more time to collect the legally required support from two-thirds of its outstanding shares.

By Jim DobbsMay 4 -

The company, which has faced opposition from a big investor, had to reschedule its shareholder vote after it was unable to secure the legally required two-thirds backing of outstanding shares at an April 27 meeting.

By Jim DobbsMay 3 -

Kerry Killinger, former CEO of Washington Mutual, says the asset bubbles and increased consumer debt that contributed to his company's failure are reappearing.

By Jim DobbsApril 30 -

At first the deal seemed an unlikely marriage of two mortgage-heavy companies. But acquiring the Michigan company would help New York Community accomplish its two chief goals — reducing deposit costs and its concentration of multifamily loans — while giving it the scale to pursue more deals.

By Jim DobbsApril 26 -

The company promoted Bob Fehlman to become its president and hired Jay Brogdon from Stephens Inc. to succeed Fehlman as chief financial officer.

By Jim DobbsApril 22 -

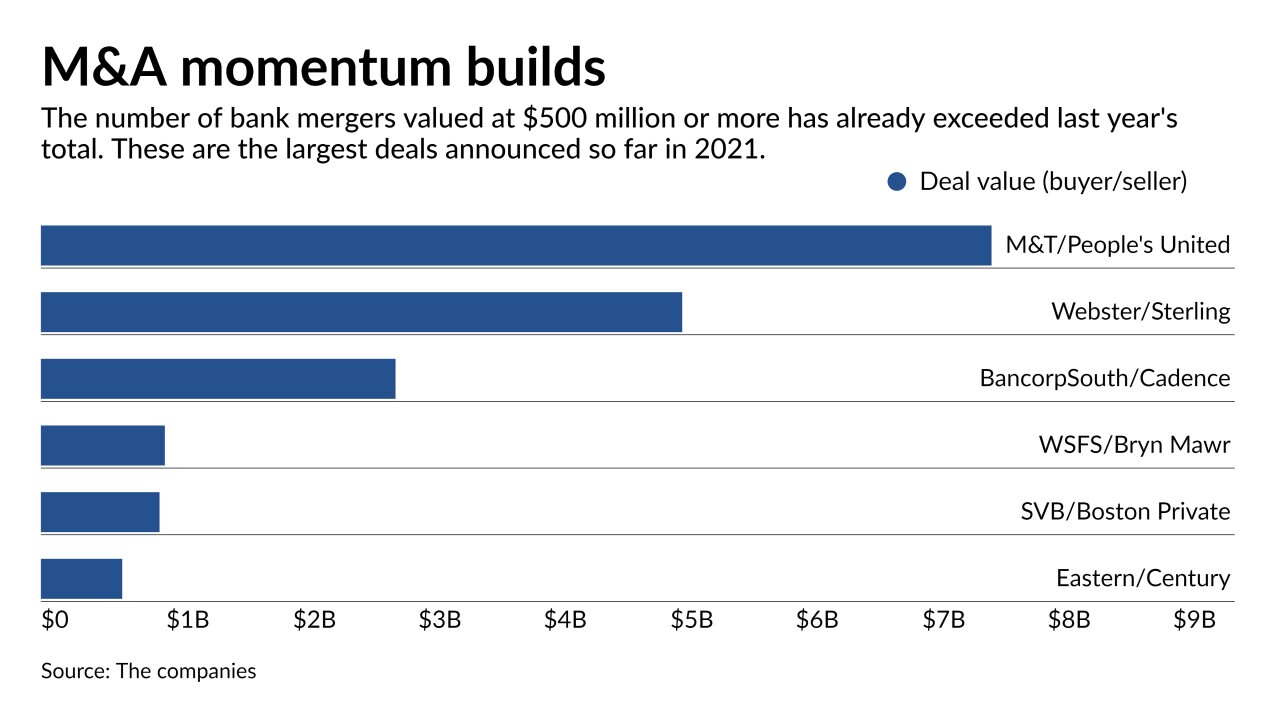

Clarity on credit quality has bankers ready to strike deals after a lengthy pause. A steady rise in stock prices has also given potential buyers the financial wherewithal to pursue acquisitions.

By Jim DobbsApril 21 -

BofA is awash in liquidity, but an uptick in credit card applications and heightened interest from commercial borrowers have executives hopeful that loan demand will soon rebound.

By Jim DobbsApril 15 -

The Iowa company, which operates a dozen individually branded banks, now has a name that matches its stock symbol.

By Jim DobbsApril 14