John Adams is executive editor of payments for American Banker. John interviews top executives in the payments, cryptocurrency and fintech industries, hosts podcasts, moderates conference panels and curates the new Payments Intelligence portal.

His work includes profiles of

John has been with American Banker and related products for 30 years, covering bank technology, advertising, mortgages and capital markets.

-

The e-commerce giant is adding a surcharge for Visa credit card payments in Singapore. It's a tactic reminiscent of the time its big-box rival outright banned the card brand in Thunder Bay, Ontario, in a bid to lower its costs.

By John AdamsAugust 11 -

The combination of American Express and its fintech subsidiary Kabbage is starting to bear fruit at an opportune time, as credit card companies increasingly expand their range of products to boost revenue.

By John AdamsAugust 10 -

While other digital payment providers have partnered with banks to improve their offerings, Circle's plan would enable it to offer regulated financial services in-house to complement its U.S. Dollar Coin cryptocurrency.

By John AdamsAugust 9 -

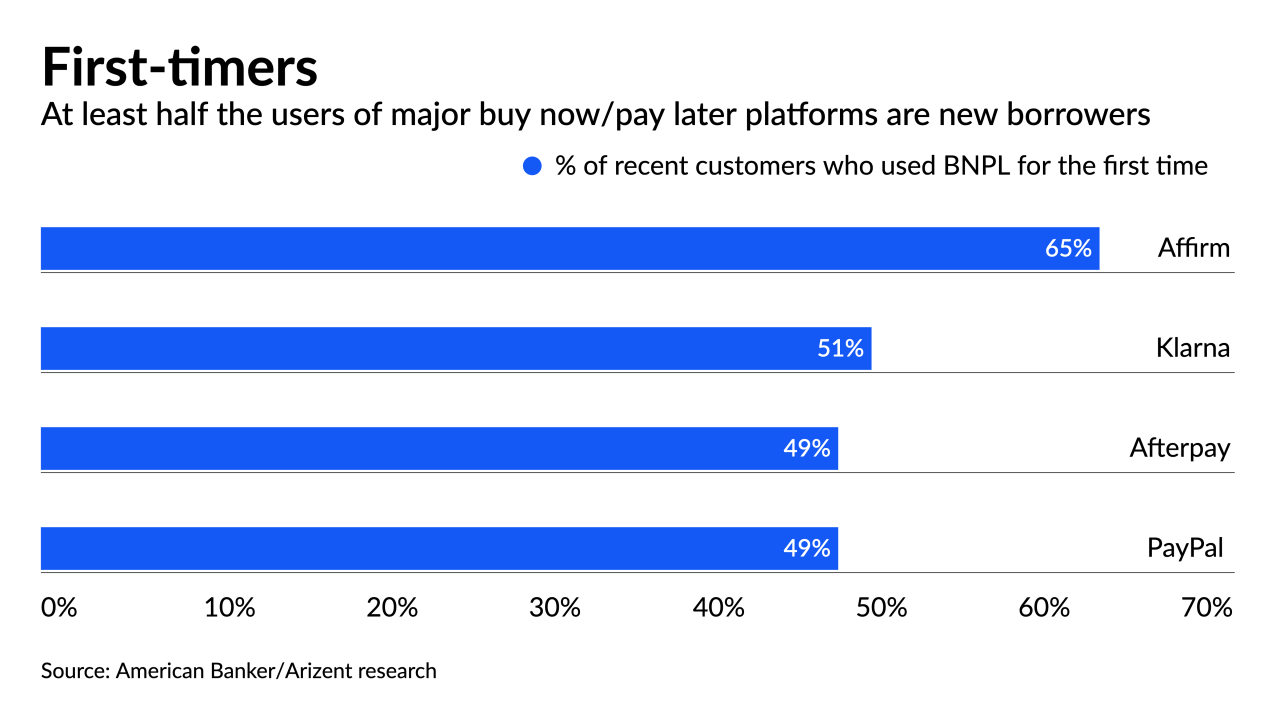

As tech giants rush into point-of-sale lending, the smaller companies that built the market are counting on acquisitions and partnerships with specialized vendors to defend their turf and pull in new borrowers.

By John AdamsAugust 9 -

The blockchain company's new lead on the Continent, Sendi Young, discusses its plans to foster real-time and cross-border transactions between banks and fintechs in ways that aren't possible on legacy networks.

By John AdamsAugust 4 -

The $29 billion purchase of the Australian installment lender would bring larger retail relationships, as well as a fast-growing product that has appeal to both consumers and merchants.

By John AdamsAugust 2 -

The $29 billion deal would enable Square to better compete with PayPal and Apple, and provide an opportunity to cross-sell other services to the Australian lender's global audience.

By John AdamsAugust 2 -

A posting for a digital currency job at Amazon stirred speculation that the e-commerce giant might begin accepting bitcoin at checkout. The company denies that — and experts say it has many other ways to make the most of its intended hire.

By John AdamsJuly 30 -

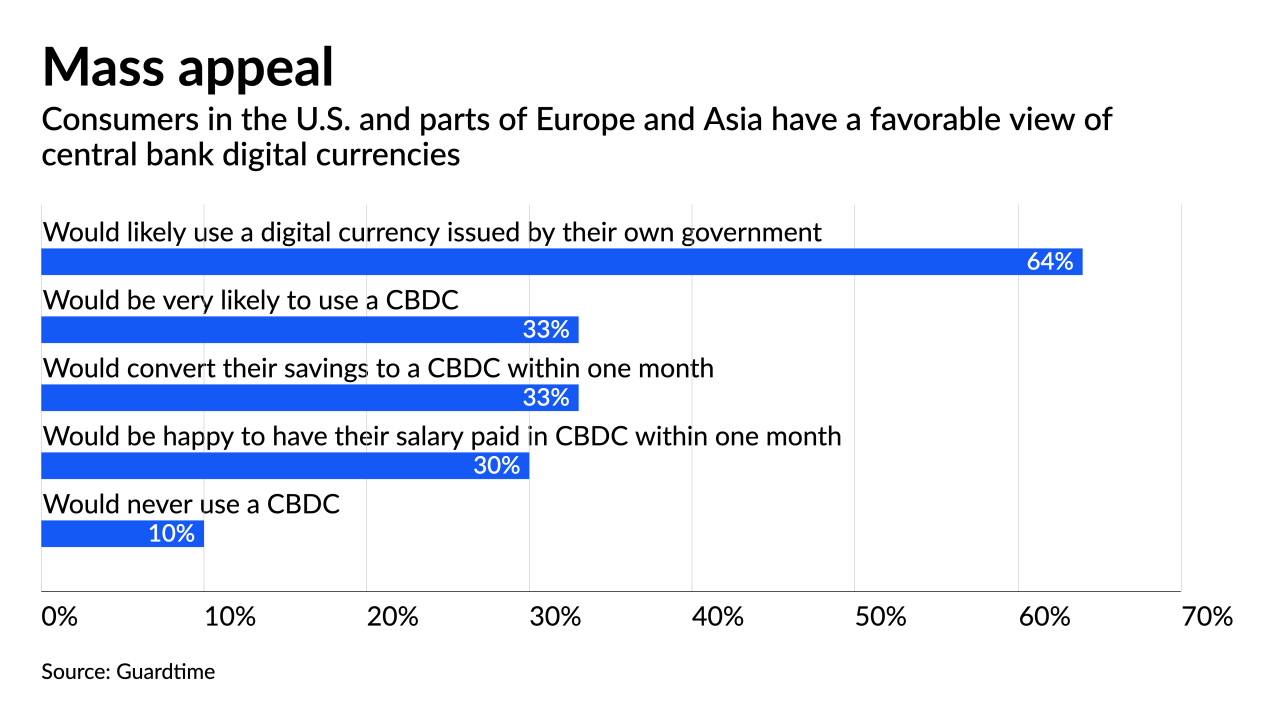

The card brand has been pitching itself as a testing ground for central bank digital currencies, a payment portal for stablecoins and — most recently — an accelerator for startups.

By John AdamsJuly 29 -

The card brand's recent deals to buy Tink and Currencycloud for a combined $3 billion are meant to give it a stronger presence in fast-growing fintech markets.

By John AdamsJuly 27 -

Western central banks trying to develop sovereign cryptocurrency models face pushback from lawmakers and other obstacles, while the digital yuan has a much clearer path.

By John AdamsJuly 27 -

These nine fintechs have made their market debuts or signaled plans to do so in the past few weeks, continuing a robust year for both IPOs and e-commerce.

By John AdamsJuly 26 -

CEO Stephen Squeri told analysts a fresh crop of rivals, possibly including Wells Fargo, will be quick to fill the void created by Citi's departure from the high-end market.

By John AdamsJuly 23 -

Buying the cross-border payment and software company can help the card brand provide more services to fast-growing challenger banks.

By John AdamsJuly 22 -

While pandemic restrictions cloud the sector's outlook, the London-based payment and fintech company is making hotel booking and other services part of its financial super app strategy.

By John AdamsJuly 22 -

The European Union has updated value-added-tax regulations that predate digital payments, hoping to reduce compliance burdens for foreign online sellers and simplify consumer billing.

By John AdamsJuly 19 -

The Reserve Bank of India says the card brand failed to comply with a requirement to store transaction details locally. The handling of payment information has become a point of contention between the Asian nation and American firms.

By John AdamsJuly 15 -

The technology holds great promise for financial services, but it could be just as powerful for scammers looking to break payment card encryption. Visa, Mastercard and others are already building new defenses.

By John AdamsJuly 15 -

The card brand is working with 70 cryptocurrency companies to meet consumer demand for paying in bitcoin and other digital currencies at the point of sale. It had little choice given that most retailers don't accept crypto directly and are in no rush to do so.

By John AdamsJuly 14 - DLocal, which connects merchants with consumers in emerging markets, has a plan to carry over momentum from its recent listing on Nasdaq into hiring and expansion efforts.Sponsored by EverC