John Adams is executive editor of payments for American Banker.

-

About two dozen banks in the U.S. and Europe, including ABN Amro and Bank of America, are working with The Clearing House and EBA Clearing, using technology from SWIFT, to make instant international transactions ubiquitous for business and e-commerce sales.

By John AdamsMay 2 -

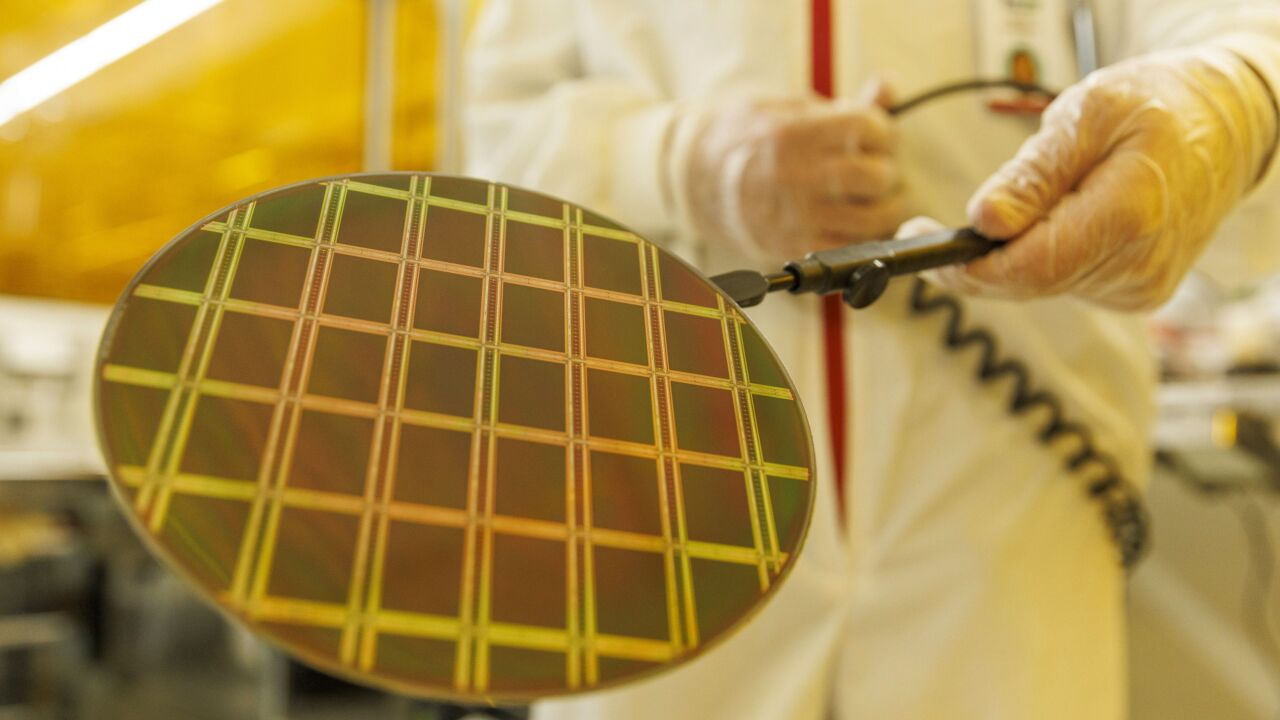

The global microchip shortage is being exacerbated by Russia's war in Ukraine and the COVID lockdowns in China. Experts are warning of an impending strain on the manufacture of cards and point-of-sale hardware.

By John AdamsApril 29 -

The recovery for airline and related spending has been robust — and thus far immune to geopolitical and inflationary pressures — according to the card network, following similar reports from Visa and American Express.

By John AdamsApril 28 -

The country was a large part of the card brand's cross-border digital business, though expansion in other markets and new services will help offset the negative impact, according to CEO Alfred Kelly.

By John AdamsApril 26 -

The card network will use artificial intelligence to improve authentication via its latest team-up with the tech giant.

By John AdamsApril 25 -

While most consumer sectors have been going digital, many physicians' offices, hospitals and clinics cling to a reimbursement system that relies heavily in printed statements, checks and manual processing.

By John AdamsApril 25 -

In global news this week, The Bank of London named Tom Wood its next deputy chief executive for the United Kingdom market, Tencent began testing a digital wallet that supports transactions in e-CNY China's central bank digital currency, Uber's online order and delivery platform expanded its payment acceptance choices to include Rakuten Pay, and more.

By John AdamsApril 20 -

Nandan Sheth hopes his experience as a fintech founder and as an executive with firms such as Fiserv will help the installment lender become a better partner for card issuers.

By John AdamsApril 18 -

A few months after cutting ties with its Diem stablecoin project, the company formerly known as Facebook is testing a virtual world marketplace.

By John AdamsApril 13 -

"With ACH payments there's a latency in how they are processed; it can take two to five days. Things can happen," warns Silvana Hernandez, senior vice president of digital payments at Mastercard.

By John AdamsApril 12