John Reosti is a reporter covering community banks in particular and the financial services industry in general. He also focuses on the Small Business Administration, the National Credit Union Administration Board and issues connected to the CECL accounting standard.

-

The U.S. unit of Toronto-Dominion Bank plans to invest in CDFIs and specialized funds that serve Black, Hispanic and other diverse business owners in its East Coast territory.

By John ReostiMay 28 -

The seemingly expensive acquisition of Aquesta Financial Holdings is the cost of expanding in North Carolina's largest city.

By John ReostiMay 27 -

Advocates for depositor-owned banks want regulators to block the combination of a one-branch thrift and Minnesota’s largest credit union, for fear it will lead to similar deals.

By John ReostiMay 27 -

Cypress Trust in Palm Beach is poised to pull off a rarity: the conversion of a wealth management firm into a community bank. It’s simply another way to take advantage of the ongoing melding of the two financial services sectors, CEO Dana Kilborne says.

By John ReostiMay 22 -

The Small Business Administration’s sluggish pace in forgiving the biggest Paycheck Protection Program loans is straining relations between banks and some borrowers.

By John ReostiMay 20 -

The Massachusetts bank, which traditionally In contrast to its typical strategy of supporting low-income housing, the invested $500,000 in CEI Ventures’ Coastal Ventures V fund to support small businesses in disadvantaged communities.

By John ReostiMay 20 -

American State would be the largest bank buyout for Equity, which has acquired 17 banks since 2003.

By John ReostiMay 17 -

Michael Butler relied on partnerships with tech startups in areas such as checking and mobile banking to turn Radius into a digital-only bank before its sale to LendingClub. As the new CEO of Grasshopper Bank, he plans to strike similar deals to expand beyond business lending.

By John ReostiMay 14 -

Princeton Portfolio Strategies Group would become the sixth asset management business that the New Jersey banking company has bought since 2014.

By John ReostiMay 13 -

The Pennsylvania company will offer commercial loans and treasury management services after hiring bankers in Dallas and Orlando.

By John ReostiMay 12 -

The change reflects the name of the Susser family, which bought the bank in 2018.

By John ReostiMay 12 -

The Denver company, which has branches in El Paso, will gain more locations in cities such as Dallas and Austin with the pending purchase.

By John ReostiMay 12 -

Less than two years after shutting down its biggest business amid fraud allegations, the Michigan company has sold branches, settled a shareholder lawsuit and returned to profitability under turnaround specialist Thomas O’Brien.

By John ReostiMay 7 -

The head of government guaranteed lending at WSFS, Caruso aims to parlay the bank's success with Paycheck Protection Program lending to better serve early-stage small businesses.

By John ReostiMay 5 -

The Paycheck Protection Program has about $8 billion remaining, with those funds earmarked for community development financial institutions, minority depository institutions and other mission-driven lenders.

By John ReostiMay 5 -

With the Paycheck Protection Program likely winding down at the end of the month, many lenders are seeing heightened demand for the Small Business Administration’s 7(a) and 504 loans.

By John ReostiMay 3 -

The Arkansas bank is turning to asset-based lending and loans to venture capital and other investment groups to help fill a void created by a shortage of new, big-ticket commercial real estate deals.

By John ReostiApril 28 -

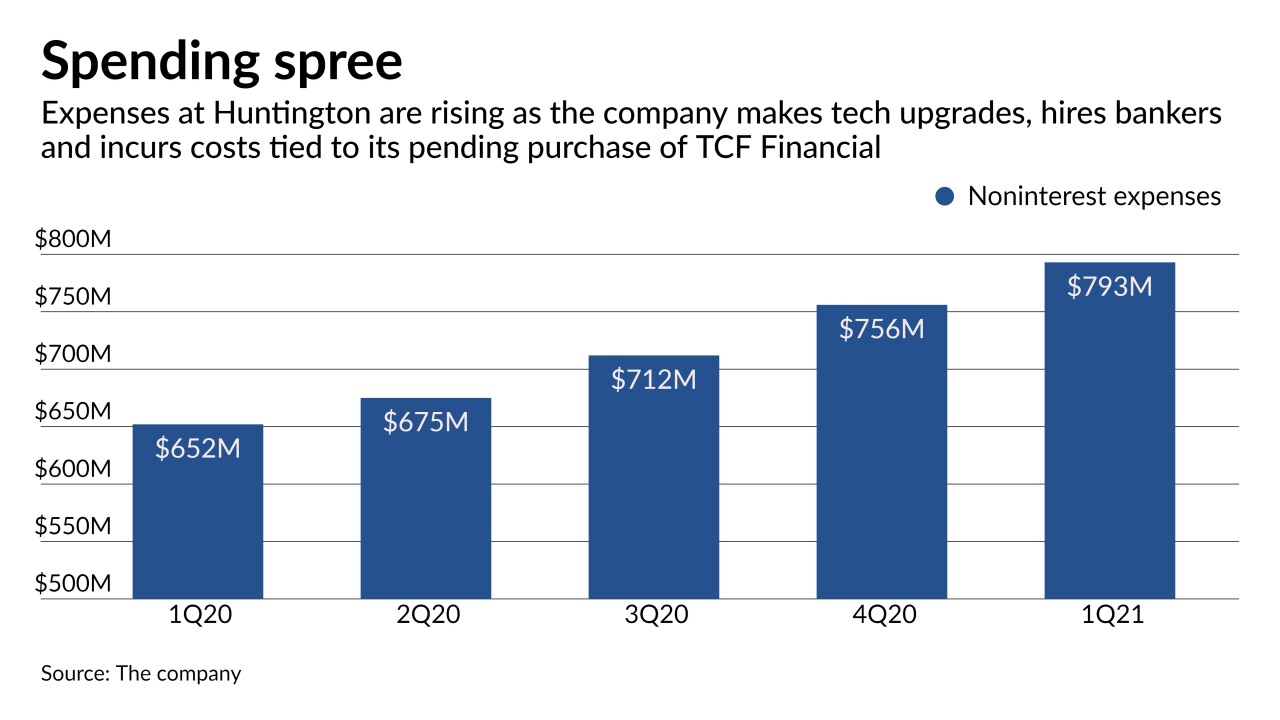

The Ohio regional took advantage of an unexpected boost in interest income in the first quarter to upgrade its digital platform and recruit bankers in wealth management, capital markets and Small Business Administration lending.

By John ReostiApril 22 -

The legislation, led by Sen. Ben Cardin, D-Md., would qualify many farmers, ranchers and self-employed Americans for more Paycheck Protection Program funds.

By John ReostiApril 21 -

The Cleveland company had a strong quarter for investment banking as midsize companies raised capital to fund growth initiatives. Executives expressed confidence that such activity will translate into more loans over the second half of 2021.

By John ReostiApril 20